Thailand Contact Lenses Market Overview

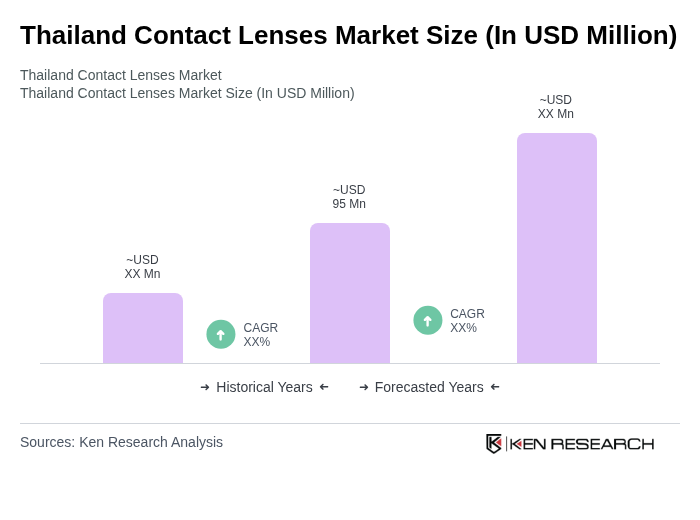

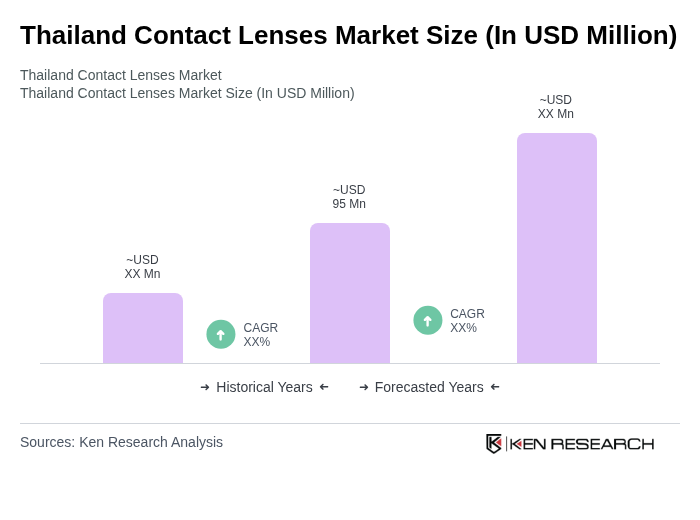

- The Thailand Contact Lenses Market is valued at USD 95 million, based on a five-year historical analysis. This growth is primarily driven by increasing awareness of eye health, a rise in myopia cases, growing preference for contact lenses over traditional eyewear, and expanding adoption of daily disposables and silicone hydrogel lenses. The market has seen a significant uptick in demand for innovative products, including daily disposables and specialty lenses, catering to diverse consumer needs.

- Key cities such as Bangkok, Chiang Mai, and Pattaya dominate the market due to their high population density and urban lifestyle, which fosters a greater demand for vision correction solutions. The presence of numerous eye care clinics and optical retailers in these areas further enhances accessibility to contact lenses, making them the focal points of market activity.

- The Medical Device Act B.E. 2551 (2008) issued by the Thai Food and Drug Administration (FDA) under the Ministry of Public Health classifies contact lenses as Class 2B or Class 3 medical devices depending on risk level, mandating registration, Good Manufacturing Practice (GMP) compliance, labeling in Thai with usage instructions, and post-market surveillance for all importers and distributors.

Thailand Contact Lenses Market Segmentation

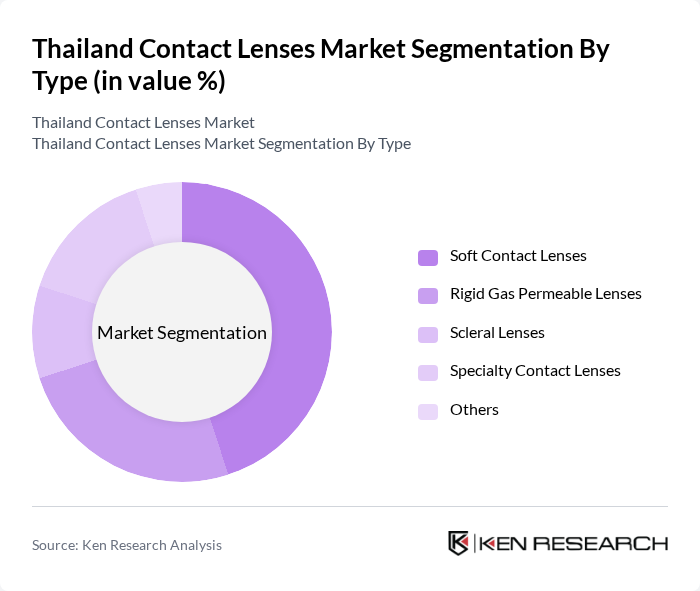

By Type:The contact lenses market can be segmented into various types, including Soft Contact Lenses, Rigid Gas Permeable Lenses, Scleral Lenses, Specialty Contact Lenses, and Others. Among these, Soft Contact Lenses dominate the market due to their comfort, ease of use, and increasing consumer preference for daily wear options, with silicone hydrogel leading as the largest material segment. The trend towards disposable lenses has also contributed to the growth of this segment, as consumers seek convenience and hygiene in their eye care solutions.

