Region:Middle East

Author(s):Dev

Product Code:KRAB7784

Pages:94

Published On:October 2025

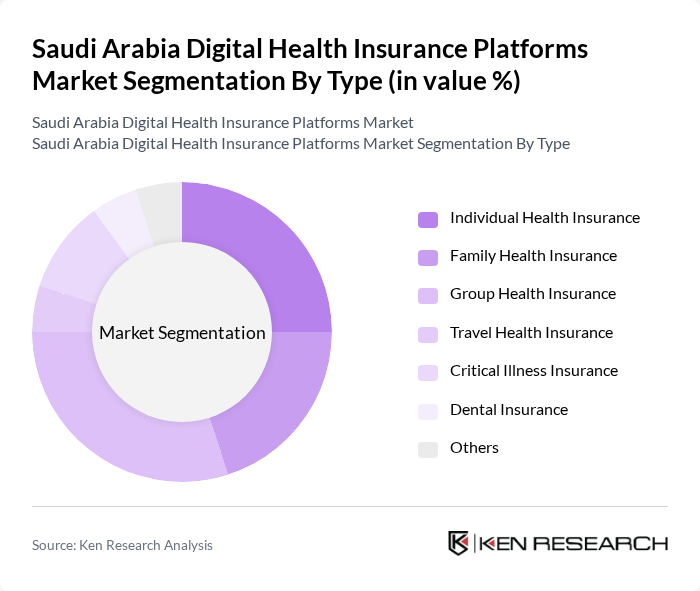

By Type:The market is segmented into various types of health insurance products, including Individual Health Insurance, Family Health Insurance, Group Health Insurance, Travel Health Insurance, Critical Illness Insurance, Dental Insurance, and Others. Each of these segments caters to different consumer needs and preferences, reflecting the diverse landscape of health insurance offerings.

The Group Health Insurance segment is currently dominating the market due to the increasing number of corporates providing health benefits to their employees. This trend is driven by the rising awareness of employee wellness and the need for comprehensive health coverage. Additionally, the growing number of expatriates in Saudi Arabia has led to a higher demand for group insurance plans, making it a preferred choice for many organizations.

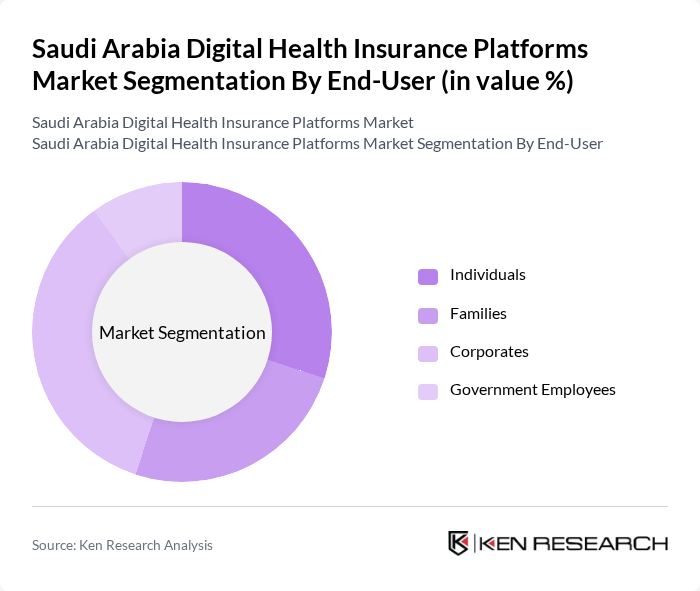

By End-User:The market is segmented by end-users, including Individuals, Families, Corporates, and Government Employees. Each segment has unique requirements and preferences, influencing the types of health insurance products they choose.

The Corporates segment is leading the market as many companies are increasingly recognizing the importance of providing health insurance to their employees. This trend is driven by the competitive job market and the need to attract and retain talent. Corporates are also leveraging group health insurance plans to manage costs effectively while ensuring comprehensive coverage for their workforce.

The Saudi Arabia Digital Health Insurance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tawuniya, Bupa Arabia, Medgulf, Allianz Saudi Fransi, Gulf Insurance Group, Al Rajhi Takaful, United Cooperative Assurance, Alinma Tokio Marine, Al-Ahlia Insurance Company, Al-Etihad Cooperative Insurance, Al-Jazira Takaful, Al-Mawared Insurance, Al-Sagr Cooperative Insurance, Al-Bilad Insurance, Al-Faisal Insurance contribute to innovation, geographic expansion, and service delivery in this space.

The future of digital health insurance platforms in Saudi Arabia appears promising, driven by technological advancements and increasing consumer acceptance. As the government continues to promote digital health initiatives, platforms are likely to integrate more advanced features, such as AI-driven personalized health plans. Additionally, the growing trend of preventive healthcare will encourage users to engage more actively with their health insurance providers, fostering a more proactive approach to health management and insurance utilization.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Health Insurance Family Health Insurance Group Health Insurance Travel Health Insurance Critical Illness Insurance Dental Insurance Others |

| By End-User | Individuals Families Corporates Government Employees |

| By Distribution Channel | Direct Sales Online Platforms Insurance Brokers Agents |

| By Coverage Type | Inpatient Coverage Outpatient Coverage Emergency Coverage Maternity Coverage |

| By Payment Model | Pay-per-visit Subscription-based Fee-for-service |

| By Age Group | Children Adults Seniors |

| By Policy Duration | Short-term Policies Long-term Policies Annual Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Health Insurance Users | 150 | Policyholders, Health Insurance Customers |

| Healthcare Providers | 100 | Doctors, Clinic Administrators |

| Insurance Brokers | 80 | Insurance Agents, Financial Advisors |

| Regulatory Bodies | 50 | Policy Makers, Health Regulators |

| Technology Providers in Health Sector | 70 | IT Managers, Health Tech Entrepreneurs |

The Saudi Arabia Digital Health Insurance Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of digital health solutions, rising healthcare costs, and a focus on preventive care.