Australia Investment Banking Market Overview

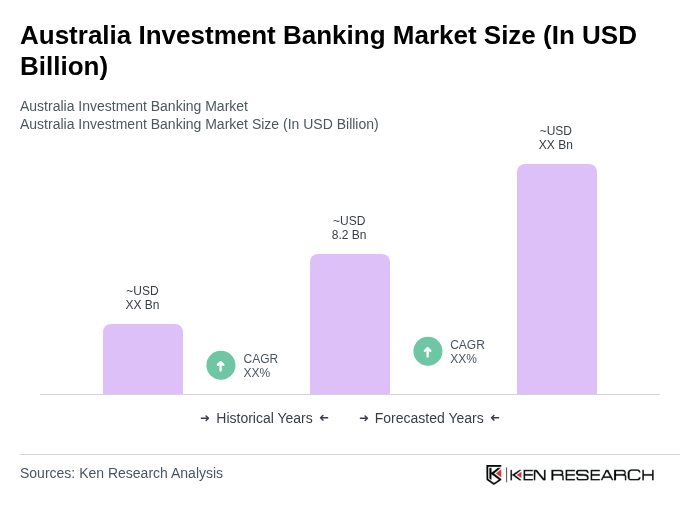

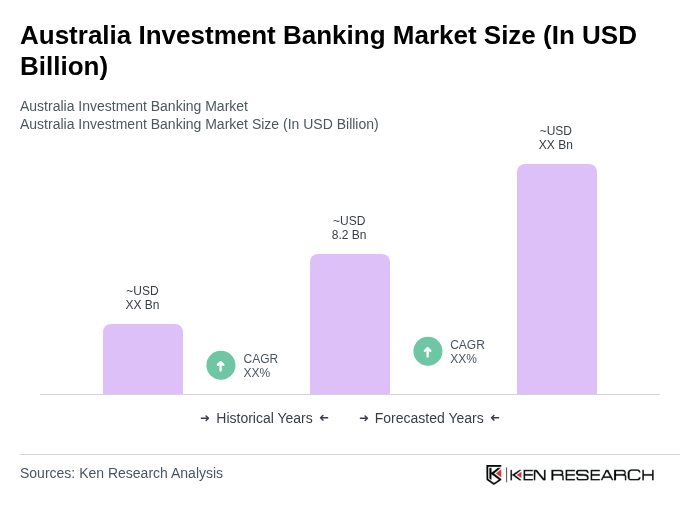

- The Australia Investment Banking Market is valued at approximately USD 8.2 billion, based on a five-year historical analysis. This growth is primarily driven by increased corporate activities, including mergers and acquisitions, as well as a robust demand for capital raising services. The market has seen a surge in private equity investments and a growing trend towards sustainable finance, which has further fueled its expansion. Structured transactions including joint ventures, recapitalizations, and M&A activities continue to drive market momentum, with alternatives capturing significant growth momentum in the investment management space.

- Key players in this market include Sydney and Melbourne, which dominate due to their status as financial hubs with a concentration of major banks and investment firms. These cities benefit from a well-established regulatory framework, a skilled workforce, and a diverse economy, making them attractive for both domestic and international investors. Offshore investment flows into Australia have strengthened, with U.S., Japanese, and Singapore-based investors increasingly participating in the market as currency advantages and Australia's strong fundamentals continue to attract global capital.

- The Financial Accountability Regime (FAR), issued by the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC), establishes accountability obligations for senior executives and directors of financial institutions. This regulation requires key management personnel to be responsible for their actions and compliance with financial laws, thereby promoting ethical conduct and reducing risks associated with financial misconduct. The regime applies to Australian Prudentially Regulated Institutions and Australian Financial Services Licensees, with specific licensing and standards requirements for compliance.

