Region:Middle East

Author(s):Geetanshi

Product Code:KRAE1059

Pages:99

Published On:February 2026

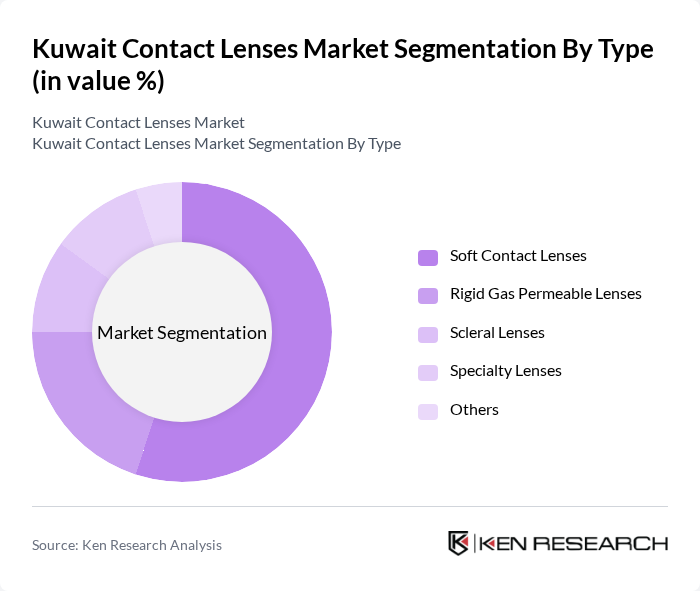

By Type:The market is segmented into various types of contact lenses, including Soft Contact Lenses, Rigid Gas Permeable Lenses, Scleral Lenses, Specialty Lenses, and Others. Among these, Soft Contact Lenses dominate the market due to their comfort and convenience, appealing to a wide range of consumers, with silicone hydrogel variants leading due to enhanced oxygen permeability. The increasing trend of daily disposable lenses is also contributing to the growth of this segment, as they offer ease of use and reduced maintenance.

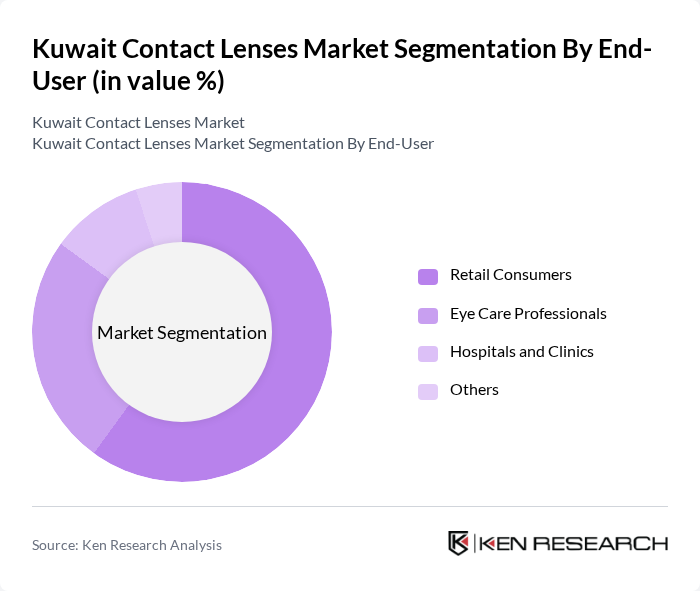

By End-User:The end-user segmentation includes Retail Consumers, Eye Care Professionals, Hospitals and Clinics, and Others. Retail Consumers represent the largest segment, driven by the increasing number of individuals opting for contact lenses for vision correction and cosmetic purposes. The growing trend of online shopping has also facilitated access to a wider range of products, further boosting this segment's growth.

The Kuwait Contact Lenses Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alcon, Johnson & Johnson Vision, Bausch + Lomb, CooperVision, Hoya Corporation, Menicon Co., Ltd., EssilorLuxottica, Carl Zeiss AG, SynergEyes, Vision Source, Acuvue, Opti-Free, Biofinity, Air Optix, Dailies contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait contact lenses market appears promising, driven by increasing consumer awareness and technological innovations. As the population ages and the prevalence of vision disorders rises, demand for contact lenses is expected to grow. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of products. Companies are likely to invest in research and development to create more advanced and comfortable lenses, catering to the evolving needs of consumers in Kuwait.

| Segment | Sub-Segments |

|---|---|

| By Type | Soft Contact Lenses Rigid Gas Permeable Lenses Scleral Lenses Specialty Lenses Others |

| By End-User | Retail Consumers Eye Care Professionals Hospitals and Clinics Others |

| By Distribution Channel | Online Retail Optical Stores Pharmacies Hospitals Others |

| By Material | Hydrogel Lenses Silicone Hydrogel Lenses Rigid Gas Permeable Materials Others |

| By Usage Duration | Daily Disposable Lenses Bi-weekly Lenses Monthly Lenses Others |

| By Age Group | Children Adults Seniors Others |

| By Geographic Distribution | Urban Areas Rural Areas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ophthalmologist Insights | 50 | Ophthalmologists, Optometrists |

| Consumer Preferences | 120 | Contact Lens Users, Potential Users |

| Retailer Feedback | 30 | Optical Retail Managers, Store Owners |

| Market Analysts | 20 | Healthcare Market Analysts, Industry Experts |

| Focus Group Discussions | 40 | Contact Lens Users, Eye Care Advocates |

The Kuwait Contact Lenses Market is valued at approximately USD 80 million, reflecting a significant growth trend driven by increasing awareness of eye health and a rise in myopia cases among the population.