Australia Automotive Telematics Market Overview

- The Australia Automotive Telematics Market is valued at USD 1.3 billion, based on a five-year historical analysis, supported by the strong expansion of fleet management, connected car, and telematics-driven compliance solutions in the country. This growth is primarily driven by the increasing adoption of connected vehicles, advancements in telematics technology (including GPS tracking, remote diagnostics, and cloud-based analytics), and the rising demand for fleet management solutions across logistics, leasing, construction, and services sectors. The integration of telematics in vehicles enhances safety through driver behavior monitoring, improves efficiency via route optimization and fuel management, and enriches user experience through connected infotainment and navigation, all of which contribute to the market's expansion.

- Key demand centers in this market include major cities such as Sydney, Melbourne, and Brisbane, which lead in telematics adoption due to high vehicle ownership rates, concentration of commercial vehicle fleets, and significant investments in smart city and intelligent transport initiatives that rely on connected vehicle data. These urban centers are also characterized by growing demand for innovative telematics solutions that support congestion management, incident response, and integrated mobility services through advanced traffic management and real-time fleet visibility.

- In 2023, the Australian government further strengthened the policy environment supporting telematics in road transport through measures linked to heavy vehicle safety, chain-of-responsibility compliance, and fatigue management, which are increasingly operationalized using certified telematics and in-vehicle monitoring systems. A key binding framework is the Heavy Vehicle National Law and associated Heavy Vehicle (Fatigue Management) National Regulation, administered by the National Heavy Vehicle Regulator and state and territory road agencies, which sets mandatory requirements on work and rest hours, record-keeping, and compliance monitoring; many operators use telematics-based electronic work diaries and location tracking to demonstrate adherence to these rules and to improve overall fleet efficiency and safety outcomes.

Australia Automotive Telematics Market Segmentation

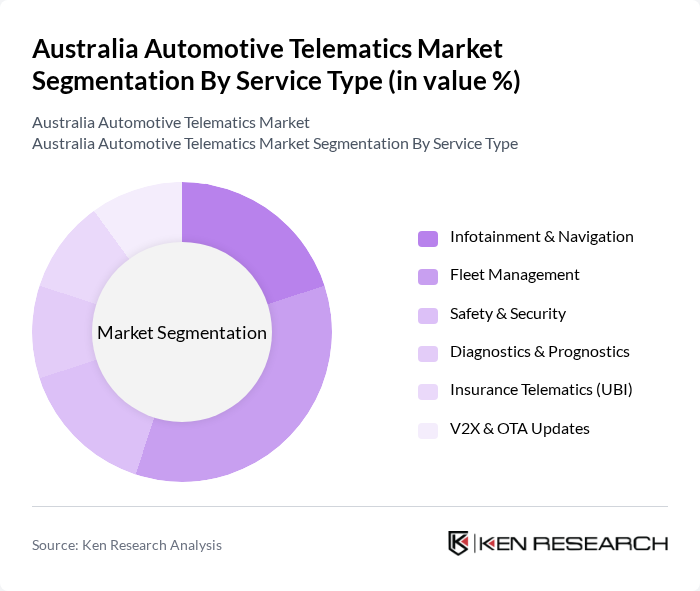

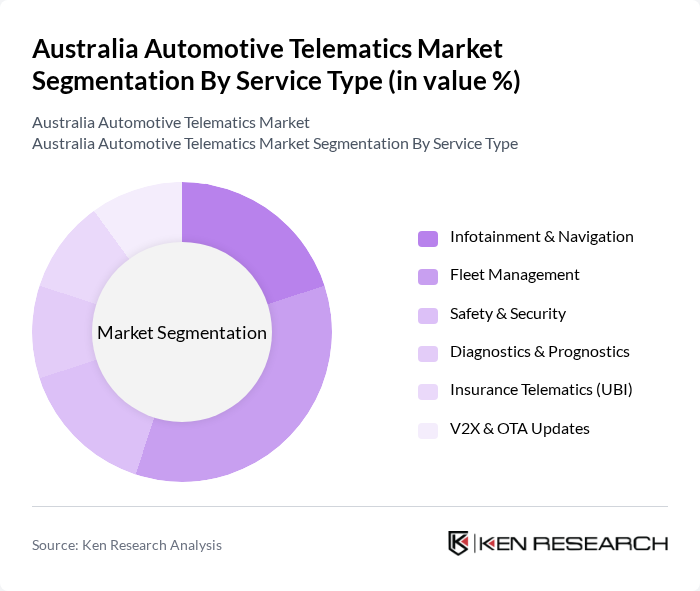

By Service Type:The service type segmentation includes various subsegments such as Infotainment & Navigation, Fleet Management, Safety & Security, Diagnostics & Prognostics, Insurance Telematics (UBI), and V2X & OTA Updates. Among these, Fleet Management is currently the leading subsegment, driven by the increasing need for businesses to optimize their operations, comply with safety and fatigue regulations, and reduce costs through better fuel management, routing, and asset utilization. The demand for real-time tracking, driver behavior analytics, and integrated compliance reporting in fleet management has surged, making it a critical component of telematics solutions across commercial vehicle segments.