Australia Investment Banking Market Segmentation

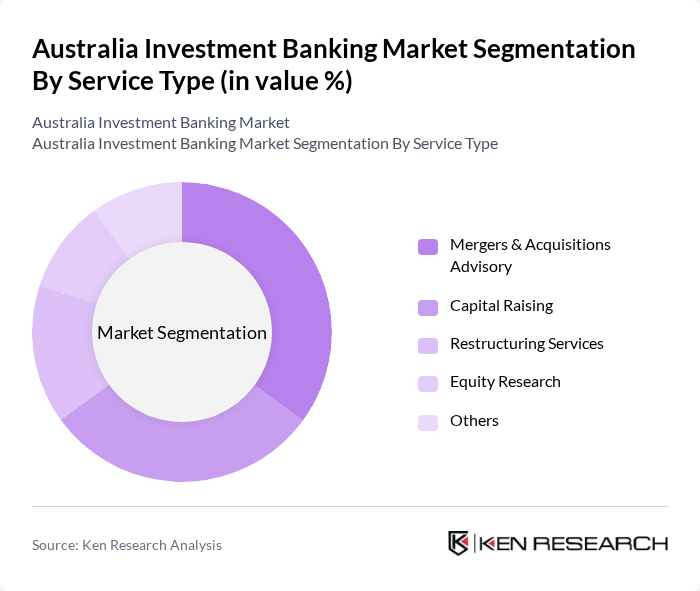

By Service Type:The service type segmentation includes various offerings that cater to the diverse needs of clients in the investment banking sector. The primary subsegments are Mergers & Acquisitions Advisory, Capital Raising, Restructuring Services, Equity Research, and Others. Each of these services plays a crucial role in facilitating corporate transactions and financial strategies.

The Mergers & Acquisitions Advisory subsegment is currently dominating the market due to a significant increase in corporate consolidation activities. Companies are increasingly seeking strategic partnerships and acquisitions to enhance their market position and achieve operational efficiencies. This trend is driven by favorable economic conditions and a competitive landscape that encourages businesses to explore growth opportunities through mergers and acquisitions.

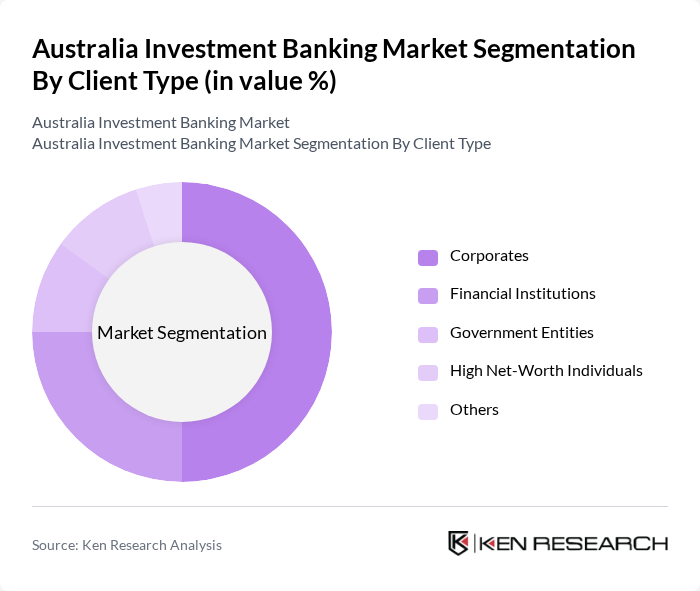

By Client Type:The client type segmentation encompasses various categories of clients that utilize investment banking services. The primary subsegments include Corporates, Financial Institutions, Government Entities, High Net-Worth Individuals, and Others. Each client type has distinct needs and requirements, influencing the services they seek from investment banks.

Corporates are the leading client type in the investment banking market, driven by their need for strategic financial advice and capital solutions. The increasing complexity of business operations and the need for growth through acquisitions and capital investments have made corporates the primary consumers of investment banking services. Their significant financial resources and diverse operational needs further enhance their reliance on investment banks for tailored financial solutions.

