Region:Asia

Author(s):Rebecca

Product Code:KRAA6549

Pages:99

Published On:January 2026

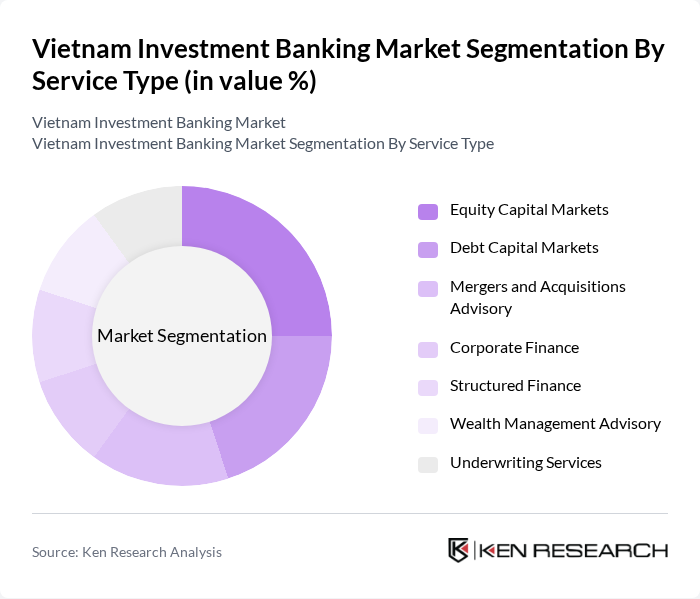

By Service Type:The service type segmentation includes various offerings that cater to different financial needs. The subsegments are Equity Capital Markets, Debt Capital Markets, Mergers and Acquisitions Advisory, Corporate Finance, Structured Finance, Wealth Management Advisory, and Underwriting Services. Each of these services plays a vital role in the overall investment banking landscape, with specific trends and consumer preferences shaping their growth.

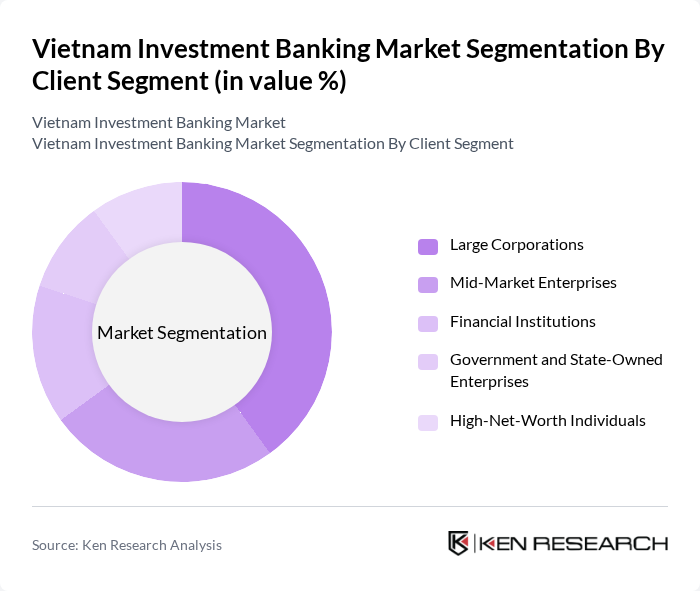

By Client Segment:The client segment categorization encompasses various types of clients that utilize investment banking services. This includes Large Corporations, Mid-Market Enterprises, Financial Institutions, Government and State-Owned Enterprises, and High-Net-Worth Individuals. Each client segment has distinct needs and preferences, influencing the types of services they seek from investment banks.

The Vietnam Investment Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vietcombank Securities, SSI Securities Corporation, BIDV Securities, HSC Securities, VNDirect Securities, Mirae Asset Securities Vietnam, FPT Securities, Agribank Securities, Saigon Securities Inc., Techcombank Securities, MB Securities, ACB Securities, VPBank Securities, Dragon Capital, Sacombank Securities contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam investment banking market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As digital banking solutions gain traction, investment banks will increasingly adopt fintech innovations to enhance service delivery and operational efficiency. Additionally, the focus on sustainable finance is expected to grow, with more firms integrating environmental, social, and governance (ESG) criteria into their investment strategies, aligning with global trends and investor expectations.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Equity Capital Markets Debt Capital Markets Mergers and Acquisitions Advisory Corporate Finance Structured Finance Wealth Management Advisory Underwriting Services |

| By Client Segment | Large Corporations Mid-Market Enterprises Financial Institutions Government and State-Owned Enterprises High-Net-Worth Individuals |

| By Geographic Region | Northern Vietnam (Hanoi and surrounding provinces) Central Vietnam (Da Nang and surrounding provinces) Southern Vietnam (Ho Chi Minh City and surrounding provinces) |

| By Transaction Size | Small Transactions (Under $50 million) Mid-Market Transactions ($50 million - $500 million) Large Transactions (Over $500 million) |

| By Industry Sector | Infrastructure and Energy Manufacturing and Export Real Estate and Construction Technology and Telecommunications Consumer Goods and Retail |

| By Investor Type | Domestic Institutional Investors Foreign Institutional Investors Retail Investors |

| By Capital Market Status | Primary Market (IPOs and New Issuances) Secondary Market (Trading and Liquidity) Over-the-Counter (OTC) Transactions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| M&A Advisory Services | 120 | Investment Bankers, Corporate Development Managers |

| Equity Underwriting | 100 | Equity Analysts, Capital Markets Executives |

| Debt Capital Markets | 90 | Debt Analysts, Treasury Managers |

| Asset Management | 80 | Portfolio Managers, Wealth Advisors |

| Regulatory Compliance in Investment Banking | 70 | Compliance Officers, Risk Management Executives |

The Vietnam Investment Banking Market is valued at approximately USD 1.1 billion, driven by factors such as increasing foreign direct investment, a growing middle class, and government economic reforms aimed at enhancing the financial landscape.