Region:Middle East

Author(s):Geetanshi

Product Code:KRAA3716

Pages:85

Published On:September 2025

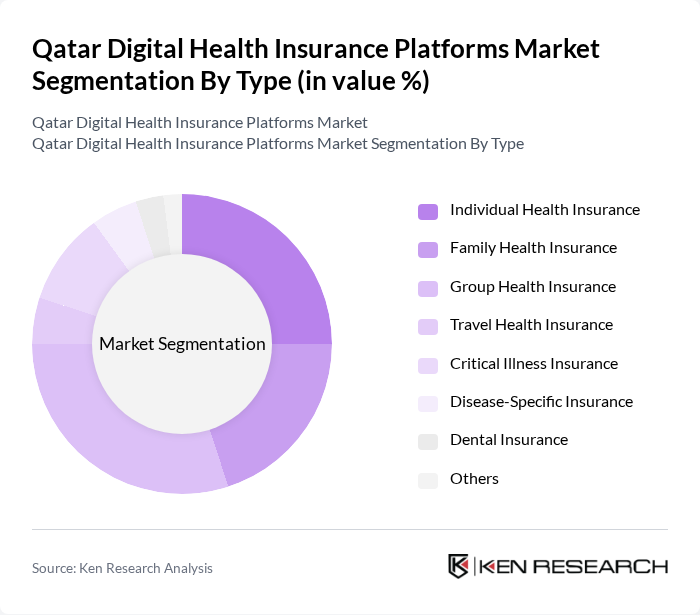

By Type:The market is segmented into various types of health insurance products, including Individual Health Insurance, Family Health Insurance, Group Health Insurance, Travel Health Insurance, Critical Illness Insurance, Disease-Specific Insurance, Dental Insurance, and Others. Each sub-segment addresses specific consumer needs, reflecting the diverse landscape of health insurance in Qatar, with a notable trend toward personalized and comprehensive coverage options .

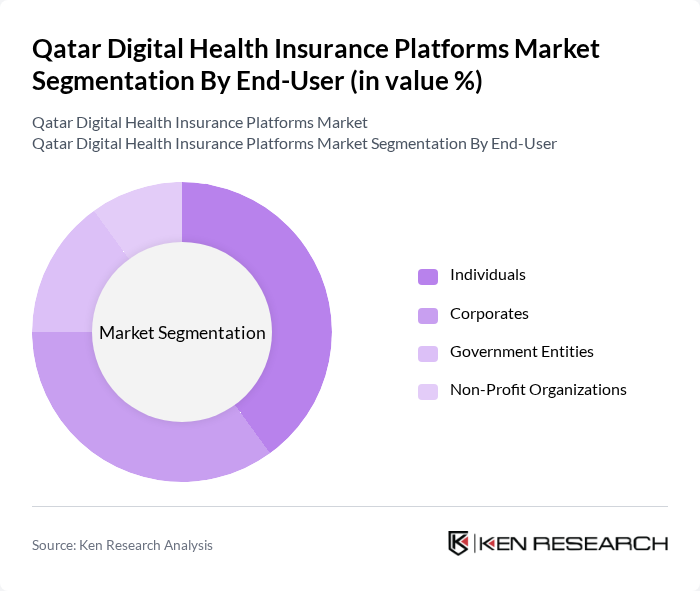

By End-User:The market is segmented by end-users, including Individuals, Corporates, Government Entities, and Non-Profit Organizations. Each segment has unique requirements and preferences, influencing the types of health insurance products they seek. Corporates and government entities are increasingly adopting digital platforms to streamline employee and citizen health benefits management, while individuals and non-profits are leveraging digital solutions for convenience and transparency .

The Qatar Digital Health Insurance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Insurance Company (QIC), Doha Insurance Group, Al Khaleej Takaful Insurance, QLM Life & Medical Insurance Company, Damaan Islamic Insurance Company (Beema), Qatar General Insurance and Reinsurance Company, Gulf Insurance Group (GIG Qatar), Medgulf Takaful, AXA Gulf (now part of GIG Gulf), Allianz Qatar, Aetna International (Qatar), Cigna Insurance Middle East (Qatar), Bupa Global (Qatar), MetLife Qatar, and NextCare Qatar contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Qatar digital health insurance market appears promising, driven by technological advancements and increasing consumer acceptance. The integration of artificial intelligence and health analytics is expected to enhance service delivery and personalization. Additionally, the growing emphasis on mental health services and value-based care models will likely reshape the landscape, encouraging platforms to innovate and adapt to evolving consumer needs. As regulatory frameworks mature, the market is poised for significant growth and transformation.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Health Insurance Family Health Insurance Group Health Insurance Travel Health Insurance Critical Illness Insurance Disease-Specific Insurance Dental Insurance Others |

| By End-User | Individuals Corporates Government Entities Non-Profit Organizations |

| By Distribution Channel | Direct Sales Online Platforms Insurance Brokers Agents Bancassurance |

| By Coverage Type | Comprehensive Coverage Basic Coverage Customizable Plans |

| By Payment Model | Pay-Per-Use Subscription-Based One-Time Payment |

| By Customer Demographics | Age Group (Children, Adults, Seniors) Income Level (Low, Middle, High) Employment Status (Employed, Unemployed, Retired) Nationality (Qatari, Expatriate) |

| By Policy Duration | Short-Term Policies Long-Term Policies Annual Renewals |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Health Insurance Providers | 60 | CEOs, Product Managers, IT Directors |

| Healthcare Service Providers | 50 | Hospital Administrators, Clinic Managers, IT Specialists |

| Insurance Policyholders | 120 | Individual Consumers, Family Plan Holders |

| Regulatory Bodies | 40 | Policy Makers, Health Economists, Compliance Officers |

| Technology Vendors in Health Insurance | 40 | Product Development Managers, Sales Executives |

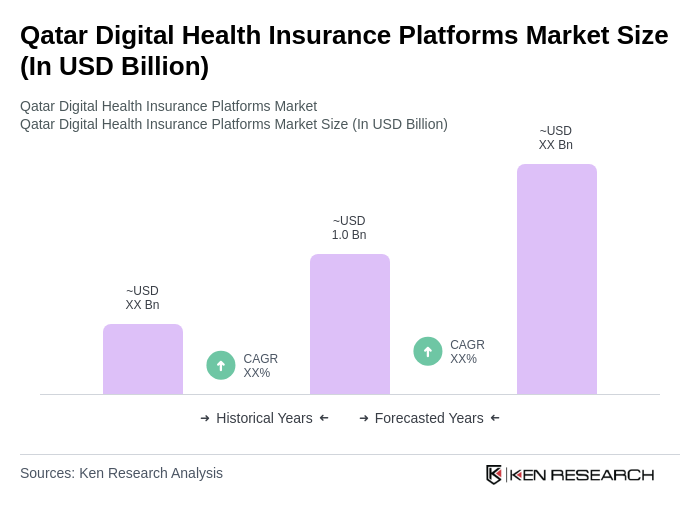

The Qatar Digital Health Insurance Platforms Market is valued at approximately USD 1.0 billion, reflecting the significant growth driven by the adoption of digital health solutions and rising healthcare costs in the region.