Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB4580

Pages:82

Published On:October 2025

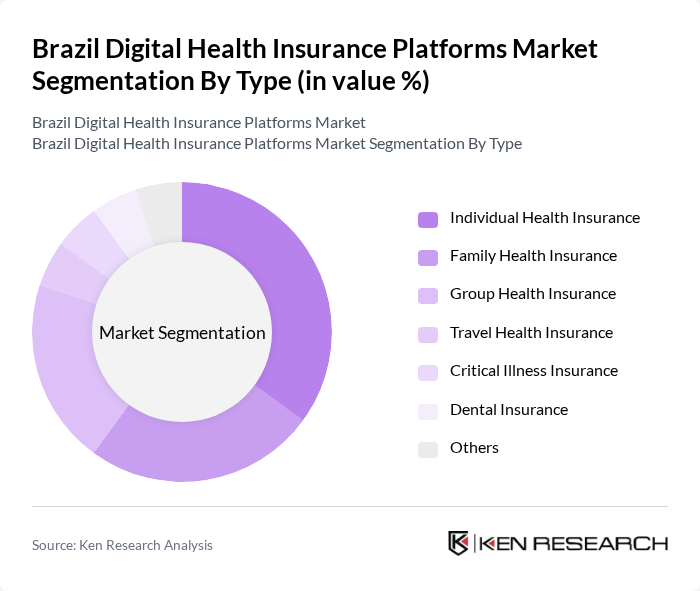

By Type:

The market is segmented into Individual Health Insurance, Family Health Insurance, Group Health Insurance, Travel Health Insurance, Critical Illness Insurance, Dental Insurance, and Others. Individual Health Insurance remains the leading subsegment, supported by the growing number of self-employed professionals and heightened awareness of personal health management. Family Health Insurance is gaining momentum as families seek comprehensive coverage, while Group Health Insurance is increasingly adopted by corporates to provide employee benefits. Travel and Critical Illness Insurance address specific needs for frequent travelers and those seeking protection against major health risks. Dental Insurance continues to be relevant due to increased demand for oral healthcare.

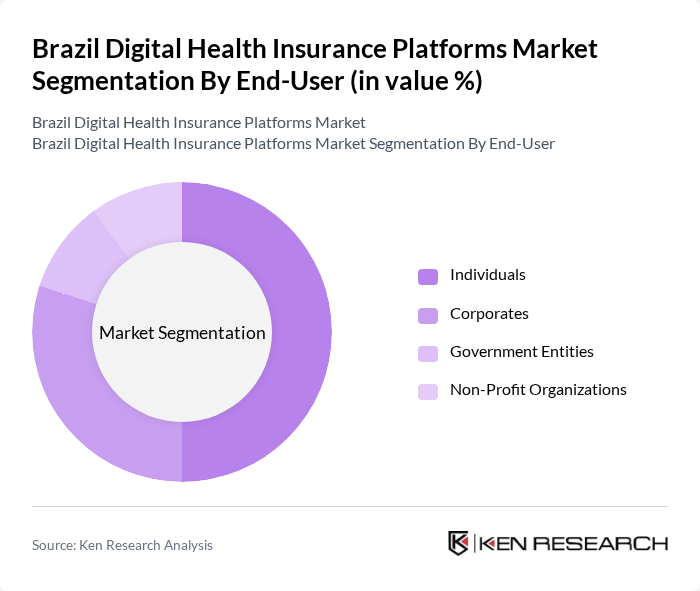

By End-User:

End-user segmentation includes Individuals, Corporates, Government Entities, and Non-Profit Organizations. Individuals constitute the largest segment, reflecting the rising preference for personal health insurance plans. Corporates are increasingly investing in Group Health Insurance to attract and retain talent, while Government Entities focus on extending coverage to underserved populations. Non-Profit Organizations play an important role in promoting insurance awareness and facilitating access, especially in rural and low-income areas.

The Brazil Digital Health Insurance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amil Saúde S.A., Bradesco Saúde S.A., Hapvida Participações e Administração S.A., Unimed do Brasil, SulAmérica S.A., Grupo NotreDame Intermédica, Porto Seguro S.A., Allianz Saúde S.A., Omint Saúde S.A., Prevent Senior, Caixa Seguradora S.A., Odontoprev S.A., Doctoralia, Zenklub, Conexa Saúde, Saúde iD, Dasa S.A., Teladoc Health, Inc., Grupo Sabin, AMHE Med Assistência contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's digital health insurance platforms is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As telemedicine continues to gain traction, platforms will increasingly integrate AI and machine learning to enhance service delivery and personalization. Additionally, the focus on mental health services is expected to expand, reflecting societal shifts towards holistic health approaches. These trends will likely create a more dynamic and responsive market landscape, fostering innovation and improved health outcomes for consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Health Insurance Family Health Insurance Group Health Insurance Travel Health Insurance Critical Illness Insurance Dental Insurance Others |

| By End-User | Individuals Corporates Government Entities Non-Profit Organizations |

| By Distribution Channel | Direct Sales Online Platforms Insurance Brokers Agents |

| By Payment Model | Fee-for-Service Capitation Pay-for-Performance |

| By Coverage Type | Comprehensive Coverage Basic Coverage Supplemental Coverage |

| By Technology Integration | Mobile Applications Web Portals AI-driven Solutions |

| By Policy Duration | Short-Term Policies Long-Term Policies Lifetime Policies |

| By Demographics | Age Group (Children, Adults, Seniors) Income Level (Low, Middle, High) Urban vs Rural |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Health Insurance Users | 120 | Policyholders, Health Insurance Customers |

| Healthcare Providers | 90 | Doctors, Clinic Administrators |

| Insurance Brokers | 60 | Insurance Agents, Financial Advisors |

| Regulatory Bodies | 40 | Health Policy Makers, Compliance Officers |

| Technology Developers in Health Sector | 50 | CTOs, Product Managers |

The Brazil Digital Health Insurance Platforms Market is valued at approximately USD 15 billion, driven by the rapid adoption of digital health solutions, rising healthcare costs, and increased awareness of health insurance among the population.