Region:Asia

Author(s):Rebecca

Product Code:KRAA6550

Pages:96

Published On:January 2026

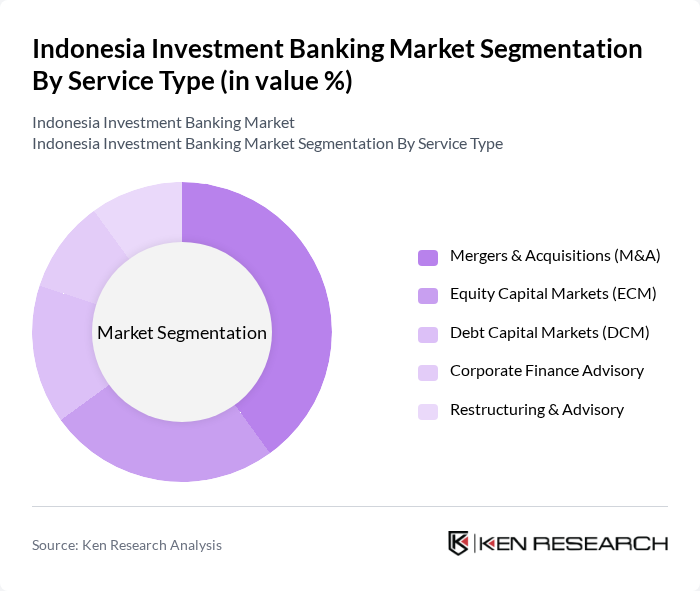

By Service Type:

The service type segmentation of the Indonesia Investment Banking Market includes Mergers & Acquisitions (M&A), Equity Capital Markets (ECM), Debt Capital Markets (DCM), Corporate Finance Advisory, and Restructuring & Advisory. Among these, M&A has emerged as the leading sub-segment, driven by a surge in corporate consolidation and strategic partnerships. The increasing number of domestic and cross-border transactions reflects a robust appetite for growth and expansion among Indonesian firms, making M&A a critical focus area for investment banks.

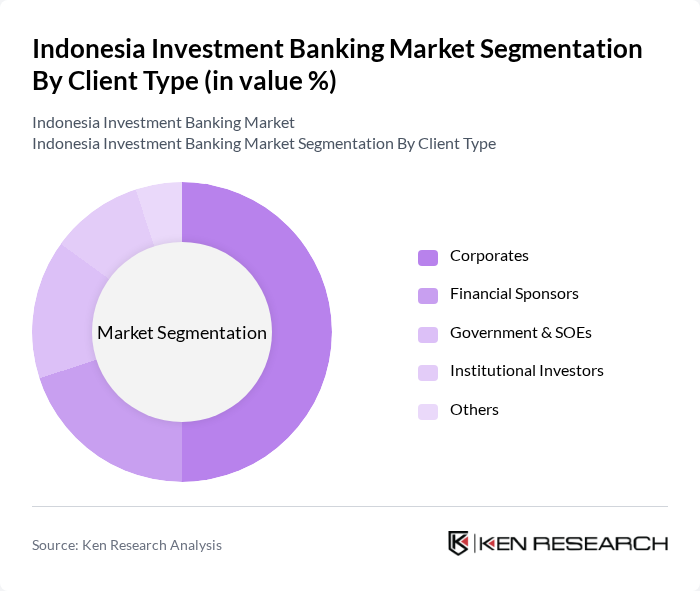

By Client Type:

The client type segmentation includes Corporates, Financial Sponsors, Government & SOEs, Institutional Investors, and Others. Corporates dominate this segment, as they are increasingly seeking investment banking services for capital raising, strategic advisory, and M&A activities. The growing trend of corporate restructuring and expansion into new markets has led to a heightened demand for tailored financial solutions, positioning corporates as the primary clients for investment banks in Indonesia.

The Indonesia Investment Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mandiri Sekuritas Indonesia, Danareksa Sekuritas, Bahana Sekuritas, CIMB Niaga Sekuritas, BNI Sekuritas, RHB Sekuritas Indonesia, Credit Suisse Sekuritas Indonesia, Deutsche Bank Sekuritas Indonesia, UBS Sekuritas Indonesia, Mandiri Manajemen Investasi, Mirae Asset Sekuritas Indonesia, Trimegah Sekuritas Indonesia, Kresna Graha Investama (KGI), Panin Sekuritas, Sinarmas Sekuritas contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's investment banking market appears promising, driven by a combination of increasing foreign investments and a burgeoning middle class. As the government continues to prioritize infrastructure development, investment banks will find ample opportunities to engage in project financing. Additionally, the rise of fintech collaborations and a focus on sustainable finance will reshape the landscape, enabling banks to innovate and offer more diverse financial products tailored to evolving market demands.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Mergers & Acquisitions (M&A) Equity Capital Markets (ECM) Debt Capital Markets (DCM) Corporate Finance Advisory Restructuring & Advisory |

| By Client Type | Corporates Financial Sponsors Government & SOEs Institutional Investors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| M&A Advisory Services | 100 | Investment Bankers, Corporate Finance Managers |

| Equity Underwriting | 80 | Equity Analysts, Capital Markets Executives |

| Debt Financing Solutions | 70 | Debt Capital Market Specialists, CFOs |

| Asset Management Services | 60 | Portfolio Managers, Wealth Advisors |

| Corporate Client Engagement | 90 | Corporate Treasurers, Business Development Managers |

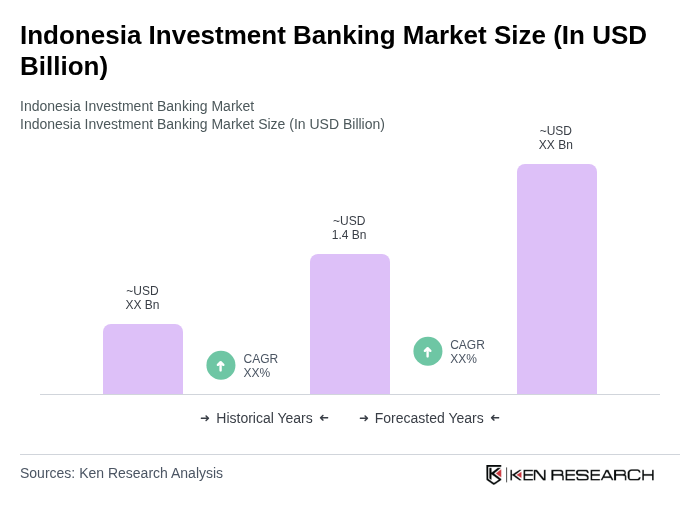

The Indonesia Investment Banking Market is valued at approximately USD 1.4 billion, driven by factors such as increasing foreign direct investment, a growing middle class, and a rise in corporate mergers and acquisitions.