Region:Global

Author(s):Geetanshi

Product Code:KRAE1060

Pages:88

Published On:February 2026

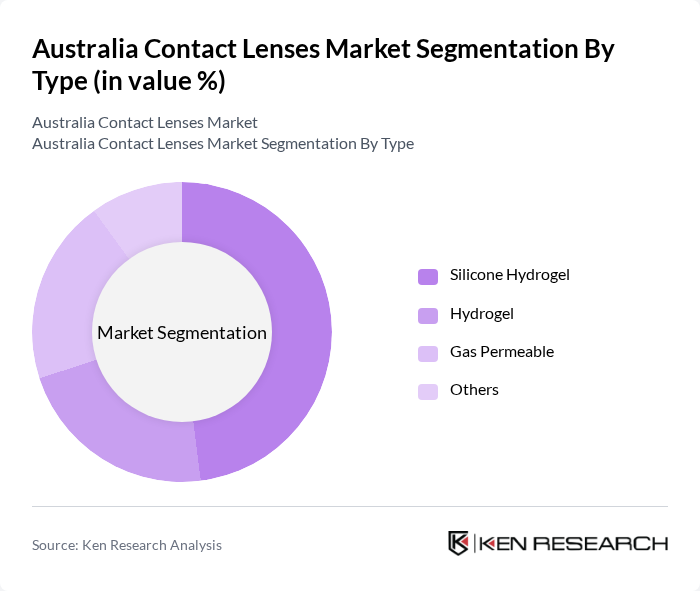

By Type:The contact lenses market can be segmented into various material types, including silicone hydrogel, hydrogel, and gas permeable lenses. Silicone hydrogel emerged as the largest revenue-generating material segment in 2024, driven by superior oxygen permeability and comfort characteristics. Soft contact lenses remain the most popular due to their comfort and ease of use, appealing to a wide range of consumers. Gas permeable lenses are also gaining traction, particularly among those with specific vision correction needs. Specialty lenses cater to niche markets, while advanced designs are preferred for certain medical conditions.

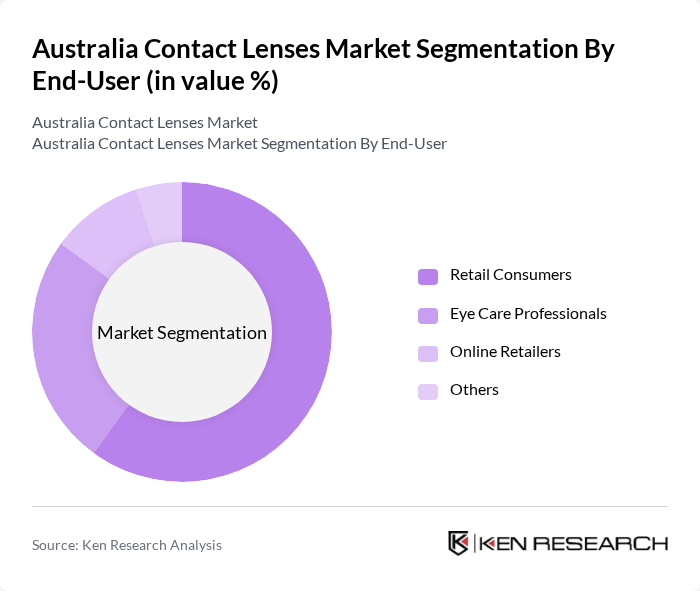

By End-User:The end-user segmentation includes retail consumers, eye care professionals, online retailers, and others. Retail consumers represent the largest segment, driven by the increasing trend of self-purchase and convenience. Eye care professionals play a crucial role in recommending and fitting lenses, while online retailers are gaining popularity due to the ease of access and competitive pricing. The market is also seeing growth in other segments, including institutional buyers and hospital clinics.

The Australia Contact Lenses Market is characterized by a dynamic mix of regional and international players. Leading participants such as CooperVision Australia, Johnson & Johnson Australia, Bausch & Lomb (Australia) Pty Ltd, Alcon Laboratories (Australia) Pty Ltd, Menicon Australia Pty Ltd, SAS ONE PTY LTD, Capricornia Contact Lens Pty Ltd, Gelflex Australia, ColourVUE Australia, and Contact Lens Centre Australia contribute to innovation, geographic expansion, and service delivery in this space.

The Australia contact lenses market is poised for significant growth, driven by increasing awareness of vision health and the rising prevalence of vision disorders. As the population ages, the demand for corrective lenses will likely escalate, particularly for daily disposable and specialty lenses. Additionally, the integration of digital health technologies and the trend towards eco-friendly products will shape consumer preferences, creating a dynamic market landscape. Companies that adapt to these trends will be well-positioned for success in the evolving market.

| Segment | Sub-Segments |

|---|---|

| By Type | Soft Contact Lenses Rigid Gas Permeable Lenses Specialty Lenses Scleral Lenses Others |

| By End-User | Retail Consumers Eye Care Professionals Online Retailers Others |

| By Distribution Channel | Optical Stores E-commerce Platforms Hospitals and Clinics Others |

| By Material | Hydrogel Lenses Silicone Hydrogel Lenses Rigid Gas Permeable Materials Others |

| By Age Group | Children Adults Seniors Others |

| By Usage Frequency | Daily Disposable Bi-weekly Monthly Others |

| By Geographic Region | New South Wales Victoria Queensland Western Australia Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Optometrist Insights | 100 | Optometrists, Eye Care Specialists |

| Contact Lens User Surveys | 120 | Current Contact Lens Users, Potential Users |

| Retailer Feedback | 80 | Retail Managers, Optical Store Owners |

| Market Trend Analysis | 60 | Market Analysts, Industry Experts |

| Consumer Focus Groups | 50 | General Consumers, Young Adults |

The Australia Contact Lenses Market is valued at approximately USD 280 million, reflecting a five-year historical analysis. This growth is attributed to increased awareness of eye health and advancements in lens technology, particularly in comfort and hygiene.