Region:Asia

Author(s):Rebecca

Product Code:KRAA6599

Pages:91

Published On:January 2026

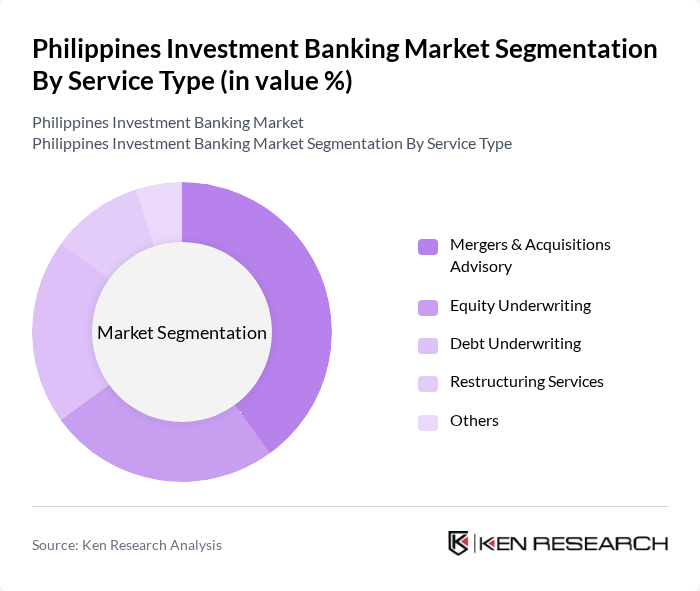

By Service Type:

The service type segmentation includes Mergers & Acquisitions Advisory, Equity Underwriting, Debt Underwriting, Restructuring Services, and Others. Among these, Mergers & Acquisitions Advisory is the leading sub-segment, driven by a surge in corporate consolidations and strategic partnerships. The increasing complexity of transactions and the need for expert guidance have made advisory services indispensable for companies navigating the investment landscape. Equity Underwriting follows closely, as firms seek to raise capital through public offerings, reflecting a growing trend in the market.

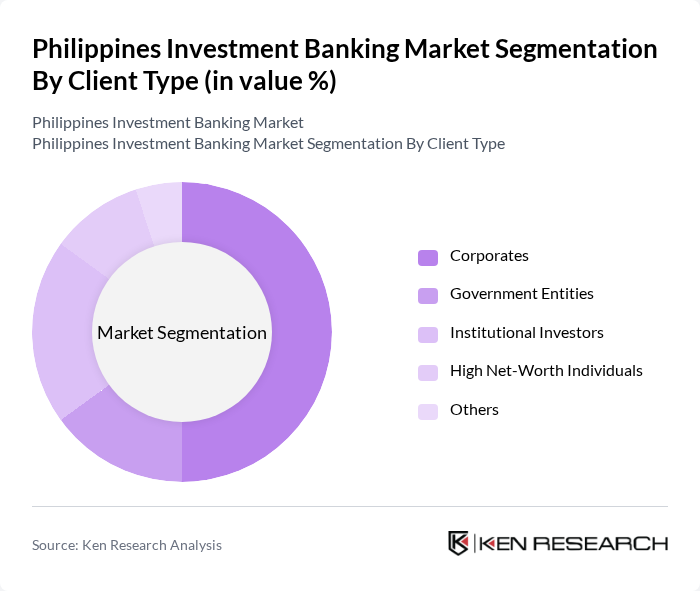

By Client Type:

This segmentation includes Corporates, Government Entities, Institutional Investors, High Net-Worth Individuals, and Others. Corporates dominate this segment, as they are the primary clients seeking investment banking services for capital raising, mergers, and acquisitions. The increasing number of startups and SMEs in the Philippines has also contributed to the growth of this segment, as these entities seek financial expertise to navigate their growth trajectories. Small and medium-size enterprises account for approximately 50 percent of transaction banking revenue and their value for investment banking institutions is expected to increase as they mature and demand more sophisticated credit and account services. Institutional Investors are also significant players, driven by their need for strategic investments and portfolio diversification.

The Philippines Investment Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as BDO Capital & Investment Corporation, First Metro Investment Corporation, RCBC Capital Corporation, Maybank ATR Kim Eng Capital Partners, Deutsche Bank AG, UBS AG, Citigroup Global Markets Inc., HSBC Securities (Philippines) Inc., J.P. Morgan Securities Philippines, Inc., Standard Chartered Bank, Nomura Securities Philippines, Inc., Philippine National Bank Capital Investment Corporation, Investment & Capital Corporation of the Philippines, Bank of the Philippine Islands, Security Bank Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines investment banking market appears promising, driven by ongoing digital transformation and a growing emphasis on sustainable finance. As the government continues to implement infrastructure projects, investment banks will play a crucial role in facilitating funding. Additionally, the rise of fintech partnerships is expected to enhance service delivery, making financial products more accessible. With a focus on customer experience and technological integration, the market is poised for significant evolution in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Service Type (Mergers & Acquisitions, Underwriting, Advisory Services) | Mergers & Acquisitions Advisory Equity Underwriting Debt Underwriting Restructuring Services Others |

| By Client Type (Corporate, Government, Institutional Investors) | Corporates Government Entities Institutional Investors High Net-Worth Individuals Others |

| By Industry (Real Estate, Telecommunications, Energy, Financial Services) | Real Estate Telecommunications Energy Financial Services Others |

| By Transaction Size (Small, Medium, Large) | Small Transactions Medium Transactions Large Transactions Others |

| By Geographic Focus (Metro Manila, Luzon, Visayas, Mindanao) | Metro Manila Luzon Visayas Mindanao Others |

| By Investment Type (Equity, Debt, Hybrid) | Equity Investments Debt Investments Hybrid Investments Others |

| By Regulatory Framework (Local, International Standards) | Local Regulations International Standards Compliance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| M&A Advisory Services | 100 | Investment Bankers, Corporate Development Executives |

| Equity Underwriting | 80 | Equity Analysts, Capital Markets Managers |

| Debt Financing Solutions | 70 | Debt Capital Markets Specialists, CFOs |

| Asset Management Trends | 90 | Portfolio Managers, Wealth Advisors |

| Regulatory Compliance Insights | 60 | Compliance Officers, Legal Advisors |

The Philippines Investment Banking Market is valued at approximately USD 2.5 billion. This valuation reflects the growth driven by increasing foreign direct investment, economic expansion, and a rise in mergers and acquisitions within the country.