Region:Europe

Author(s):Rebecca

Product Code:KRAB2893

Pages:82

Published On:October 2025

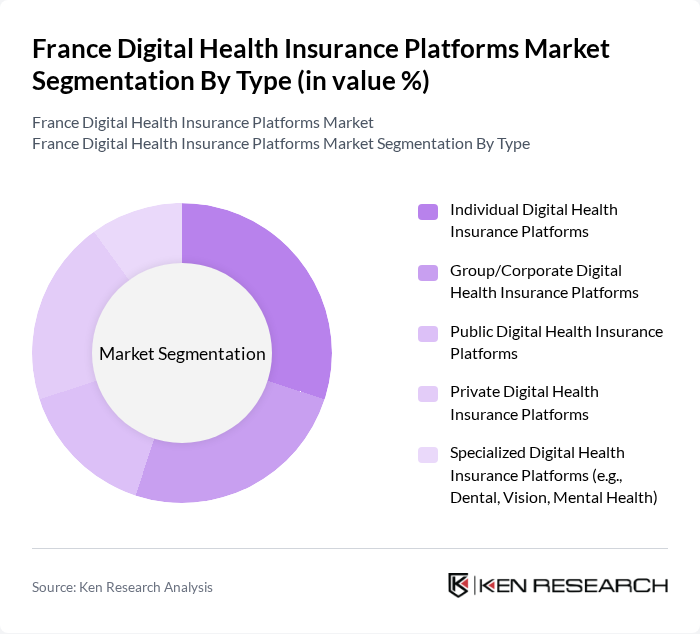

By Type:The market is segmented into various types of digital health insurance platforms, including Individual Digital Health Insurance Platforms, Group/Corporate Digital Health Insurance Platforms, Public Digital Health Insurance Platforms, Private Digital Health Insurance Platforms, and Specialized Digital Health Insurance Platforms (e.g., Dental, Vision, Mental Health). Among these, Individual Digital Health Insurance Platforms are gaining traction due to the increasing demand for personalized health solutions and the growing trend of self-managed healthcare. Consumers are increasingly seeking tailored insurance products that cater to their specific health needs, driving the growth of this subsegment. The rise of digital-first insurance providers and the integration of telemedicine and digital wellness programs further support this trend .

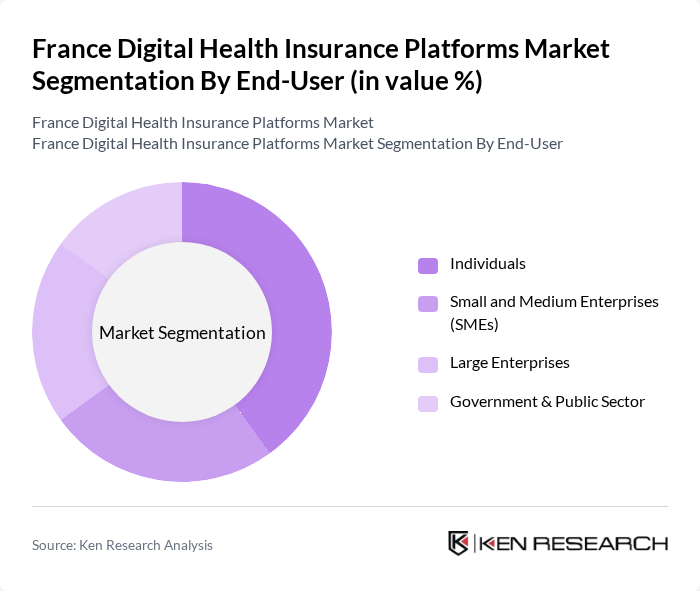

By End-User:The end-user segmentation includes Individuals, Small and Medium Enterprises (SMEs), Large Enterprises, and Government & Public Sector. The Individuals segment is currently leading the market, driven by the increasing awareness of health insurance benefits and the growing trend of digital health solutions among consumers. As more individuals seek convenient and accessible healthcare options, this segment is expected to continue its dominance in the market. The proliferation of mobile health apps and digital onboarding processes has made health insurance more accessible to individuals, supporting this segment’s growth .

The France Digital Health Insurance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alan, Luko, Qare, Doctolib, SantéVet, APRIL, Assurpeople, Mutuelle.com, Leocare, Healthily, Livi, MédecinDirect, MonDocteur, AXA, Allianz, Cegedim, Santech, Orange Healthcare, Crédit Agricole Assurances, Generali France contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France digital health insurance platforms market appears promising, driven by technological advancements and increasing consumer demand for personalized healthcare solutions. As the integration of AI and big data analytics becomes more prevalent, platforms will enhance their service offerings, improving patient outcomes. Additionally, the focus on preventive healthcare will likely lead to innovative partnerships between digital health providers and traditional healthcare systems, fostering a more holistic approach to health management in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Digital Health Insurance Platforms Group/Corporate Digital Health Insurance Platforms Public Digital Health Insurance Platforms Private Digital Health Insurance Platforms Specialized Digital Health Insurance Platforms (e.g., Dental, Vision, Mental Health) |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Large Enterprises Government & Public Sector |

| By Distribution Channel | Direct Online Platforms Insurance Brokers & Agents Bancassurance Employer-Based Platforms Others |

| By Service Type | Policy Administration & Claims Management Telemedicine Integration Services Health Risk Assessment & Wellness Services Customer Support & Engagement Services Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Freemium/Trial Commission-Based Others |

| By Technology Used | Cloud-Based Solutions Mobile Applications AI & Data Analytics Platforms Blockchain-Based Platforms Others |

| By Customer Segment | Young Adults (18-35) Families Seniors High-Risk/Chronic Condition Patients Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Health Insurance Users | 120 | Policyholders, Digital Health Platform Users |

| Healthcare Providers Utilizing Digital Platforms | 90 | Doctors, Clinic Administrators |

| Insurance Company Executives | 40 | CEOs, Product Development Managers |

| Regulatory Bodies and Health Policy Makers | 50 | Health Economists, Policy Analysts |

| Technology Providers in Digital Health | 60 | CTOs, Product Managers |

The France Digital Health Insurance Platforms Market is valued at approximately USD 6.6 billion, driven by the increasing adoption of digital health solutions, rising healthcare costs, and a focus on preventive care.