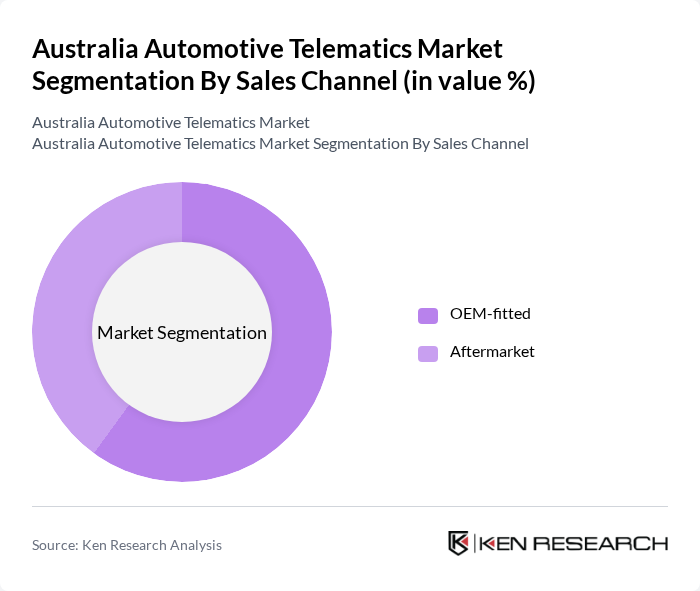

By Sales Channel:The sales channel segmentation consists of OEM-fitted and Aftermarket solutions. The OEM-fitted segment is currently leading the market due to the increasing integration of embedded connectivity, eCall, navigation, and remote diagnostics platforms into new vehicles by global and regional manufacturers operating in Australia, in line with global connected car strategies. This trend is driven by consumer demand for advanced features, subscription-based connected services, and the growing emphasis on safety, over-the-air software updates, and always-on connectivity in modern vehicles, while the aftermarket remains important for retrofitting commercial fleets with advanced tracking and compliance capabilities.

Australia Automotive Telematics Market Competitive Landscape

The Australia Automotive Telematics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Telstra Corporation Limited, Fleet Complete Australia, Teletrac Navman Australia, MiX Telematics, Geotab Inc., Verizon Connect, TomTom Telematics (Webfleet), Ctrack by Inseego, Navman Wireless (Legacy Operations), Inseego Corp., Blackline Safety Corp., Zubie Inc., Omnicomm, Agero, Inc., Octo Telematics contribute to innovation, geographic expansion, and service delivery in this space, providing solutions that range from basic GPS tracking to advanced analytics, driver safety, and integrated compliance platforms for commercial fleets.

Australia Automotive Telematics Market Industry Analysis

Growth Drivers

- Increasing Demand for Vehicle Safety and Security:The Australian automotive market is witnessing a surge in demand for enhanced vehicle safety and security features. In future, the Australian government reported a 15% increase in road safety initiatives, leading to a rise in telematics adoption. With over 1.3 million registered vehicles equipped with advanced safety systems, the focus on reducing road fatalities, which stood at approximately 1,260 road deaths, is driving telematics integration significantly.

- Rising Adoption of Connected Vehicles:The connected vehicle segment in Australia is expanding rapidly, with over 2 million connected vehicles on the road as of future. This growth is fueled by consumer demand for real-time data and connectivity features. The Australian Bureau of Statistics reported that 60% of new vehicle sales in future included connected technology, indicating a strong trend towards telematics solutions that enhance user experience and vehicle performance.

- Government Initiatives Promoting Telematics:The Australian government has implemented various initiatives to promote telematics adoption, including funding for smart transport projects. In future, the government allocated AUD 50 million to enhance telematics infrastructure. This investment aims to improve traffic management and reduce congestion, which is projected to save the economy AUD 1.5 billion annually by future, further driving telematics market growth.

Market Challenges

- High Initial Investment Costs:One of the significant barriers to telematics adoption in Australia is the high initial investment required for hardware and software integration. The average cost of telematics systems can range from AUD 1,000 to AUD 3,000 per vehicle. This upfront expense poses a challenge for small fleet operators, who may find it difficult to justify the investment against potential long-term savings, limiting market penetration.

- Data Privacy and Security Concerns:As telematics systems collect vast amounts of data, concerns regarding data privacy and security are prevalent. In future, a survey indicated that 70% of consumers expressed worries about how their data is used and shared. The Australian Cyber Security Centre reported a 30% increase in cyber threats targeting connected vehicles, highlighting the need for robust security measures to build consumer trust and encourage adoption.

Australia Automotive Telematics Market Future Outlook

The future of the automotive telematics market in Australia appears promising, driven by technological advancements and increasing consumer awareness. The expansion of 5G networks is expected to enhance connectivity, enabling real-time data transmission and improved telematics services. Additionally, the integration of AI and machine learning will facilitate predictive analytics, allowing for better fleet management and personalized user experiences. These trends are likely to shape the market landscape significantly in the coming years.

Market Opportunities

- Expansion of 5G Networks:The rollout of 5G technology in Australia presents a significant opportunity for telematics providers. With 5G expected to cover 90% of the population by future, telematics solutions can leverage faster data speeds and lower latency, enhancing real-time vehicle tracking and communication capabilities, ultimately improving service delivery and customer satisfaction.

- Integration of AI and Machine Learning:The incorporation of AI and machine learning into telematics systems offers substantial growth potential. By future, it is anticipated that 40% of telematics solutions will utilize AI for predictive maintenance and driver behavior analysis. This integration can lead to reduced operational costs and improved safety outcomes, making telematics more appealing to fleet operators and consumers alike.