Region:Central and South America

Author(s):Shubham

Product Code:KRAB4440

Pages:91

Published On:October 2025

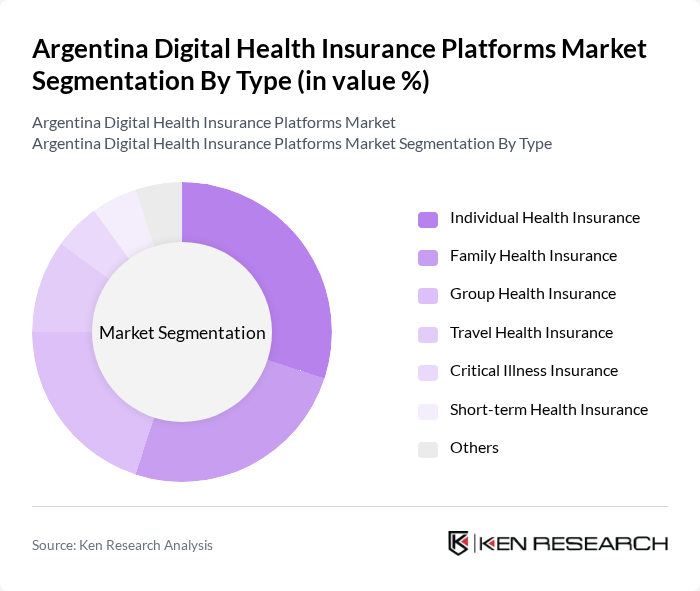

By Type:The market is segmented into various types of health insurance products, including Individual Health Insurance, Family Health Insurance, Group Health Insurance, Travel Health Insurance, Critical Illness Insurance, Short-term Health Insurance, and Others. Each of these segments caters to different consumer needs and preferences, reflecting the diverse landscape of health insurance in Argentina.

The Individual Health Insurance segment is currently dominating the market due to the increasing awareness among consumers about the importance of personal health coverage. This segment appeals to a wide range of individuals seeking tailored health solutions that meet their specific needs. The rise in chronic diseases and the growing trend of preventive healthcare have further fueled the demand for individual policies. Additionally, the flexibility and customization options available in individual health plans make them a preferred choice for many consumers.

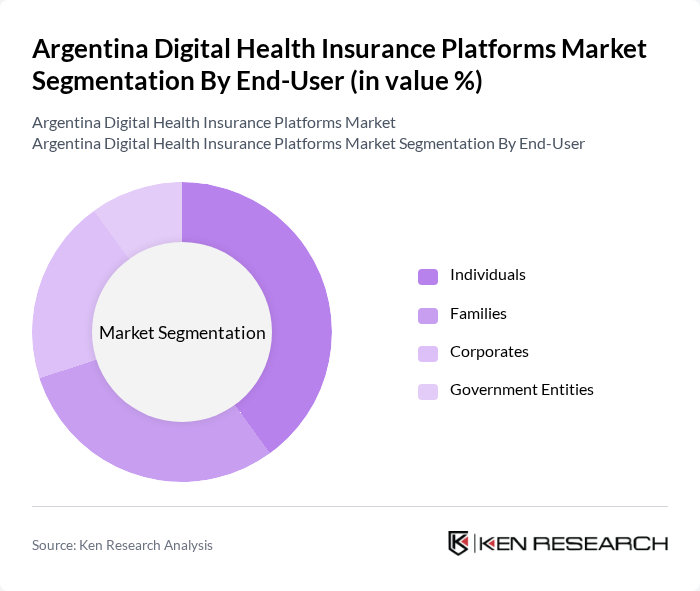

By End-User:The market is segmented by end-users into Individuals, Families, Corporates, and Government Entities. Each segment has unique requirements and preferences, influencing the types of health insurance products they seek.

The Individuals segment leads the market, driven by a growing awareness of health issues and the need for personal health coverage. This segment is characterized by a diverse demographic, including young adults and seniors, who are increasingly seeking insurance products that offer comprehensive coverage and flexibility. The rise in health-related concerns and the increasing cost of healthcare services have prompted individuals to invest in health insurance, making this segment a key driver of market growth.

The Argentina Digital Health Insurance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Sancor Seguros, OSDE, Swiss Medical Group, Galeno Salud, Medicus, Hospital Italiano, CNP Assurances, Allianz Argentina, Mapfre Argentina, Seguros de Salud, Medifé, Prevención Salud, DAP Salud, Prosalud, Aseguradora de Salud contribute to innovation, geographic expansion, and service delivery in this space.

The future of digital health insurance platforms in Argentina appears promising, driven by technological advancements and changing consumer preferences. As internet connectivity improves and healthcare costs continue to rise, more individuals are likely to seek digital solutions for their health insurance needs. Additionally, the integration of artificial intelligence and big data analytics will enhance personalized healthcare offerings, making services more tailored and efficient. This evolution will likely foster a more competitive landscape, encouraging innovation and improved consumer experiences.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Health Insurance Family Health Insurance Group Health Insurance Travel Health Insurance Critical Illness Insurance Short-term Health Insurance Others |

| By End-User | Individuals Families Corporates Government Entities |

| By Distribution Channel | Direct Sales Online Platforms Insurance Brokers Agents |

| By Coverage Type | Comprehensive Coverage Basic Coverage Supplemental Coverage |

| By Payment Model | Pay-per-Use Subscription-Based One-time Payment |

| By Customer Segment | Young Adults Middle-aged Adults Seniors |

| By Policy Duration | Short-term Policies Long-term Policies Annual Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Health Insurance Users | 150 | Policyholders, Health Insurance Customers |

| Healthcare Providers | 100 | Doctors, Clinic Administrators |

| Insurance Brokers | 80 | Insurance Agents, Financial Advisors |

| Regulatory Bodies | 50 | Policy Makers, Health Regulators |

| Technology Providers in Health Sector | 70 | IT Managers, Health Tech Innovators |

The Argentina Digital Health Insurance Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of digital health solutions and rising healthcare costs.