Region:Asia

Author(s):Shubham

Product Code:KRAD2683

Pages:88

Published On:January 2026

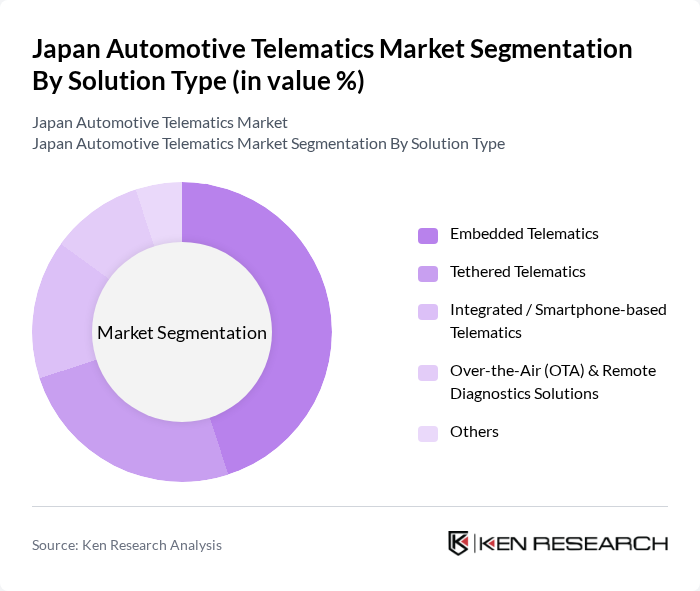

By Solution Type:

The solution type segmentation includes Embedded Telematics, Tethered Telematics, Integrated / Smartphone-based Telematics, Over-the-Air (OTA) & Remote Diagnostics Solutions, and Others. Among these, Embedded Telematics is the leading subsegment, driven by its seamless integration into vehicles, providing real-time data, safety services, and connectivity from the point of sale. The growing trend of connected cars, OEM-branded connected services, and the demand for advanced safety and navigation features have further propelled the adoption of embedded solutions in Japan. Tethered and integrated/smartphone-based telematics are also gaining traction, particularly among tech-savvy consumers who prefer app-based services and smartphone connectivity for infotainment, navigation, and basic vehicle status functions.

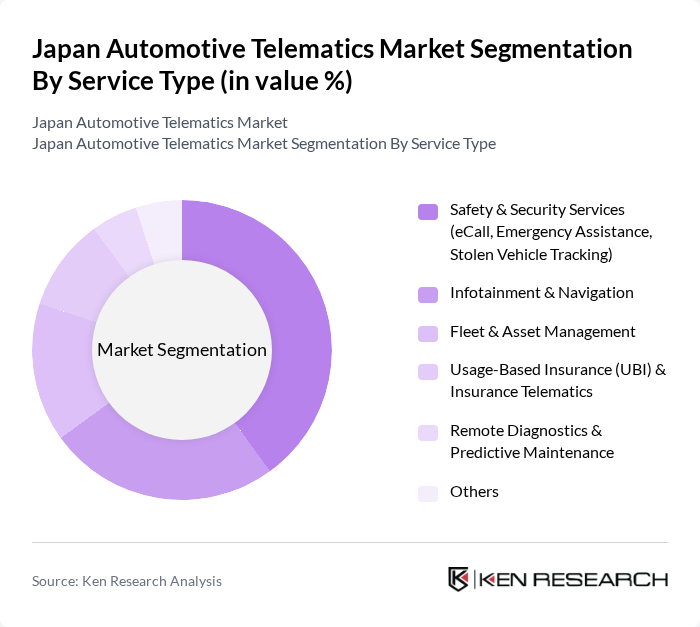

By Service Type:

The service type segmentation encompasses Safety & Security Services (eCall, Emergency Assistance, Stolen Vehicle Tracking), Infotainment & Navigation, Fleet & Asset Management, Usage-Based Insurance (UBI) & Insurance Telematics, Remote Diagnostics & Predictive Maintenance, and Others. Safety & Security Services are the most prominent subsegment, driven by increasing consumer awareness regarding vehicle safety, demand for automatic emergency notification, and support for government safety initiatives. The rise in connected safety applications, accident response needs, and OEM offerings such as emergency call, roadside assistance, and stolen vehicle tracking has further fueled the demand for these services, making them a priority for both manufacturers, insurers, and consumers.

The Japan Automotive Telematics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Motor Corporation, Honda Motor Co., Ltd., Nissan Motor Co., Ltd., DENSO Corporation, Panasonic Holdings Corporation, Fujitsu Limited, Hitachi, Ltd., Mitsubishi Electric Corporation, Subaru Corporation, Mazda Motor Corporation, Clarion Co., Ltd. (Faurecia Clarion Electronics), Aisin Corporation, Continental AG, Valeo SA, Robert Bosch GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan automotive telematics market appears promising, driven by technological advancements and government support. As 5G networks expand, the potential for enhanced vehicle-to-everything (V2X) communication will significantly improve telematics capabilities. Furthermore, the increasing adoption of electric vehicles will create new opportunities for telematics integration, allowing for better energy management and user experience. The collaboration between automotive manufacturers and technology firms will also play a crucial role in shaping the market landscape, fostering innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Embedded Telematics Tethered Telematics Integrated / Smartphone-based Telematics Over-the-Air (OTA) & Remote Diagnostics Solutions Others |

| By Service Type | Safety & Security Services (eCall, Emergency Assistance, Stolen Vehicle Tracking) Infotainment & Navigation Fleet & Asset Management Usage-Based Insurance (UBI) & Insurance Telematics Remote Diagnostics & Predictive Maintenance Others |

| By Connectivity | Cellular (3G/4G/LTE) G Satellite Short-Range (Wi-Fi, Bluetooth, DSRC) Others |

| By Channel Type | OEM-installed Telematics Aftermarket Telematics |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles (LCVs) Heavy Commercial Vehicles (HCVs & Buses) Two-wheelers and Micro-mobility Electric Vehicles (Battery Electric, Plug-in Hybrid) Others |

| By Application | Navigation & Route Optimization Driver Behavior Monitoring & Scoring Vehicle Health Monitoring & Diagnostics V2X & ADAS Support Functions Regulatory Compliance & Electronic Logging Others |

| By Region (Japan) | Kanto Kansai / Kinki Chubu (Central) Kyushu–Okinawa Tohoku Chugoku Hokkaido Shikoku |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telematics Service Providers | 60 | Product Managers, Business Development Executives |

| Automotive Manufacturers | 50 | R&D Managers, Technology Officers |

| Fleet Management Companies | 40 | Operations Managers, Fleet Directors |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| End-Users (Consumers) | 70 | Car Owners, Fleet Users |

The Japan Automotive Telematics Market is valued at approximately USD 1.8 billion, driven by the increasing demand for connected vehicles and advancements in communication technologies, enhancing vehicle safety and operational efficiency.