Japan Contact Lenses Market Overview

- The Japan Contact Lenses Market is valued at USD 1.96 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing prevalence of vision disorders, a growing aging population, and rising consumer awareness regarding eye health. The market has seen a significant shift towards innovative lens technologies, including daily disposables and silicone hydrogel lenses, which cater to diverse consumer needs. Additionally, increased screen time among the Japanese population has become a significant catalyst for demand, as advanced lenses equipped with blue-light filtering technology address digital eye strain concerns.

- Tokyo, Osaka, and Yokohama are the dominant cities in the Japan Contact Lenses Market due to their high population density, advanced healthcare infrastructure, and a strong presence of leading optical retailers. The Kanto region, in particular, serves as a key player in the market, benefiting from its dense population, bustling cities, and culture emphasizing visual clarity. These cities also benefit from a tech-savvy consumer base that is increasingly adopting contact lenses over traditional eyewear, further propelling market growth.

- The Japanese government has established stringent quality control measures for contact lens manufacturing through regulatory frameworks that mandate compliance with high standards of quality and performance. These regulations aim to enhance consumer safety and product reliability, ensuring that all contact lenses meet rigorous safety and efficacy requirements, thereby fostering consumer trust in the market.

Japan Contact Lenses Market Segmentation

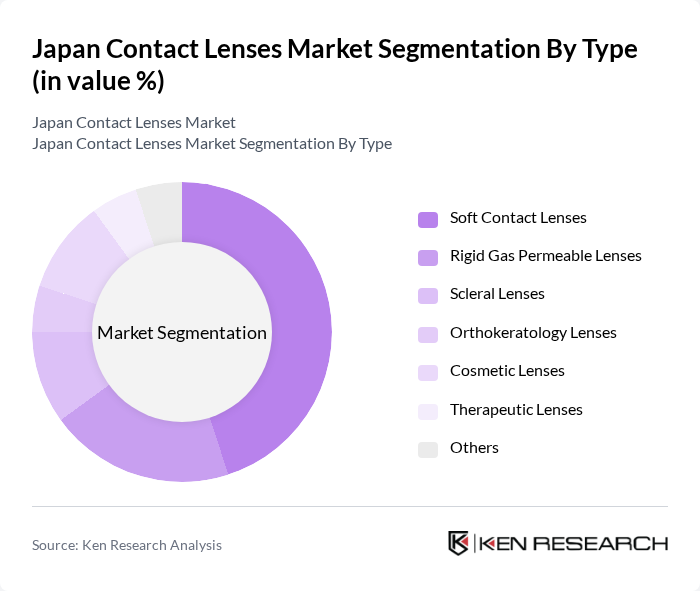

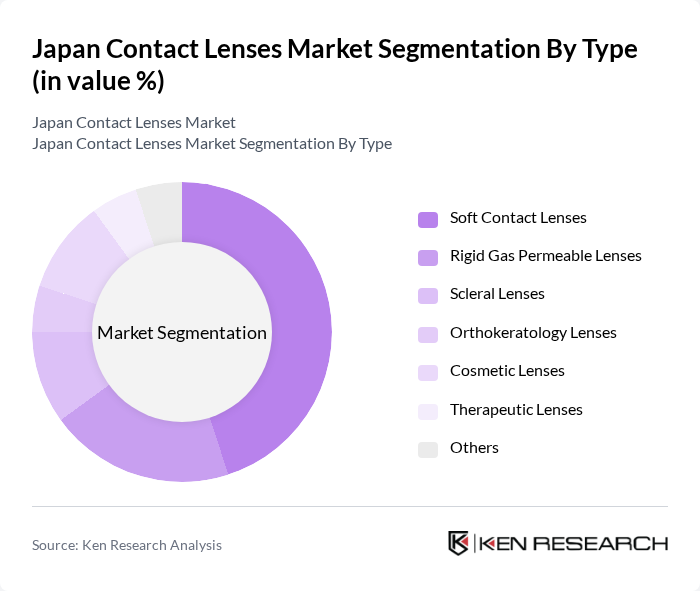

By Type:The contact lenses market can be segmented into various types, including Soft Contact Lenses, Rigid Gas Permeable Lenses, Scleral Lenses, Orthokeratology Lenses, Cosmetic Lenses, Therapeutic Lenses, and Others. Among these, soft contact lenses dominate the market due to their comfort, ease of use, and wide availability. Silicone hydrogel emerged as the largest revenue-generating material segment in 2024, registering the fastest growth during the forecast period. The increasing trend of daily disposables has also contributed to the growth of this segment, as consumers prefer the convenience and hygiene they offer.

