Region:Middle East

Author(s):Shubham

Product Code:KRAD2681

Pages:94

Published On:January 2026

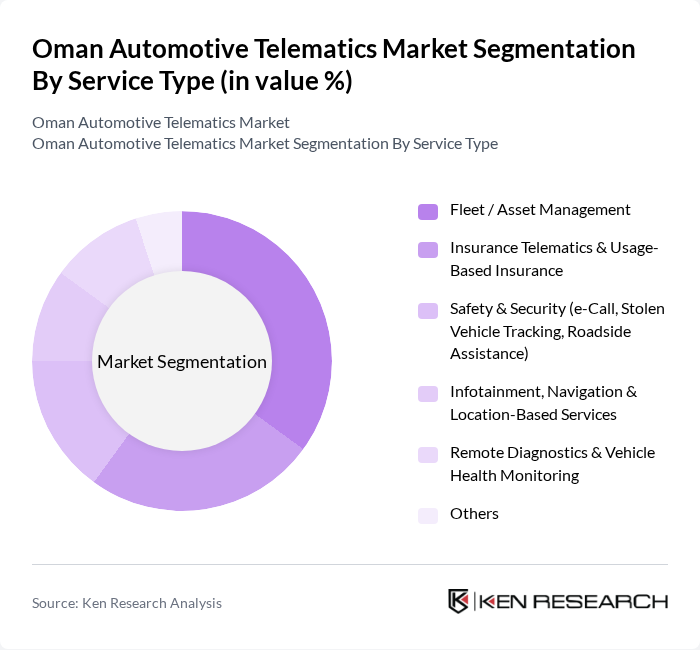

By Service Type:The service type segmentation includes various offerings that cater to different needs within the automotive telematics landscape. The subsegments include Fleet / Asset Management, Insurance Telematics & Usage-Based Insurance, Safety & Security (e-Call, Stolen Vehicle Tracking, Roadside Assistance), Infotainment, Navigation & Location-Based Services, Remote Diagnostics & Vehicle Health Monitoring, and Others. Fleet / Asset Management is currently the leading subsegment due to the increasing need for efficient fleet operations, fuel and route optimization, electronic trip and driver logs, and compliance support for commercial and logistics operators in Oman.

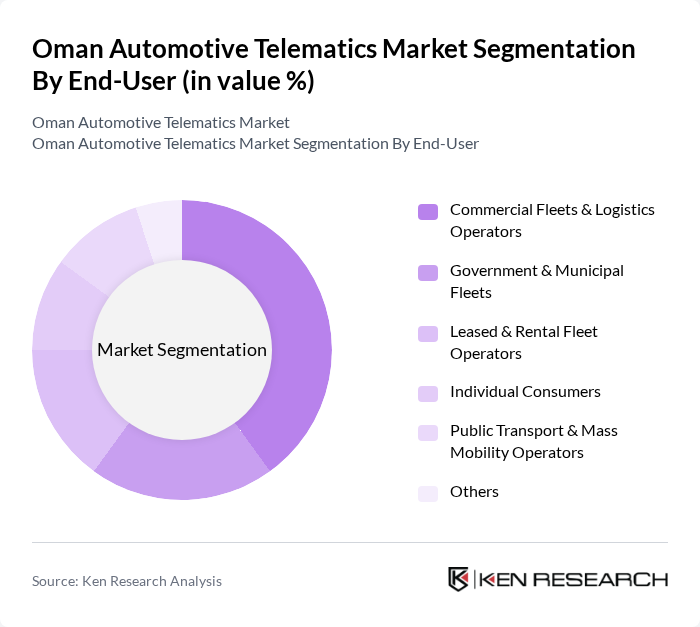

By End-User:The end-user segmentation encompasses various categories of consumers utilizing telematics services. This includes Commercial Fleets & Logistics Operators, Government & Municipal Fleets, Leased & Rental Fleet Operators, Individual Consumers, Public Transport & Mass Mobility Operators, and Others. Commercial Fleets & Logistics Operators dominate this segment due to the increasing reliance on telematics for operational efficiency, fuel and maintenance cost reduction, driver-behavior monitoring, and real-time visibility across trucking, courier, last?mile delivery, and port-related logistics chains in Oman.

The Oman Automotive Telematics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Omnicomm, Geotab, Verizon Connect, Fleet Complete, Teletrac Navman, Webfleet (Formerly TomTom Telematics), Zubie, Gurtam (Wialon), MiX Telematics, Inseego, CalAmp, Agero, Navman Wireless, Ctrack (Inseego/Ctrack by Inseego), Fleetio contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman automotive telematics market appears promising, driven by technological advancements and increasing consumer awareness. The integration of AI and machine learning into telematics systems is expected to enhance predictive analytics, improving vehicle maintenance and safety. Additionally, the expansion of 5G networks will facilitate faster data transmission, enabling real-time monitoring and management of vehicles, which is crucial for fleet operators and individual consumers alike.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Fleet / Asset Management Insurance Telematics & Usage-Based Insurance Safety & Security (e-Call, Stolen Vehicle Tracking, Roadside Assistance) Infotainment, Navigation & Location-Based Services Remote Diagnostics & Vehicle Health Monitoring Others |

| By End-User | Commercial Fleets & Logistics Operators Government & Municipal Fleets Leased & Rental Fleet Operators Individual Consumers Public Transport & Mass Mobility Operators Others |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles (LCV) Heavy Commercial Vehicles (HCV, Trucks & Buses) Two-Wheelers & Micro-Mobility Off-Highway & Specialized Vehicles (Construction, Oil & Gas, Mining) |

| By Connectivity & Technology | GPS / GNSS Tracking Cellular (2G/3G/4G/5G) Communication Satellite & Hybrid Connectivity Telematics Control Units (TCUs) & On-Board Devices Integrated / Embedded / Tethered Solutions Others |

| By Deployment & Ownership Model | OEM-Embedded Telematics Aftermarket Installed Solutions SaaS / Subscription-Based Platforms On-Premise Enterprise Platforms Hybrid Models |

| By Use Case Cluster | Real-Time Tracking & Route Optimization Driver Behavior Monitoring & Safety Analytics Compliance, Regulation & ESG Reporting Fuel Management & Operational Efficiency Predictive Maintenance & Asset Uptime Emergency Response & Incident Management Others |

| By Policy & Regulatory Alignment | Mandated Tracking & Safety Requirements Incentives for Digital & Smart Mobility Data Protection & Cybersecurity Compliance Tendering & Public Procurement Frameworks Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fleet Management Solutions | 120 | Fleet Managers, Operations Directors |

| Insurance Telematics | 90 | Insurance Underwriters, Risk Assessment Analysts |

| Navigation and Mapping Services | 70 | Product Managers, Software Developers |

| Telematics Device Manufacturers | 60 | Product Development Engineers, Sales Executives |

| Consumer Usage Insights | 80 | Car Owners, Technology Enthusiasts |

The Oman Automotive Telematics Market is valued at approximately USD 160 million, reflecting a significant growth driven by the adoption of connected vehicle technologies and fleet management solutions, alongside advancements in IoT and AI technologies.