Region:Middle East

Author(s):Geetanshi

Product Code:KRAA4479

Pages:86

Published On:January 2026

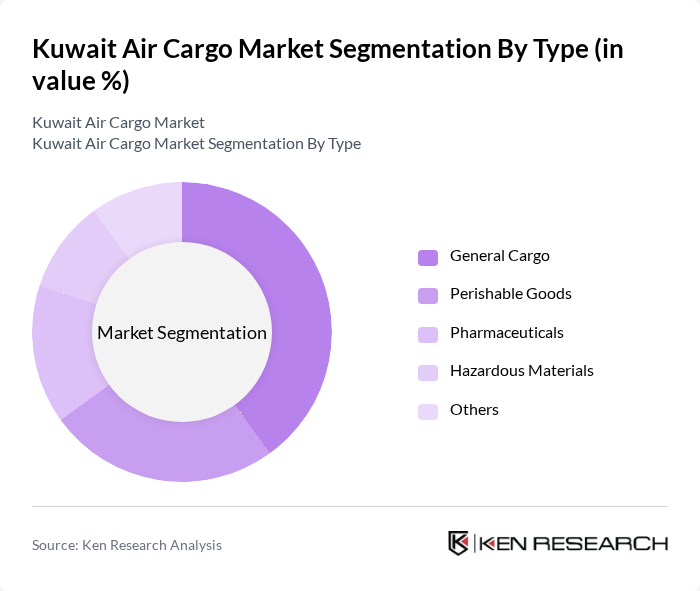

By Type:The air cargo market can be segmented into various types, including General Cargo, Perishable Goods, Pharmaceuticals, Hazardous Materials, and Others. Each of these sub-segments plays a crucial role in the overall market dynamics, with specific demands and requirements that cater to different industries.

The General Cargo segment dominates the market due to its broad applicability across various industries, including retail and manufacturing. This segment benefits from the increasing volume of goods traded internationally, as businesses seek efficient logistics solutions to meet consumer demand. The rise of e-commerce has also significantly contributed to the growth of general cargo, as online retailers require reliable air freight services to ensure timely deliveries.

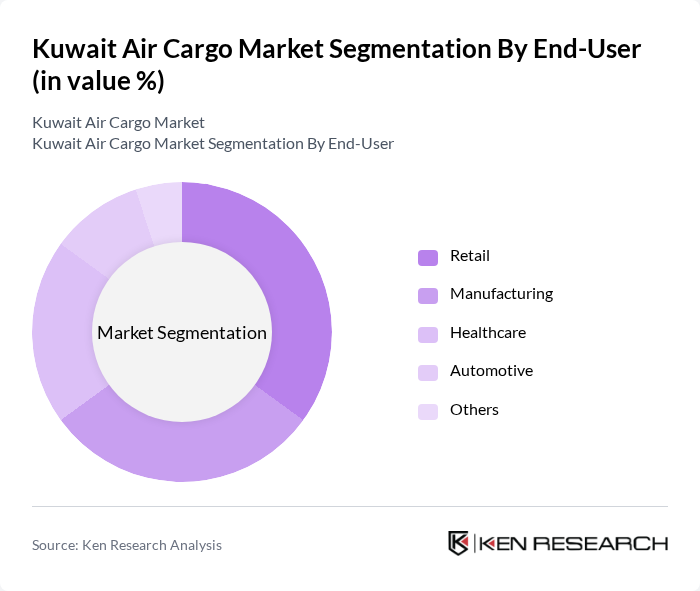

By End-User:The air cargo market is segmented by end-user into Retail, Manufacturing, Healthcare, Automotive, and Others. Each segment has unique requirements and contributes differently to the overall market landscape.

The Retail segment is the leading end-user in the air cargo market, driven by the rapid growth of e-commerce and the increasing demand for fast delivery services. Retailers rely heavily on air cargo to ensure that products reach consumers quickly, especially for high-demand items. The Manufacturing sector also plays a significant role, as companies require timely delivery of components and finished goods to maintain production schedules.

The Kuwait Air Cargo Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Airways, Agility Logistics, DHL Express, FedEx, UPS, Qatar Airways Cargo, Emirates SkyCargo, Etihad Cargo, Kuehne + Nagel, DB Schenker, Panalpina, Agility Logistics, Aramex, Cargolux, Menzies Aviation contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait air cargo market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of digital freight platforms is expected to streamline operations, enhancing efficiency and transparency. Additionally, the focus on sustainability will likely lead to increased investments in eco-friendly logistics solutions. As the demand for on-demand air cargo services rises, operators will need to adapt quickly to meet customer expectations, positioning themselves for future growth in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | General Cargo Perishable Goods Pharmaceuticals Hazardous Materials Others |

| By End-User | Retail Manufacturing Healthcare Automotive Others |

| By Cargo Size | Small Shipments Medium Shipments Large Shipments Others |

| By Delivery Speed | Same-Day Delivery Next-Day Delivery Standard Delivery Others |

| By Destination | Domestic International Regional Others |

| By Service Type | Express Services Freight Forwarding Charter Services Others |

| By Payment Method | Prepaid Postpaid Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Freight Forwarding Services | 100 | Logistics Managers, Operations Directors |

| Air Cargo Handling Facilities | 80 | Facility Managers, Cargo Operations Supervisors |

| Customs Clearance Processes | 70 | Customs Brokers, Compliance Officers |

| Perishable Goods Transport | 60 | Supply Chain Managers, Quality Assurance Heads |

| Pharmaceutical Logistics | 90 | Pharmaceutical Supply Chain Directors, Regulatory Affairs Managers |

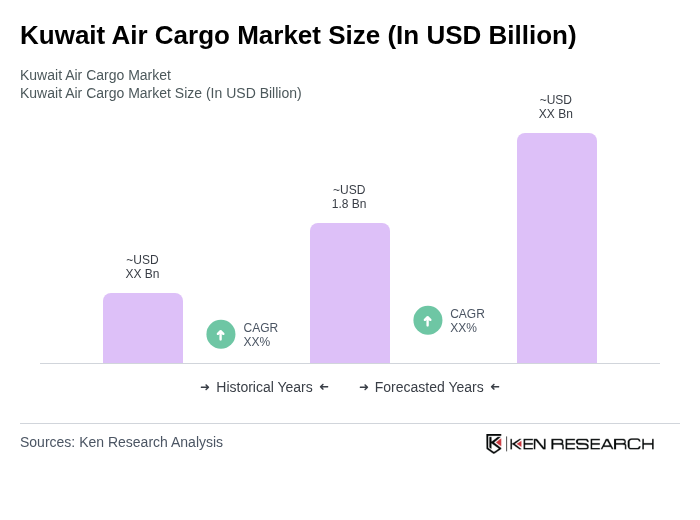

The Kuwait Air Cargo Market is valued at approximately USD 1.8 billion, reflecting significant growth driven by increasing demand for logistics solutions, e-commerce expansion, and Kuwait's strategic location as a logistics hub in the Middle East.