Region:Asia

Author(s):Rebecca

Product Code:KRAA6598

Pages:89

Published On:January 2026

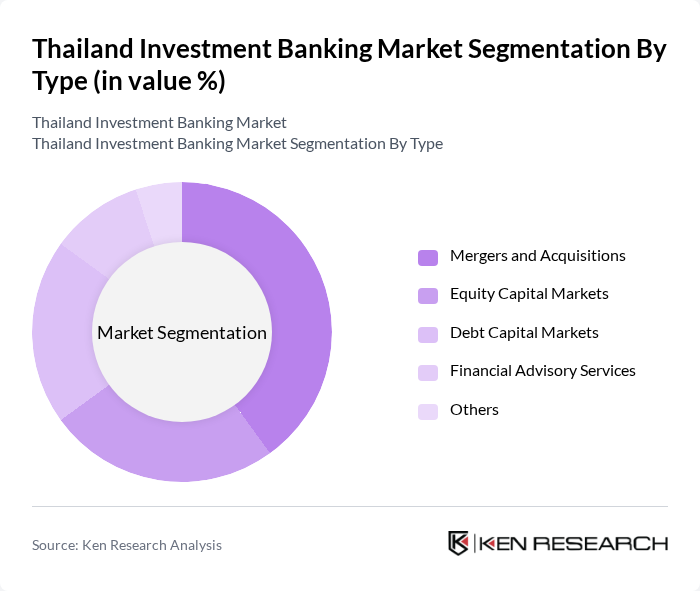

By Type:The Thailand Investment Banking Market is segmented into various types, including Mergers and Acquisitions, Equity Capital Markets, Debt Capital Markets, Financial Advisory Services, and Others. Among these, Mergers and Acquisitions (M&A) dominate the market due to the increasing trend of corporate consolidation and strategic partnerships. Companies are actively seeking to enhance their market position and operational efficiencies through M&A, which has become a critical strategy for growth in a competitive landscape.

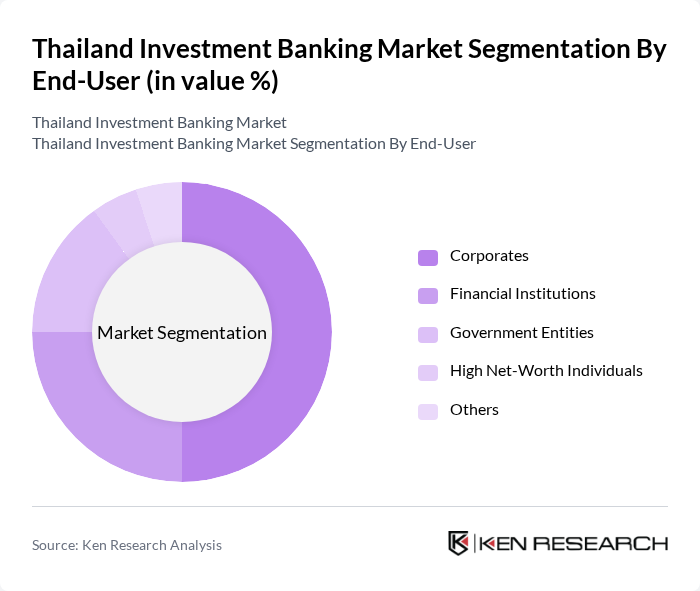

By End-User:The market is also segmented by end-users, including Corporates, Financial Institutions, Government Entities, High Net-Worth Individuals, and Others. Corporates are the leading end-users, driven by their need for capital raising, strategic advisory, and financial restructuring services. The increasing complexity of business operations and the need for expert financial guidance have made corporates the primary consumers of investment banking services.

The Thailand Investment Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bangkok Bank, Kasikornbank, Siam Commercial Bank, Krung Thai Bank, TMBThanachart Bank, CIMB Thai Bank, Phatra Securities, KGI Securities, Maybank Kim Eng Securities, UOB Kay Hian, Bualuang Securities, Asia Plus Securities, Trinity Securities, and Finansa Public Company Limited contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand investment banking market is poised for significant evolution, driven by technological advancements and changing investor preferences. The increasing integration of digital solutions will enhance operational efficiency and customer engagement. Additionally, the growing emphasis on sustainable finance will reshape investment strategies, encouraging banks to develop innovative products that align with ESG criteria. As these trends unfold, investment banks must adapt to remain competitive and meet the evolving demands of their clients in a dynamic economic environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Mergers and Acquisitions Equity Capital Markets Debt Capital Markets Financial Advisory Services Others |

| By End-User | Corporates Financial Institutions Government Entities High Net-Worth Individuals Others |

| By Industry Sector | Technology Healthcare Real Estate Consumer Goods Others |

| By Service Type | Advisory Services Underwriting Services Asset Management Research and Analysis Others |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions Mega Transactions Others |

| By Client Type | Institutional Clients Retail Clients Corporate Clients Government Clients Others |

| By Geographic Focus | Domestic Market Southeast Asia Asia-Pacific Global Markets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| M&A Advisory Services | 100 | Investment Bankers, Corporate Finance Managers |

| Equity Underwriting | 80 | Equity Analysts, Capital Markets Executives |

| Debt Financing Solutions | 70 | Debt Capital Market Specialists, CFOs |

| Asset Management Services | 60 | Portfolio Managers, Wealth Advisors |

| Corporate Client Engagement | 90 | Corporate Treasurers, Business Development Managers |

The Thailand Investment Banking Market is valued at approximately USD 2.8 billion, driven by increasing corporate activities, foreign investments, and a supportive regulatory framework that enhances financial transactions and investor confidence in the region.