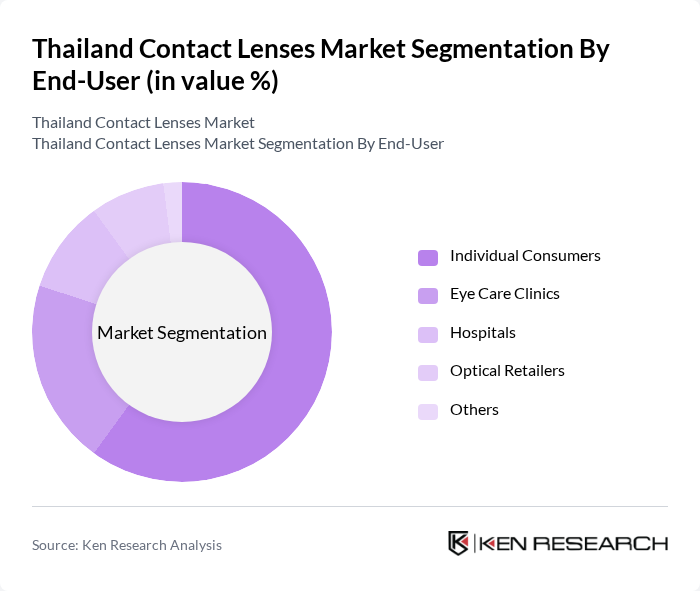

By End-User:The end-user segmentation includes Individual Consumers, Eye Care Clinics, Hospitals, Optical Retailers, and Others. Individual Consumers represent the largest segment, driven by the increasing number of people opting for contact lenses for vision correction and cosmetic purposes. The rise in online shopping has also made it easier for consumers to purchase lenses directly, further boosting this segment's growth.

Thailand Contact Lenses Market Competitive Landscape

The Thailand Contact Lenses Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson Vision Care, Bausch + Lomb, Alcon, CooperVision, Hoya Corporation, Menicon Co., Ltd., EssilorLuxottica, Carl Zeiss AG, SynergEyes, Inc., Vision Source, Eyeconic, Acuvue, FreshLook, Air Optix, Biofinity contribute to innovation, geographic expansion, and service delivery in this space.

Thailand Contact Lenses Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Vision Disorders:The World Health Organization reported that approximately 2.7 million people in Thailand suffer from vision disorders, with myopia affecting around 30% of the population. This rising incidence drives demand for corrective solutions, including contact lenses. As the population ages, the prevalence of presbyopia is also expected to increase, further boosting the market for contact lenses. The growing awareness of vision health is prompting more individuals to seek corrective options, enhancing market growth.

- Rising Demand for Cosmetic Contact Lenses:The cosmetic contact lens segment in Thailand has seen significant growth, with sales reaching approximately 1.5 million units in the future. This trend is fueled by a cultural inclination towards aesthetic enhancement, particularly among younger consumers. The popularity of social media and beauty influencers has further amplified this demand, as individuals seek to enhance their appearance. The cosmetic lens market is projected to continue expanding, driven by innovative designs and marketing strategies targeting fashion-conscious consumers.

- Technological Advancements in Lens Materials:Innovations in lens technology have led to the development of high-quality, breathable materials that enhance comfort and wearability. For instance, silicone hydrogel lenses, which account for over 60% of the market, offer improved oxygen permeability. This advancement is crucial as it addresses consumer concerns regarding eye health and comfort. The introduction of smart contact lenses, which can monitor health metrics, is also anticipated to create new market segments, further driving growth in the industry.

Market Challenges

- High Competition from Alternative Vision Correction Methods:The contact lenses market in Thailand faces stiff competition from alternative vision correction methods, such as laser eye surgery and eyeglasses. In the future, approximately 1.2 million laser eye surgeries are expected to be performed, highlighting a significant consumer shift towards permanent solutions. This trend poses a challenge for contact lens manufacturers, as consumers may prefer long-term solutions over daily or monthly lens wear, impacting overall market growth.

- Regulatory Hurdles in Product Approvals:The Thai Food and Drug Administration (FDA) imposes stringent regulations on the approval of contact lens products, which can delay market entry for new innovations. In the future, the average approval time for new lens products is expected to be reported at 18 months, creating barriers for companies looking to introduce advanced technologies. These regulatory challenges can hinder the responsiveness of manufacturers to market demands, affecting their competitive edge and overall market dynamics.

Thailand Contact Lenses Market Future Outlook

The Thailand contact lenses market is poised for significant growth, driven by increasing awareness of vision health and the rising prevalence of vision disorders. As consumers become more health-conscious, the demand for innovative and comfortable lens options will likely rise. Additionally, the integration of technology in lenses, such as smart features, will attract tech-savvy consumers. E-commerce platforms will continue to expand, providing greater accessibility and convenience, further enhancing market dynamics in the future.

Market Opportunities

- Expansion of Distribution Channels:The growth of e-commerce in Thailand presents a significant opportunity for contact lens manufacturers. Online sales have increased by 25% in the future, driven by consumer preference for convenience. By expanding distribution channels through online platforms, companies can reach a broader audience, enhancing sales and brand visibility in a competitive market.

- Introduction of Smart Contact Lenses:The development of smart contact lenses, capable of monitoring health metrics, represents a promising market opportunity. With an estimated 500,000 potential users in Thailand interested in health-monitoring technologies, companies can capitalize on this trend. By investing in research and development, manufacturers can create innovative products that cater to health-conscious consumers, driving future growth.