Region:Asia

Author(s):Rebecca

Product Code:KRAA6967

Pages:89

Published On:September 2025

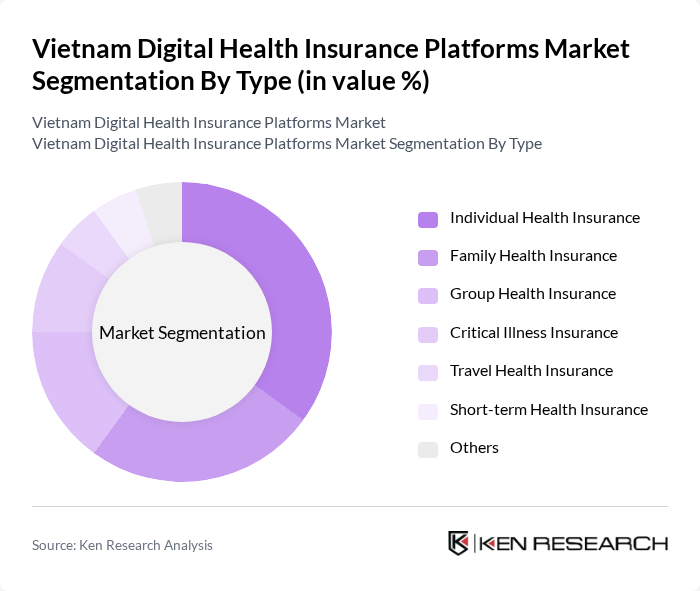

By Type:The market is segmented into various types of health insurance products, including Individual Health Insurance, Family Health Insurance, Group Health Insurance, Critical Illness Insurance, Travel Health Insurance, Short-term Health Insurance, and Others. Among these, Individual Health Insurance is currently the leading sub-segment, driven by the increasing number of self-employed individuals and a growing awareness of personal health management. Family Health Insurance is also gaining traction as families seek comprehensive coverage for all members.

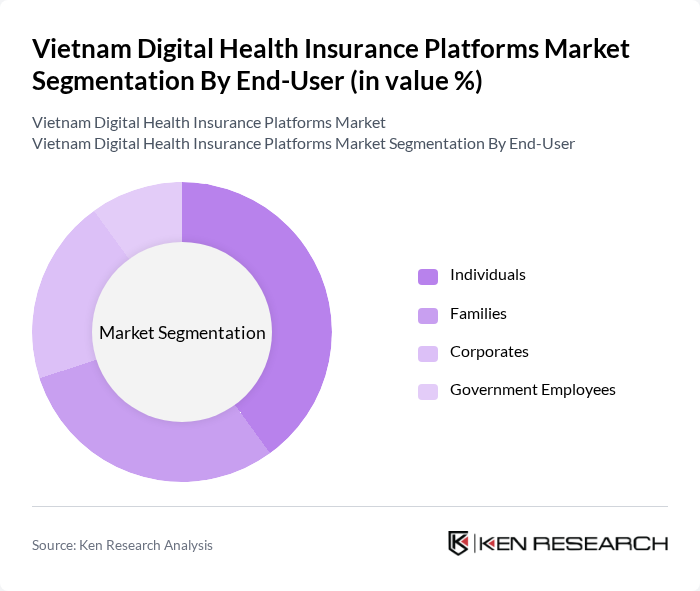

By End-User:The end-user segmentation includes Individuals, Families, Corporates, and Government Employees. The Individual segment is the most significant contributor to the market, as more people are recognizing the importance of personal health insurance. Families are also increasingly opting for comprehensive health plans that cover all members, while Corporates are investing in group health insurance to attract and retain talent.

The Vietnam Digital Health Insurance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bao Viet Holdings, Prudential Vietnam Assurance, Manulife Vietnam, AIA Vietnam, Generali Vietnam, PVI Insurance, BIC Insurance, VietinBank Insurance, FPT Insurance, Liberty Insurance, Hanwha Life Vietnam, Sun Life Vietnam, Chubb Life Vietnam, Vietcombank Insurance, HDI Insurance contribute to innovation, geographic expansion, and service delivery in this space.

The future of Vietnam's digital health insurance market appears promising, driven by technological advancements and increasing consumer demand for personalized healthcare solutions. As the government continues to invest in digital health infrastructure, platforms are likely to enhance their offerings through innovative technologies such as AI and telemedicine. Additionally, the growing trend towards preventive healthcare will encourage consumers to seek insurance products that align with their health goals, fostering a more proactive approach to health management in the country.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Health Insurance Family Health Insurance Group Health Insurance Critical Illness Insurance Travel Health Insurance Short-term Health Insurance Others |

| By End-User | Individuals Families Corporates Government Employees |

| By Distribution Channel | Online Platforms Insurance Agents Brokers Direct Sales |

| By Policy Duration | Short-term Policies Long-term Policies |

| By Premium Range | Low Premium Medium Premium High Premium |

| By Customer Demographics | Age Group (Children, Adults, Seniors) Income Level (Low, Middle, High) |

| By Policy Features | Cashless Treatment Pre-existing Condition Coverage Maternity Benefits Wellness Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Health Insurance Users | 150 | Policyholders, Health Insurance Customers |

| Healthcare Providers | 100 | Doctors, Clinic Administrators |

| Insurance Company Executives | 80 | CEOs, Product Managers |

| Regulatory Bodies | 50 | Health Policy Makers, Regulatory Officers |

| Technology Providers in Health Sector | 70 | IT Managers, Software Developers |

The Vietnam Digital Health Insurance Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of digital technologies in healthcare and increasing awareness of health insurance among the population.