Region:Asia

Author(s):Shubham

Product Code:KRAD2679

Pages:92

Published On:January 2026

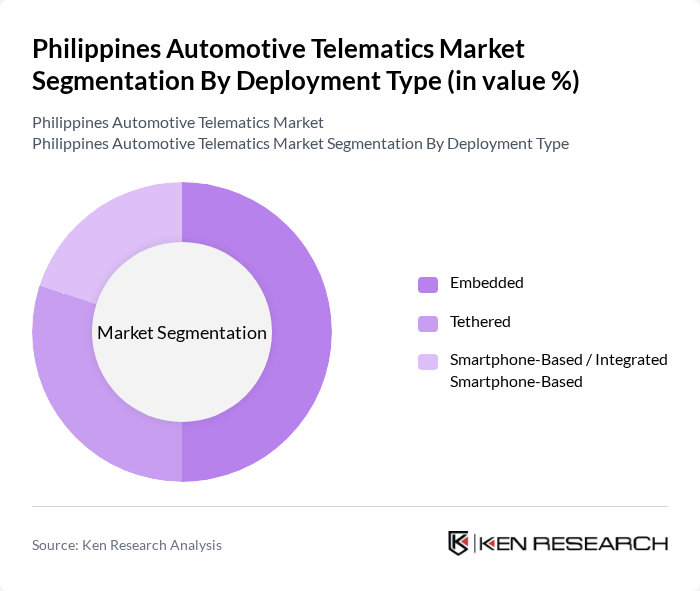

By Deployment Type:The deployment type segmentation includes Embedded, Tethered, and Smartphone-Based / Integrated Smartphone-Based solutions. Embedded systems are increasingly popular due to their tight integration into vehicle electronic architectures, enabling secure real-time data capture for diagnostics, safety, and over?the?air services. Tethered solutions, which connect aftermarket hardware or onboard units via cellular or Wi?Fi links, offer flexibility, faster retrofit of existing fleets, and lower upfront cost for commercial operators. Smartphone-based and integrated smartphone-based systems leverage mobile apps and handset sensors to provide basic tracking, driver behavior monitoring, and navigation, catering to cost?sensitive users and small fleets seeking entry?level connectivity aligned with the growing penetration of smartphones and mobile internet in the Philippines.

By Service Type:The service type segmentation encompasses Safety and Security (eCall, stolen vehicle tracking), Fleet/Vehicle Management, Usage-Based Insurance and Risk Assessment, Remote Vehicle Diagnostics & Predictive Maintenance, Navigation, Routing & Real-Time Traffic, Infotainment & In-Car Connectivity, and Others. Fleet management services are particularly dominant due to the strong development of the Philippine freight and logistics sector, the need for real-time visibility of trucks and delivery vehicles, and the demonstrated benefits of telematics in reducing fuel costs, improving driver performance, and optimizing last?mile delivery operations.

The Philippines Automotive Telematics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Globe Telecom, Smart Communications, PLDT Enterprise, Philippine Long Distance Telephone Company (PLDT Inc.), Toyota Motor Philippines, Mitsubishi Motors Philippines, Isuzu Philippines, Fuso Philippines, Hino Motors Philippines, Geotab, Teletrac Navman, Verizon Connect, Bosch Mobility Solutions, Continental AG, Trimble contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive telematics market in the Philippines appears promising, driven by technological advancements and increasing consumer awareness. As the government continues to invest in smart transportation initiatives, the integration of telematics with emerging technologies like AI and machine learning will enhance service offerings. Additionally, the growing emphasis on sustainability and fuel efficiency will likely lead to innovative telematics applications, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Deployment Type | Embedded Tethered Smartphone-Based / Integrated Smartphone-Based |

| By Service Type | Safety and Security (eCall, stolen vehicle tracking) Fleet/Vehicle Management Usage-Based Insurance and Risk Assessment Remote Vehicle Diagnostics & Predictive Maintenance Navigation, Routing & Real-Time Traffic Infotainment & In-Car Connectivity Others |

| By Vehicle Type | Passenger Vehicles Light Commercial Vehicles Medium & Heavy Commercial Vehicles Two-Wheelers and Motorcycles Others |

| By End-User | Individual Consumers Corporate & Logistics Fleets Government & Public Sector Mobility Service Providers (Ride-Hailing, Car Rental) Others |

| By Connectivity & Technology | Cellular (3G/4G/5G) Satellite Short-Range (Wi-Fi, Bluetooth) GPS / GNSS Others |

| By Offering | Hardware (TCU, Sensors, OBD Devices) Software & Platforms Services (Installation, Managed Services) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Telematics Adoption | 120 | Car Owners, Fleet Operators |

| Commercial Vehicle Fleet Management | 100 | Fleet Managers, Logistics Coordinators |

| Telematics Service Providers | 60 | Business Development Managers, Product Managers |

| Insurance Telematics Insights | 40 | Insurance Underwriters, Risk Assessment Analysts |

| Consumer Attitudes Towards Telematics | 80 | General Consumers, Tech Enthusiasts |

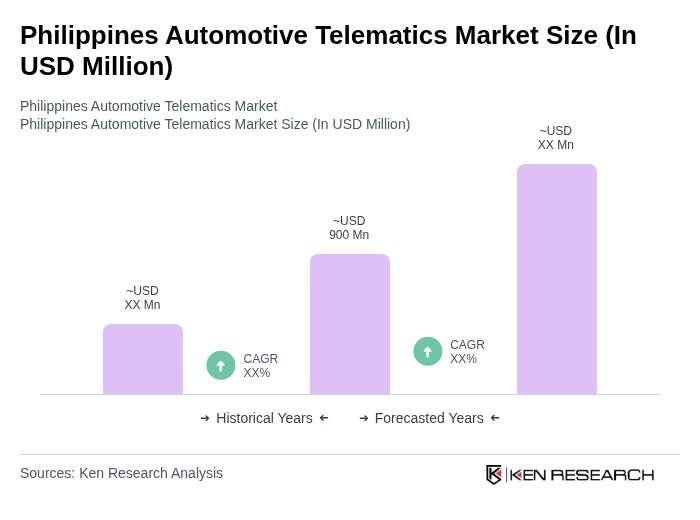

The Philippines Automotive Telematics Market is valued at approximately USD 900 million, driven by the increasing adoption of connected vehicles, fleet telematics expansion, and advancements in mobile broadband technologies.