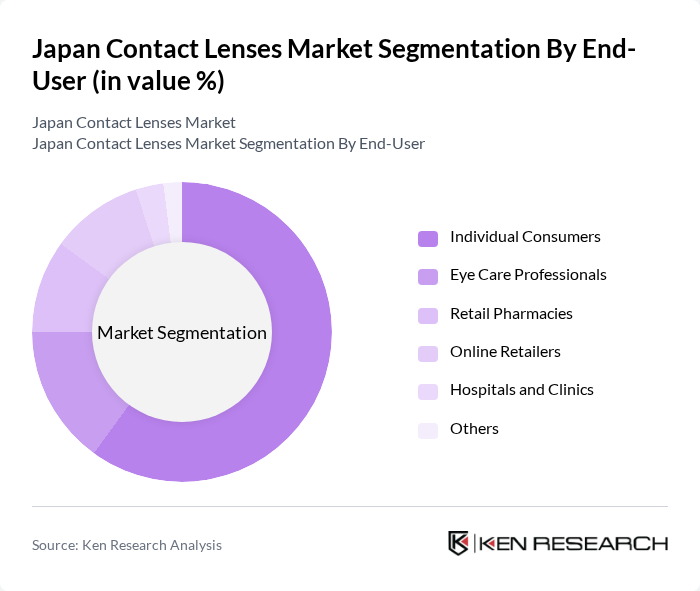

By End-User:The end-user segmentation includes Individual Consumers, Eye Care Professionals, Retail Pharmacies, Online Retailers, Hospitals and Clinics, and Others. Individual consumers represent the largest segment, driven by the increasing adoption of contact lenses for daily wear and cosmetic purposes. The mean age of lens users in the country is approximately 30 years, with females comprising 68% of the user base, which supports market growth. The rise of e-commerce has also facilitated easier access to contact lenses, further boosting this segment's growth.

Japan Contact Lenses Market Competitive Landscape

The Japan Contact Lenses Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson Vision Care, CooperVision, Alcon, Bausch + Lomb, Menicon Co., Ltd., SEED Co., Ltd., Hoya Corporation, Carl Zeiss AG, Santen Pharmaceutical Co., Ltd., Nidek Co., Ltd., Ocular Therapeutix, Inc., Vision Care, Inc., Tokyo Optical Co., Ltd., Kowa Company, Ltd., OptoTech contribute to innovation, geographic expansion, and service delivery in this space.

Japan Contact Lenses Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Vision Disorders:The rise in vision disorders in Japan is significant, with approximately 36 million people affected by myopia alone. This growing demographic is driving demand for corrective lenses. The World Health Organization estimates that in future, the number of individuals with vision impairments will increase by 15%, further boosting the contact lens market. Enhanced awareness of eye health is prompting more consumers to seek corrective solutions, thereby expanding market opportunities.

- Rising Demand for Cosmetic Contact Lenses:The cosmetic contact lens segment is experiencing robust growth, with sales reaching 6 million units. This trend is fueled by a cultural inclination towards aesthetic enhancement, particularly among younger consumers. The Japan Cosmetic Industry Association reported a 20% increase in cosmetic lens sales in the past year, indicating a strong market potential. As consumers increasingly prioritize personal appearance, the demand for colored and decorative lenses is expected to continue rising.

- Technological Advancements in Lens Materials:Innovations in lens technology are transforming the market landscape. In future, over 70% of contact lenses sold in Japan utilized advanced materials such as silicone hydrogel, which enhances comfort and oxygen permeability. The Japan Optical Association projects that in future, the adoption of these materials will increase by 25%, driven by consumer preferences for high-quality, comfortable lenses. This technological shift is expected to attract new customers and retain existing ones, fostering market growth.

Market Challenges

- High Competition Among Established Brands:The Japanese contact lens market is characterized by intense competition, with major players like Johnson & Johnson and Bausch + Lomb dominating over 75% of the market share. This competitive landscape makes it challenging for new entrants to gain traction. The Japan Contact Lens Manufacturers Association reported that new brands struggle to differentiate themselves, leading to price wars and reduced profit margins, which can hinder overall market growth.

- Regulatory Hurdles for New Entrants:New companies face significant regulatory challenges in Japan, where the Pharmaceuticals and Medical Devices Agency enforces stringent quality control standards. In future, the approval process for new contact lens products averaged 12 months, creating barriers to market entry. This lengthy process can deter potential innovators and limit the introduction of new products, ultimately stifling competition and slowing market expansion in the contact lens sector.

Japan Contact Lenses Market Future Outlook

The future of the Japan contact lenses market appears promising, driven by ongoing technological advancements and changing consumer preferences. As the population ages, the demand for corrective lenses will likely increase, alongside a growing interest in cosmetic options. Additionally, the expansion of online retail platforms is expected to enhance accessibility, allowing consumers to purchase lenses conveniently. These trends indicate a dynamic market landscape, with opportunities for innovation and growth in the coming years.

Market Opportunities

- Expansion of Online Retail Platforms:The shift towards e-commerce is creating significant opportunities for contact lens sales. In future, online sales accounted for 30% of total contact lens sales in Japan, a figure projected to rise to 40%. This trend allows brands to reach a broader audience, particularly younger consumers who prefer online shopping, thus enhancing market penetration and sales growth.

- Introduction of Smart Contact Lenses:The development of smart contact lenses presents a unique opportunity for innovation. With advancements in technology, companies are exploring lenses that can monitor health metrics, such as glucose levels. The market for smart lenses is expected to grow significantly, with an estimated 1.5 million units projected to be sold. This innovation could attract tech-savvy consumers and open new revenue streams for manufacturers.