Region:Asia

Author(s):Geetanshi

Product Code:KRAE1056

Pages:90

Published On:February 2026

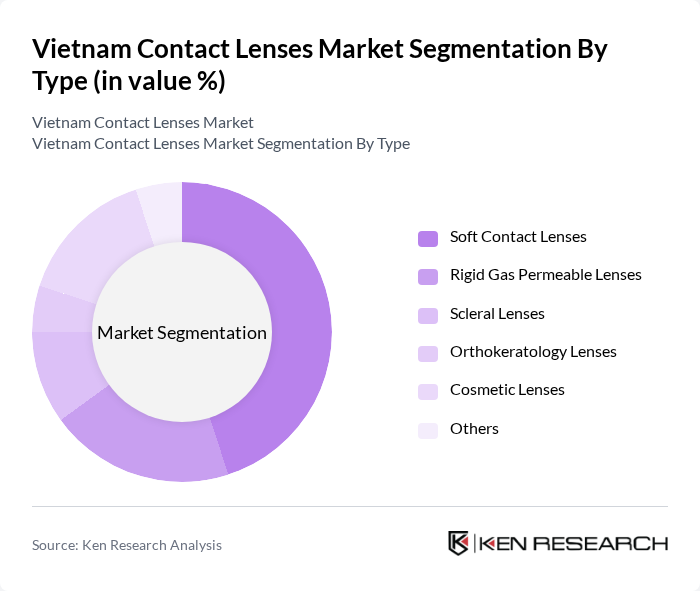

By Type:The contact lenses market can be segmented into various types, including Soft Contact Lenses, Rigid Gas Permeable Lenses, Scleral Lenses, Orthokeratology Lenses, Cosmetic Lenses, and Others. Among these, Soft Contact Lenses dominate the market due to their comfort and ease of use, making them the preferred choice for consumers. The increasing trend of cosmetic lenses for aesthetic purposes is also contributing to the growth of this segment.

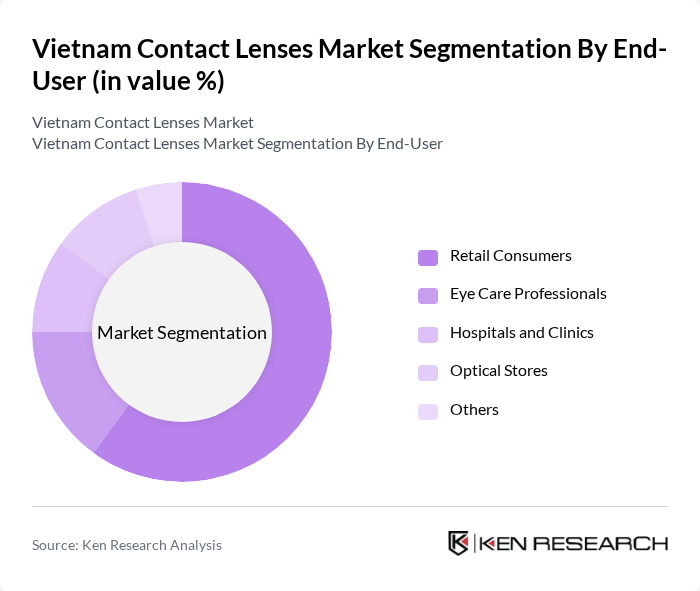

By End-User:The end-user segmentation includes Retail Consumers, Eye Care Professionals, Hospitals and Clinics, Optical Stores, and Others. Retail Consumers represent the largest segment, driven by the increasing number of individuals seeking vision correction solutions. Eye care professionals and optical stores also play a significant role in the market, providing essential services and products to consumers.

The Vietnam Contact Lenses Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson Vision Care, Bausch + Lomb, Alcon, CooperVision, Hoya Corporation, Menicon Co., Ltd., EssilorLuxottica, CIBA Vision, Vision Direct, Eyeconic, Acuvue, FreshLook, Air Optix, Biofinity, SofLens contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam contact lenses market is poised for significant growth, driven by increasing consumer awareness and technological advancements. The shift towards daily disposable lenses and the rising popularity of colored lenses are expected to shape market dynamics. Additionally, the integration of smart technology in lenses will likely attract tech-savvy consumers. As e-commerce platforms expand, accessibility to contact lenses will improve, further enhancing market penetration and consumer engagement in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Soft Contact Lenses Rigid Gas Permeable Lenses Scleral Lenses Orthokeratology Lenses Cosmetic Lenses Others |

| By End-User | Retail Consumers Eye Care Professionals Hospitals and Clinics Optical Stores Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Wholesale Distributors Others |

| By Material | Hydrogel Lenses Silicone Hydrogel Lenses Rigid Gas Permeable Materials Others |

| By Age Group | Children Teenagers Adults Seniors Others |

| By Usage Frequency | Daily Wear Extended Wear Disposable Others |

| By Price Range | Budget Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Optometrists and Ophthalmologists | 45 | Eye Care Professionals, Clinic Owners |

| Contact Lens Retailers | 60 | Store Managers, Sales Representatives |

| Consumers Using Contact Lenses | 120 | Regular Users, First-time Buyers |

| Healthcare Policy Makers | 35 | Government Officials, Health Advocates |

| Market Analysts and Researchers | 40 | Industry Analysts, Academic Researchers |

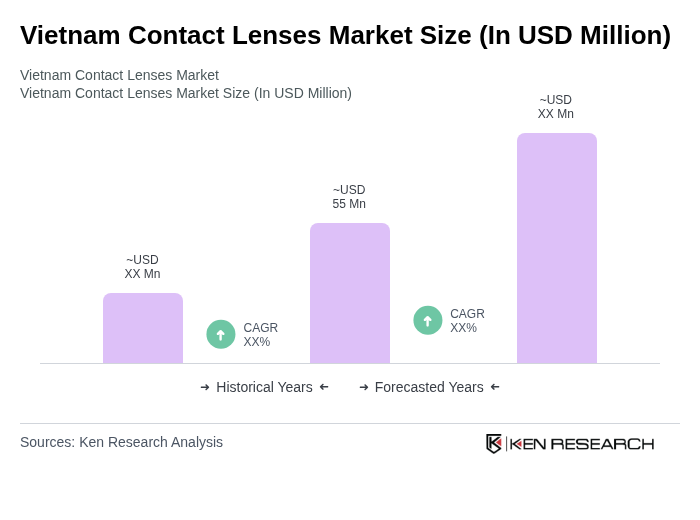

The Vietnam Contact Lenses Market is valued at approximately USD 55 million, reflecting a significant growth trend driven by increasing awareness of eye health and a rise in vision-related issues among the population.