Region:Asia

Author(s):Rebecca

Product Code:KRAA6373

Pages:93

Published On:January 2026

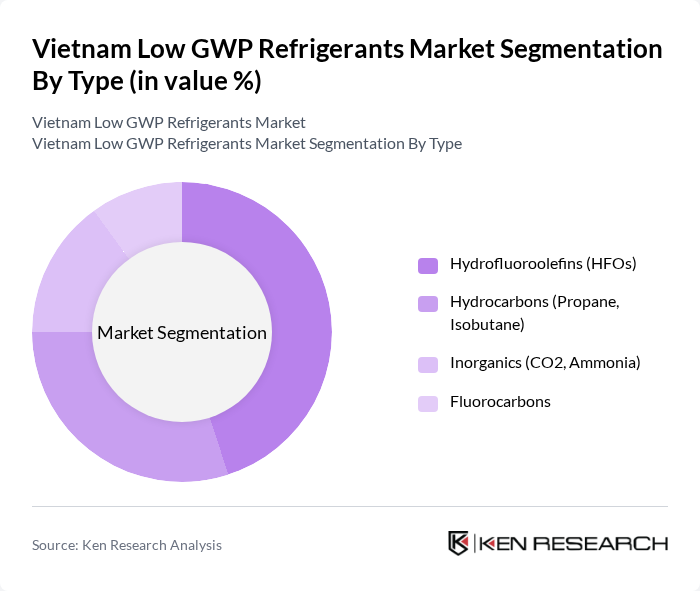

By Type:The market is segmented into Hydrocarbons (HCs), Hydrofluoroolefins (HFOs), Fluorocarbons, and Inorganics. Among these, Hydrofluoroolefins (HFOs) are gaining traction due to their low environmental impact and efficiency in various applications. The increasing regulatory pressure to reduce GWP levels is driving the adoption of HFOs, making them a preferred choice for manufacturers and end-users alike.

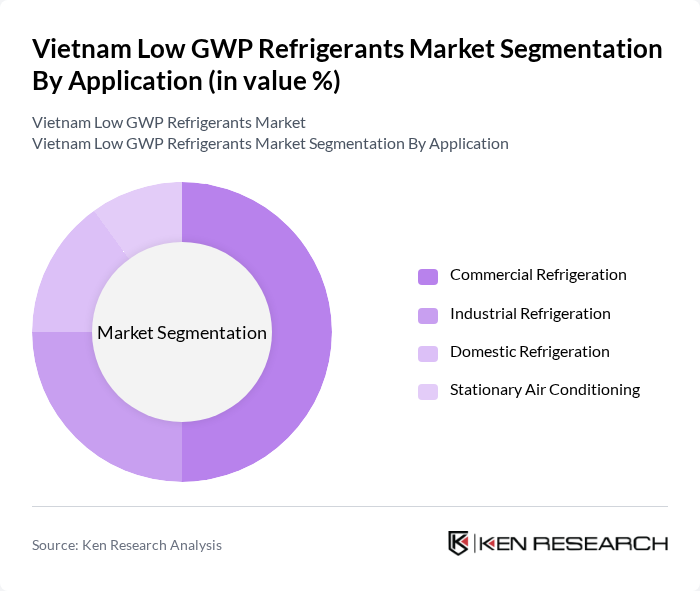

By Application:The applications of low GWP refrigerants include Commercial Refrigeration, Industrial Refrigeration, Domestic Refrigeration, Stationary Air-Conditioning, Mobile Air-Conditioning, and Others. Commercial Refrigeration is the leading application segment, driven by the booming retail and food service sectors. The demand for energy-efficient cooling solutions in supermarkets and restaurants is propelling the growth of this segment.

The Vietnam Low GWP Refrigerants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Daikin Industries, Ltd., Honeywell International Inc., The Chemours Company, Arkema S.A., Linde plc, Air Products and Chemicals, Inc., Mitsubishi Electric Corporation, Johnson Controls International plc, GEA Group AG, Carrier Global Corporation, A-Gas, Solvay S.A., BOC Group, Koura Global, and Dongyue Group Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam low GWP refrigerants market appears promising, driven by increasing environmental awareness and regulatory pressures. As the government continues to enforce stringent regulations, businesses are likely to invest in low GWP technologies. Additionally, the growing cold chain logistics sector, projected to reach $10 billion in future, will further stimulate demand for efficient refrigerants. Overall, the market is poised for significant growth as sustainability becomes a priority across various industries.

| Segment | Sub-Segments |

|---|---|

| By Type | Hydrocarbons (HCs) Hydrofluoroolefins (HFOs) Fluorocarbons Inorganics |

| By Application | Commercial Refrigeration Industrial Refrigeration Domestic Refrigeration Stationary Air-Conditioning Mobile Air-Conditioning Others |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Refrigeration Users | 100 | Facility Managers, HVAC Technicians |

| Industrial Refrigerant Manufacturers | 80 | Production Managers, Quality Control Officers |

| Retail Sector Refrigeration Systems | 70 | Store Managers, Operations Directors |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

| Research Institutions Focused on Refrigeration | 60 | Research Scientists, Environmental Consultants |

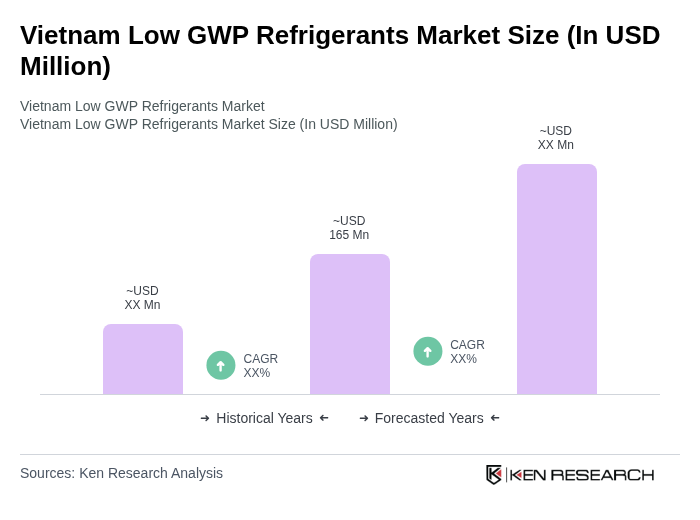

The Vietnam Low GWP Refrigerants Market is valued at approximately USD 165 million, reflecting a growing demand for environmentally friendly refrigerants driven by climate change initiatives and local regulations aimed at reducing greenhouse gas emissions.