Region:Asia

Author(s):Shubham

Product Code:KRAD2678

Pages:91

Published On:January 2026

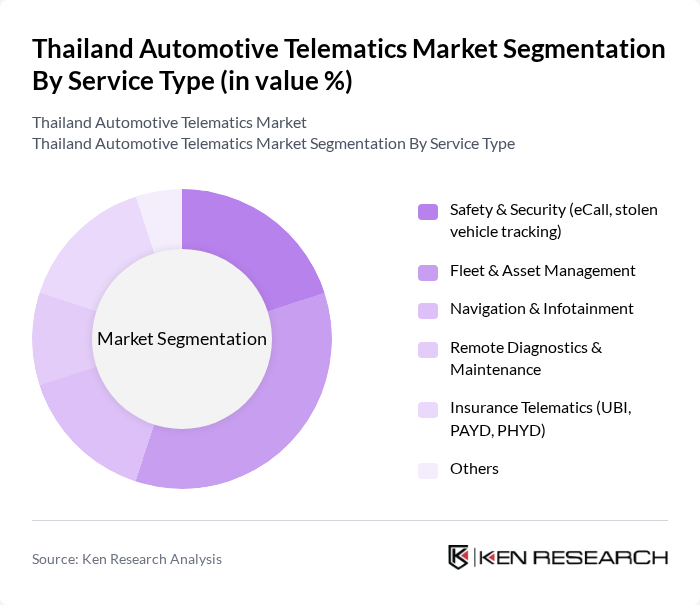

By Service Type:The service type segmentation includes various subsegments that cater to different needs within the automotive telematics market. The primary subsegments are Safety & Security (eCall, stolen vehicle tracking), Fleet & Asset Management, Navigation & Infotainment, Remote Diagnostics & Maintenance, Insurance Telematics (UBI, PAYD, PHYD), and Others. This structure is consistent with the broader Asia-Pacific and global automotive telematics service stack, where safety, fleet management, infotainment, diagnostics, and insurance telematics form the core solution clusters. Among these, Fleet & Asset Management is currently the leading subsegment, driven by the increasing need for efficient logistics and transportation solutions, growth in e?commerce and last?mile delivery, and the need for compliance with tracking mandates for commercial fleets. Companies are increasingly investing in telematics to optimize fleet operations, reduce fuel and maintenance costs, enhance driver safety, and enable data-driven route planning and performance dashboards.

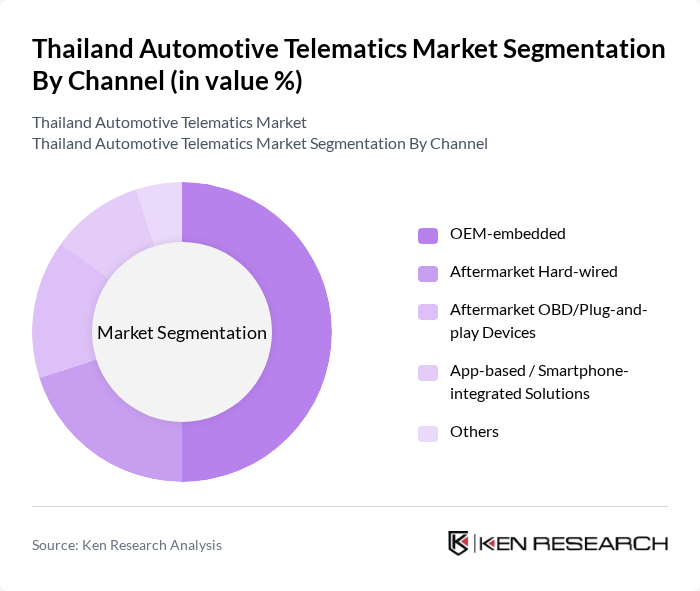

By Channel:The channel segmentation encompasses various methods through which telematics services are delivered. The subsegments include OEM-embedded, Aftermarket Hard-wired, Aftermarket OBD/Plug-and-play Devices, App-based / Smartphone-integrated Solutions, and Others. This reflects the standard deployment models observed in the Asia-Pacific automotive telematics market, where embedded factory-fit systems coexist with retrofitted and app-based solutions across passenger and commercial vehicles. The OEM-embedded channel is currently the most dominant, as automotive manufacturers increasingly integrate telematics control units, connectivity modules, and connected services directly into vehicles during production, particularly in newer passenger cars and light commercial vehicles. This trend is fueled by consumer demand for advanced features such as in-car connectivity, remote vehicle functions, and over?the?air services, along with the need for manufacturers to offer competitive, connected vehicle solutions and support regulatory and safety features.

The Thailand Automotive Telematics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Advanced Info Service Public Company Limited (AIS), True Corporation Public Company Limited, Total Access Communication Public Company Limited (dtac), AIS Business / AIS IoT, Thaicom Public Company Limited, Toyota Tsusho (Thailand) Co., Ltd., Nippon Koei – Fleet & Telematics Solutions, Bosch Mobility (Robert Bosch GmbH), Continental AG, Denso Corporation, Aisin Corporation, Garmin Ltd., TomTom International BV, Verizon Connect, Geotab Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Thailand automotive telematics market appears promising, driven by technological advancements and increasing regulatory support. The anticipated expansion of 5G networks is expected to enhance connectivity, enabling more sophisticated telematics applications. Additionally, as electric vehicle adoption rises, the integration of telematics will become essential for efficient fleet management and energy consumption monitoring. These trends indicate a robust growth trajectory for the telematics market in the coming years, fostering innovation and improved consumer experiences.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Safety & Security (eCall, stolen vehicle tracking) Fleet & Asset Management Navigation & Infotainment Remote Diagnostics & Maintenance Insurance Telematics (UBI, PAYD, PHYD) Others |

| By Channel | OEM-embedded Aftermarket Hard-wired Aftermarket OBD/Plug-and-play Devices App-based / Smartphone-integrated Solutions Others |

| By Vehicle Category | Passenger Cars Light Commercial Vehicles (LCV) Medium & Heavy Commercial Vehicles (M/HCV) Buses & Coaches Two-Wheelers & Micro-mobility Electric & Hybrid Vehicles |

| By End-User Segment | Logistics & Transport Fleet Operators Ride-hailing & Mobility Platforms Insurance Companies Automotive OEMs & Dealerships Government & Municipal Fleets Individual Vehicle Owners Others |

| By Connectivity & Technology | G/4G LTE-based Telematics G-based Telematics GNSS/GPS-based Tracking Wi-Fi / Bluetooth-enabled Solutions Telematics Control Units (TCU) & ECUs Cloud & Edge Analytics-enabled Platforms Others |

| By Solution Deployment | On-premise Platforms Cloud-based / SaaS Platforms Hybrid Deployment Managed Services & Outsourced Operations |

| By Regulatory & Compliance Use Cases | Regulatory Vehicle Tracking & Compliance Road Safety & Emergency Response Solutions Emissions, ESG & Sustainability Monitoring Smart City & Intelligent Transport Systems Integration Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Telematics | 120 | Automotive OEMs, Telematics Solution Providers |

| Commercial Fleet Management | 90 | Fleet Managers, Logistics Coordinators |

| Telematics Device Manufacturers | 60 | Product Development Managers, Sales Directors |

| Insurance Telematics | 50 | Insurance Underwriters, Risk Assessment Analysts |

| Smart City Initiatives | 40 | Urban Planners, Government Officials |

The Thailand Automotive Telematics Market is valued at approximately USD 0.5 billion, reflecting a significant growth driven by the adoption of connected vehicles, advancements in IoT technology, and increasing demand for vehicle safety and efficiency.