Australia Investment Banking Market Competitive Landscape

The Australia Investment Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Macquarie Group, UBS Australia, Goldman Sachs Australia, Morgan Stanley Australia, Citi Australia, J.P. Morgan Australia, ANZ Banking Group, Westpac Banking Corporation, National Australia Bank, Commonwealth Bank of Australia, Credit Suisse Australia, Deutsche Bank Australia, BNP Paribas Australia, Lazard Australia, Evercore Australia contribute to innovation, geographic expansion, and service delivery in this space.

Australia Investment Banking Market Industry Analysis

Growth Drivers

- Increased M&A Activity:In future, Australia is projected to witness a significant uptick in mergers and acquisitions, with an estimated total deal value reaching AUD 90 billion. This surge is driven by favorable economic conditions, including a GDP growth rate of 3.1% and low-interest rates, which encourage corporate consolidation. The technology and healthcare sectors are particularly active, contributing to a robust investment banking environment as firms seek strategic partnerships to enhance competitiveness and market share.

- Rising Demand for Capital Markets Services:The Australian capital markets are expected to see a substantial increase in activity, with equity issuance projected to exceed AUD 25 billion in future. This growth is fueled by a strong appetite for IPOs and bond issuances, as companies look to raise funds for expansion and innovation. The favorable regulatory environment and investor confidence, bolstered by a 4% increase in consumer spending, further support this demand, positioning investment banks as key facilitators in capital raising efforts.

- Expansion of Private Equity Investments:Private equity investments in Australia are anticipated to reach AUD 50 billion in future, reflecting a growing trend among institutional investors seeking higher returns. The low-interest-rate environment and increased liquidity in the market are driving this expansion. Additionally, the Australian government’s initiatives to support small and medium enterprises (SMEs) are expected to enhance private equity activity, as these firms become attractive targets for investment, thereby boosting the investment banking sector.

Market Challenges

- Regulatory Compliance Costs:Investment banks in Australia face escalating regulatory compliance costs, which are projected to reach AUD 2 billion in future. This increase is primarily due to stringent anti-money laundering (AML) and consumer protection regulations. The complexity of compliance requirements necessitates significant investment in technology and personnel, which can strain resources and impact profitability, particularly for smaller firms that may lack the infrastructure to manage these costs effectively.

- Intense Competition Among Firms:The competitive landscape in the Australian investment banking sector is intensifying, with over 120 firms vying for market share. This saturation leads to pricing pressures and reduced margins, particularly in advisory services and capital raising. In future, the average fee for M&A advisory is expected to decline by 12%, as firms engage in aggressive pricing strategies to attract clients. This environment challenges firms to differentiate their services and enhance value propositions to maintain profitability.

Australia Investment Banking Market Future Outlook

The future of the Australian investment banking market appears promising, driven by technological advancements and a growing focus on sustainable finance. As firms increasingly adopt digital solutions, operational efficiencies are expected to improve, enhancing service delivery. Additionally, the rising importance of environmental, social, and governance (ESG) criteria will likely shape investment strategies, compelling banks to innovate and align with sustainable practices. This evolving landscape presents opportunities for growth and adaptation in a competitive market.

Market Opportunities

- Growth in Sustainable Investment Banking:The demand for sustainable investment banking services is projected to increase, with an estimated AUD 15 billion allocated to green bonds and ESG-focused funds in future. This trend reflects a broader shift towards responsible investing, providing investment banks with opportunities to develop specialized services that cater to environmentally conscious investors and companies.

- Digital Transformation Initiatives:Investment banks are increasingly investing in digital transformation, with projected spending of AUD 3 billion in future on fintech solutions. This investment aims to enhance client engagement and streamline operations. By leveraging advanced analytics and artificial intelligence, banks can improve decision-making processes and offer personalized services, positioning themselves competitively in a rapidly evolving market.