Region:Middle East

Author(s):Shubham

Product Code:KRAD2680

Pages:100

Published On:January 2026

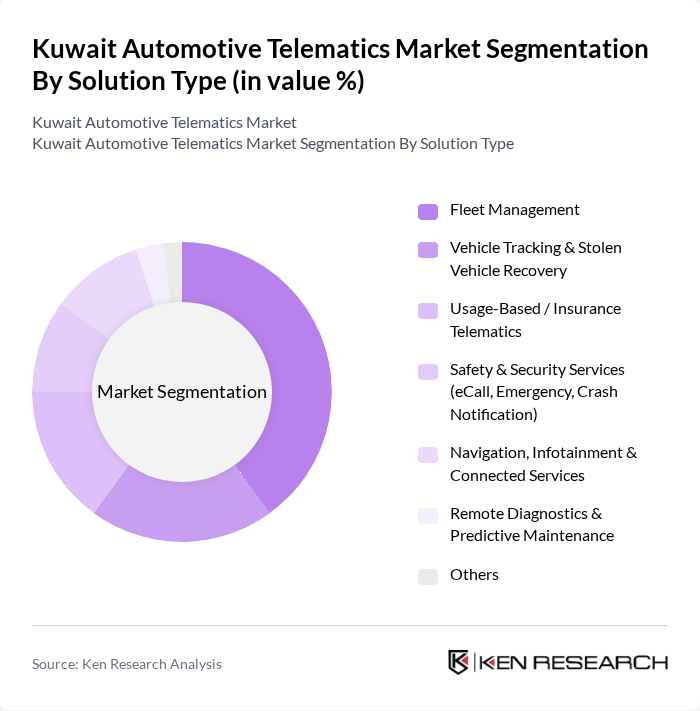

By Solution Type:

The solution type segmentation includes Fleet Management, Vehicle Tracking & Stolen Vehicle Recovery, Usage-Based / Insurance Telematics, Safety & Security Services (eCall, Emergency, Crash Notification), Navigation, Infotainment & Connected Services, Remote Diagnostics & Predictive Maintenance, and Others. Fleet Management is the leading sub-segment, driven by the increasing need for businesses to optimize their operations, improve asset utilization, and reduce fuel and maintenance costs. Companies are increasingly adopting fleet management solutions to enhance efficiency, monitor driver behavior, support electronic trip logging, and ensure compliance with transport and safety regulations, especially in sectors such as logistics, oil and gas, and public transport. The growing trend of digital transformation in logistics and transportation, the rise of real-time route optimization, and the integration of telematics with IoT platforms and cloud analytics further support the dominance of this sub-segment.

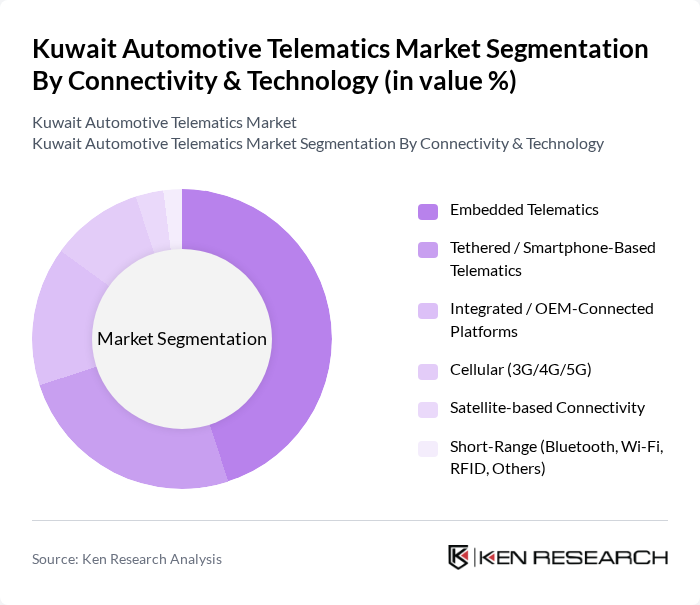

By Connectivity & Technology:

This segmentation includes Embedded Telematics, Tethered / Smartphone-Based Telematics, Integrated / OEM-Connected Platforms, Cellular (3G/4G/5G), Satellite-based Connectivity, and Short-Range (Bluetooth, Wi-Fi, RFID, Others). Embedded Telematics is the leading sub-segment, as it offers seamless integration with vehicle systems, providing real-time data, over-the-air updates, and advanced analytics for OEMs, fleet operators, and service providers. The increasing demand for advanced safety features, regulatory push for tracking and monitoring in commercial fleets, and the growing trend of connected cars in the Gulf region are driving the adoption of embedded telematics solutions. Furthermore, the rise of smart cities initiatives in Kuwait, expansion of 4G/5G cellular networks, and the integration of telematics with broader IoT ecosystems are expected to further enhance the relevance of this sub-segment in the automotive telematics market.

The Kuwait Automotive Telematics Market is characterized by a dynamic mix of regional and international players. Leading participants such as MiX Telematics, Geotab, TomTom Telematics (Webfleet Solutions), Zain Kuwait, Ooredoo Kuwait, Virgin Mobile Kuwait / FRiENDi, Kuwait Telecom Company (stc Kuwait), Traklink, Gulf Insurance Group, Warba Insurance, KGL Logistics, Agility Logistics, Kuwait Oil Company, Kuwait National Petroleum Company, Selected Local System Integrators & Solution Providers contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait automotive telematics market appears promising, driven by technological advancements and increasing consumer awareness. The expansion of 5G networks is expected to enhance connectivity, enabling more sophisticated telematics applications. Additionally, the integration of artificial intelligence and machine learning will likely improve data analytics capabilities, providing businesses with actionable insights. As the market matures, collaboration between automotive manufacturers and technology providers will be essential to drive innovation and meet evolving consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Fleet Management Vehicle Tracking & Stolen Vehicle Recovery Usage-Based / Insurance Telematics Safety & Security Services (eCall, Emergency, Crash Notification) Navigation, Infotainment & Connected Services Remote Diagnostics & Predictive Maintenance Others |

| By Connectivity & Technology | Embedded Telematics Tethered / Smartphone-Based Telematics Integrated / OEM-Connected Platforms Cellular (3G/4G/5G) Satellite-based Connectivity Short-Range (Bluetooth, Wi?Fi, RFID, Others) |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles (LCVs) Heavy Commercial Vehicles (HCVs & Buses) Specialized & Off-Highway Vehicles |

| By Sales Channel | OEM-Installed Telematics Aftermarket Telematics |

| By End-User | Fleet Operators & Logistics Companies Leasing & Rental Companies Government & Municipal Fleets Insurance Companies Individual / Retail Vehicle Owners Oil & Gas and Industrial Fleets Others |

| By Application Use Case | Route Optimization & Dispatch Driver Behavior & Safety Monitoring Regulatory Compliance & E-Logging Asset & Trailer Tracking Fuel & Operational Efficiency Management Others |

| By Kuwait Region | Capital Governorate Hawalli Governorate Al Ahmadi Governorate Farwaniya Governorate Al Jahra & Mubarak Al-Kabeer Governorates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Telematics | 120 | Automotive OEMs, Telematics Solution Providers |

| Commercial Fleet Management | 100 | Fleet Managers, Logistics Coordinators |

| Telematics in Public Transport | 80 | Public Transport Authorities, Operations Managers |

| Insurance Telematics | 70 | Insurance Underwriters, Risk Assessment Analysts |

| Telematics for Two-Wheelers | 60 | Motorcycle Manufacturers, Retailers |

The Kuwait Automotive Telematics Market is valued at approximately USD 140 million, reflecting a significant growth trend driven by the adoption of connected vehicle technologies and fleet management solutions.