Region:Middle East

Author(s):Rebecca

Product Code:KRAA6600

Pages:96

Published On:January 2026

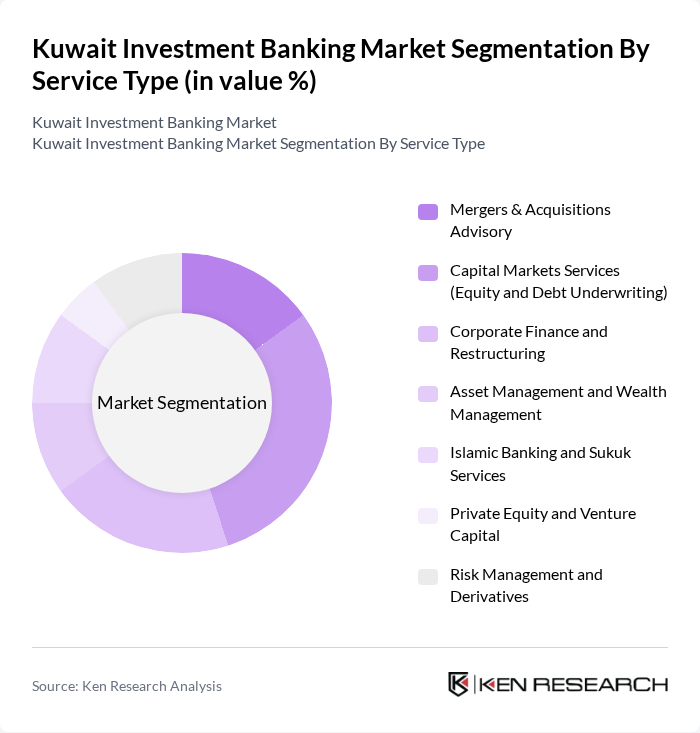

By Service Type:The service type segmentation includes various offerings that cater to the diverse needs of clients in the investment banking sector. The subsegments include Mergers & Acquisitions Advisory, Capital Markets Services (Equity and Debt Underwriting), Corporate Finance and Restructuring, Asset Management and Wealth Management, Islamic Banking and Sukuk Services, Private Equity and Venture Capital, and Risk Management and Derivatives. Among these, Capital Markets Services is currently dominating the market due to the increasing number of initial public offerings (IPOs) and bond issuances, driven by favorable economic conditions and investor confidence.

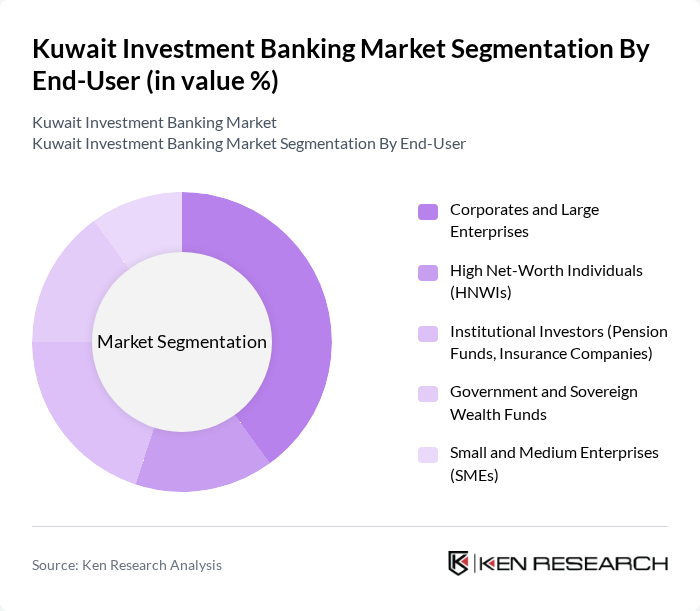

By End-User:The end-user segmentation encompasses various client categories that utilize investment banking services. This includes Corporates and Large Enterprises, High Net-Worth Individuals (HNWIs), Institutional Investors (Pension Funds, Insurance Companies), Government and Sovereign Wealth Funds, and Small and Medium Enterprises (SMEs). Corporates and Large Enterprises are the leading end-users, primarily due to their extensive need for capital raising, advisory services, and strategic financial planning, which are essential for their growth and expansion strategies.

The Kuwait Investment Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as National Bank of Kuwait (NBK), Gulf Bank, Kuwait Finance House (KFH), Boubyan Bank, Al Ahli Bank of Kuwait, KAMCO Investment Company, Markaz (Kuwait Financial Centre), Global Investment House, Al Mal Investment Company, First Investment Company, NBK Capital, Warba Bank, Commercial Bank of Kuwait, Kuwait International Bank, Noor Financial Investment Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait investment banking market appears promising, driven by ongoing digital transformation and a focus on sustainable investment practices. As banks increasingly adopt technology to enhance customer experiences, the integration of data analytics will play a crucial role in decision-making processes. Furthermore, the government's commitment to economic diversification will likely create new opportunities for investment banks, enabling them to expand their service offerings and cater to a broader client base in the evolving financial landscape.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Mergers & Acquisitions Advisory Capital Markets Services (Equity and Debt Underwriting) Corporate Finance and Restructuring Asset Management and Wealth Management Islamic Banking and Sukuk Services Private Equity and Venture Capital Risk Management and Derivatives |

| By End-User | Corporates and Large Enterprises High Net-Worth Individuals (HNWIs) Institutional Investors (Pension Funds, Insurance Companies) Government and Sovereign Wealth Funds Small and Medium Enterprises (SMEs) |

| By Product Offering | Equity Underwriting and IPO Services Debt Underwriting and Bond Issuance Financial Advisory and Consulting Portfolio Management Services Trade Finance and Working Capital Solutions |

| By Client Sector | Energy and Hydrocarbon Sector Real Estate and Construction Healthcare and Pharmaceuticals Technology and Telecommunications Financial Services |

| By Transaction Size | Micro Transactions (Below USD 10 million) Small Transactions (USD 10-50 million) Mid-Market Transactions (USD 50-250 million) Large Transactions (Above USD 250 million) |

| By Geographic Scope | Domestic (Kuwait-focused) Regional (GCC and Middle East) International (Global Markets) |

| By Regulatory Framework | Conventional Banking Services Islamic Banking and Sharia-Compliant Services International Compliance Standards (IFRS, Basel III) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Investment Banking Services | 100 | Investment Bank Executives, Financial Analysts |

| Private Equity Investments | 75 | Private Equity Managers, Venture Capitalists |

| Mergers & Acquisitions Advisory | 60 | M&A Advisors, Corporate Development Officers |

| Asset Management Trends | 80 | Portfolio Managers, Wealth Management Advisors |

| Regulatory Impact on Investment Banking | 50 | Compliance Officers, Legal Advisors in Finance |

The Kuwait Investment Banking Market is valued at approximately USD 2.8 billion, reflecting a robust growth driven by increasing foreign investments, a strong regulatory framework, and rising demand for diversified financial services.