Region:Asia

Author(s):Geetanshi

Product Code:KRAA4476

Pages:93

Published On:January 2026

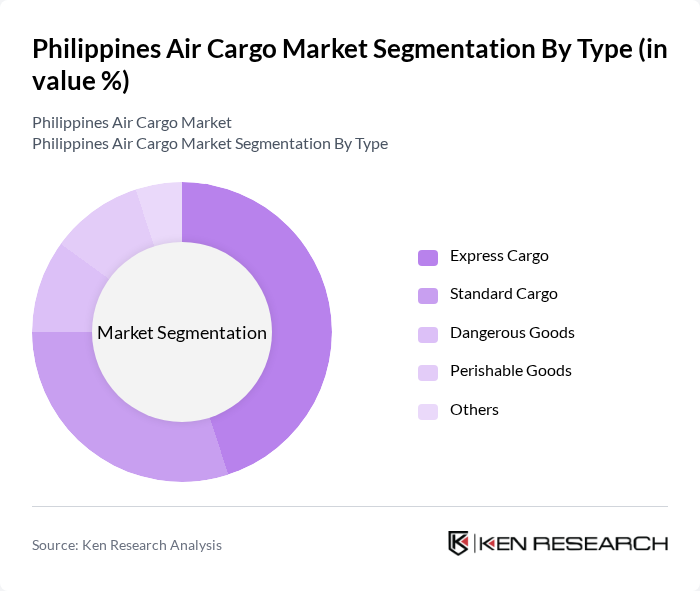

By Type:The air cargo market can be segmented into various types, including Express Cargo, Standard Cargo, Dangerous Goods, Perishable Goods, and Others. Among these, Express Cargo is the most dominant segment, driven by the increasing demand for fast delivery services, particularly in e-commerce. The rise in online shopping has led to a surge in the need for quick and reliable shipping options, making Express Cargo a critical component of the air cargo market.

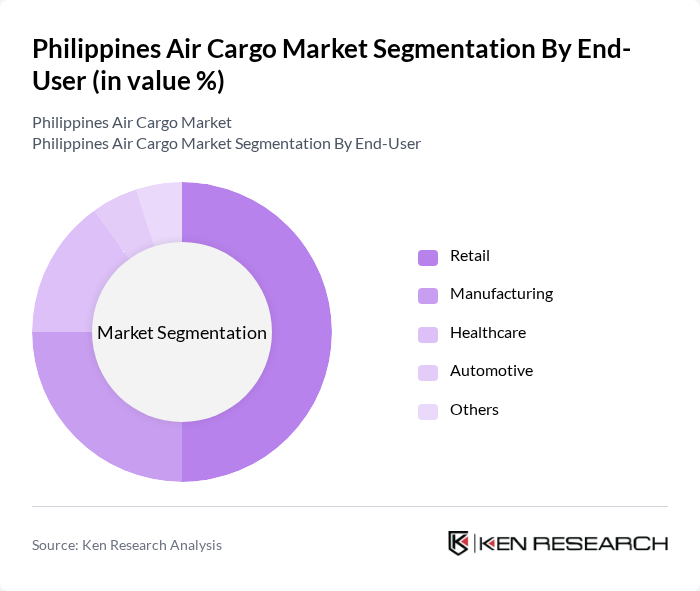

By End-User:The air cargo market serves various end-users, including Retail, Manufacturing, Healthcare, Automotive, and Others. The Retail segment is the leading end-user, primarily due to the rapid growth of e-commerce and online shopping. Retailers increasingly rely on air cargo services to ensure timely delivery of products to consumers, which has significantly boosted the demand for air freight services in this segment.

The Philippines Air Cargo Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philippine Airlines Cargo, Cebu Pacific Air Cargo, Air21, LBC Express, DHL Express Philippines, FedEx Philippines, UPS Philippines, JRS Express, Xend Business Solutions, 2GO Group, Aboitiz Transport System, Skyfreight Forwarders, Transglobal Cargo, Kuehne + Nagel Philippines, Agility Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines air cargo market is poised for significant growth, driven by the increasing demand for e-commerce and global trade. As infrastructure improvements take shape, logistics companies will enhance their operational capabilities, enabling faster delivery times. Additionally, the integration of technology, such as AI and automation, will streamline processes, further boosting efficiency. The focus on sustainability will also shape future investments, as companies seek to adopt greener practices in their operations, aligning with global trends toward environmental responsibility.

| Segment | Sub-Segments |

|---|---|

| By Type | Express Cargo Standard Cargo Dangerous Goods Perishable Goods Others |

| By End-User | Retail Manufacturing Healthcare Automotive Others |

| By Region | Luzon Visayas Mindanao |

| By Service Type | Freight Forwarding Charter Services Integrated Logistics Others |

| By Cargo Size | Small Cargo Medium Cargo Large Cargo |

| By Delivery Speed | Same-Day Delivery Next-Day Delivery Standard Delivery |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electronics Air Cargo Transport | 45 | Logistics Managers, Supply Chain Analysts |

| Pharmaceuticals Cold Chain Logistics | 40 | Operations Managers, Quality Assurance Heads |

| Perishable Goods Handling | 35 | Warehouse Managers, Distribution Coordinators |

| Textile and Apparel Air Freight | 30 | Procurement Officers, Logistics Coordinators |

| General Cargo Operations | 40 | Air Cargo Supervisors, Freight Forwarding Managers |

The Philippines Air Cargo Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by increasing e-commerce demand, international trade expansion, and the rise of high-value electronics and semiconductors.