Region:Asia

Author(s):Geetanshi

Product Code:KRAA4487

Pages:97

Published On:January 2026

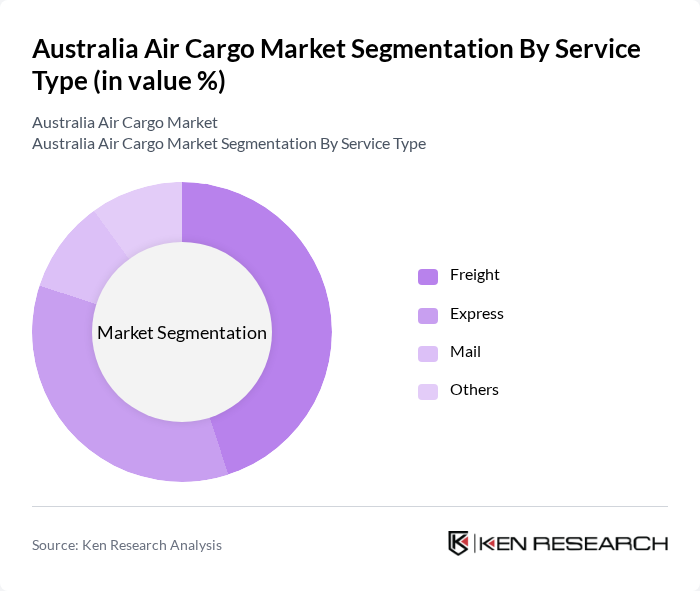

By Service Type:The service type segmentation includes various categories such as Freight, Express, Mail, and Others. Among these, the Freight segment is the most dominant due to its extensive use in transporting bulk goods and commodities. The demand for freight services is driven by industries such as manufacturing and retail, which require timely delivery of products. Express services are also gaining traction, particularly in the e-commerce sector, where speed is crucial. Mail services, while important, have seen a decline in growth compared to freight and express services.

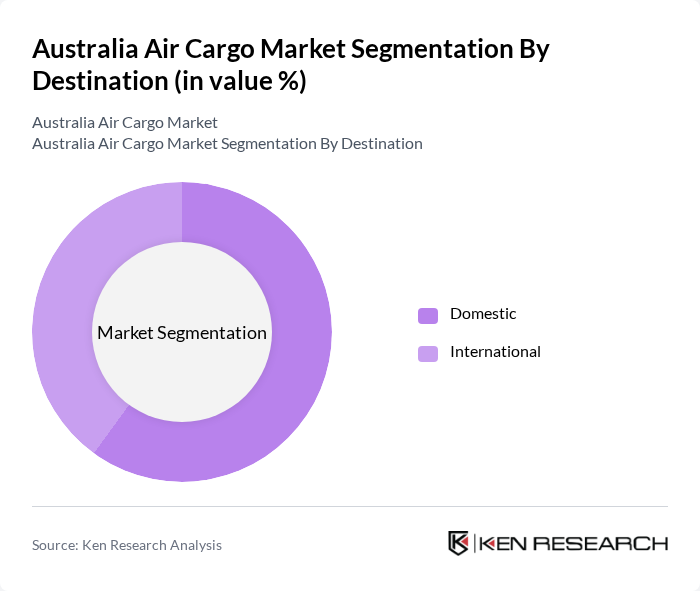

By Destination:The destination segmentation encompasses Domestic and International categories. The Domestic segment is the leading category, driven by the need for quick transportation of goods across Australia’s vast geography. The growth of e-commerce has significantly boosted domestic air cargo services, as businesses seek to meet consumer demands for rapid delivery. The International segment is also vital, as Australia engages in extensive trade with countries in Asia, North America, and Europe, necessitating efficient air cargo solutions for exports and imports.

The Australia Air Cargo Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qantas Freight, Virgin Australia Cargo, Toll Group, DHL Express Australia, FedEx Australia, UPS Australia, Australia Post, TNT Australia, Air New Zealand Cargo, Singapore Airlines Cargo, Emirates SkyCargo, Cathay Pacific Cargo, China Airlines Cargo, LATAM Cargo, Qatar Airways Cargo contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia air cargo market appears promising, driven by ongoing technological advancements and a growing emphasis on sustainability. As e-commerce continues to thrive, air cargo operators are likely to adopt innovative solutions to enhance efficiency and reduce environmental impact. Additionally, the integration of AI and automation in logistics processes will streamline operations, enabling faster and more reliable service. These trends will shape the market landscape, fostering resilience and adaptability in the face of evolving consumer demands and regulatory challenges.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Freight Express Others |

| By Destination | Domestic International |

| By End Use | Private Commercial |

| By Cargo Type | General Cargo Perishable Goods Pharmaceuticals and Healthcare Products Electronics and High-Value Goods E-commerce Shipments Others |

| By Region | New South Wales Victoria Queensland Australian Capital Territory Western Australia Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Air Freight | 50 | Logistics Managers, Compliance Officers |

| Perishable Goods Transportation | 40 | Supply Chain Directors, Quality Assurance Managers |

| Electronics and High-Value Cargo | 45 | Operations Managers, Risk Management Specialists |

| General Cargo Services | 60 | Freight Forwarders, Business Development Managers |

| E-commerce Logistics Solutions | 55 | eCommerce Managers, Fulfillment Operations Heads |

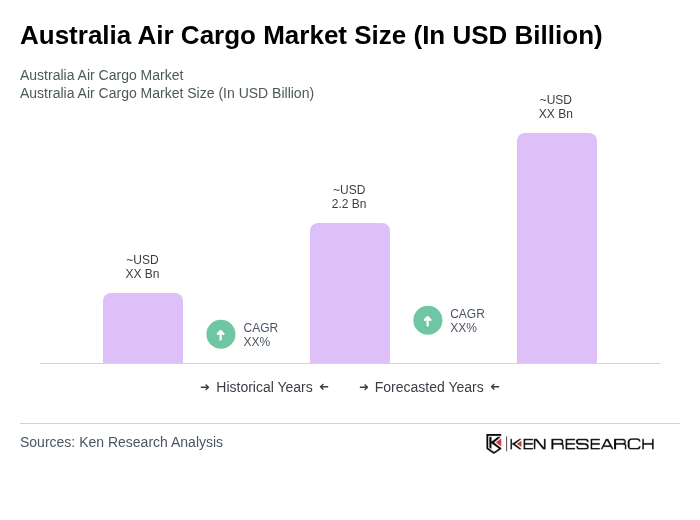

The Australia Air Cargo Market is valued at approximately USD 2.2 billion, reflecting a significant growth driven by increasing demand for fast shipping solutions, particularly in e-commerce, and the expansion of international trade.