Region:Middle East

Author(s):Dev

Product Code:KRAA5191

Pages:94

Published On:January 2026

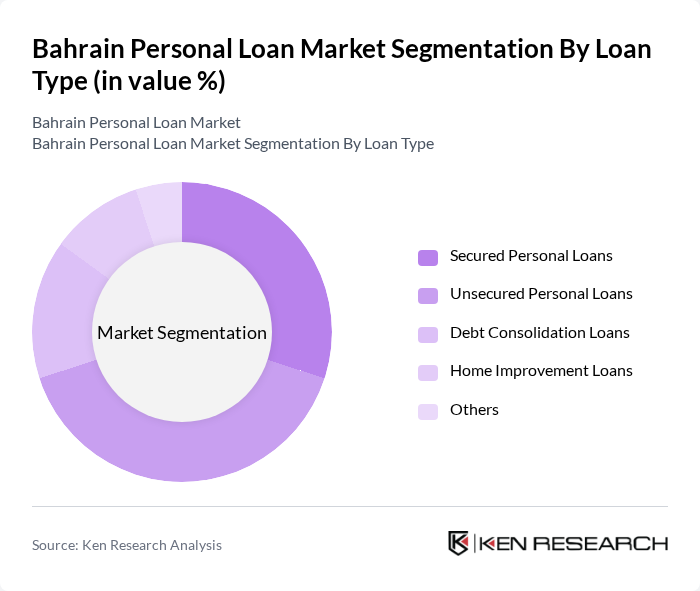

By Loan Type:The segmentation of personal loans by loan type includes various categories such as secured personal loans, unsecured personal loans, debt consolidation loans, home improvement loans, and others. Among these, unsecured personal loans are gaining significant traction due to their flexibility and the absence of collateral requirements, appealing to a broader range of consumers. Secured loans, while offering lower interest rates, are less favored due to the risk of asset forfeiture. Debt consolidation loans are also popular as they help borrowers manage multiple debts more effectively.

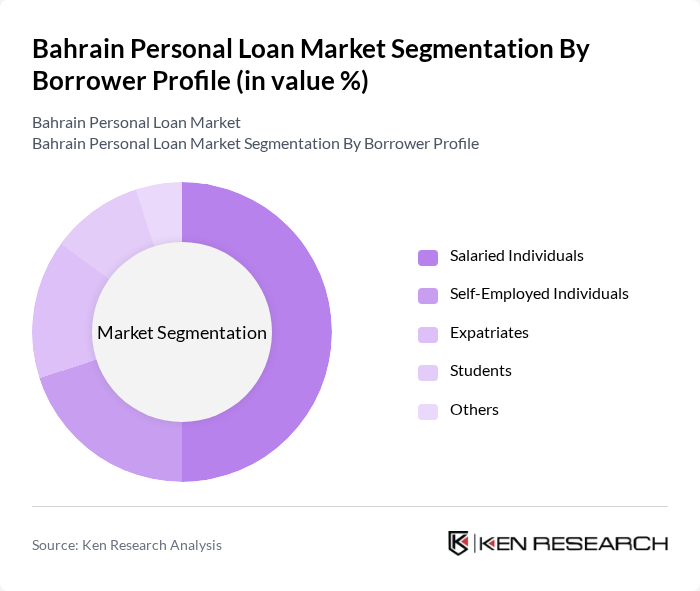

By Borrower Profile:The borrower profile segmentation includes salaried individuals, self-employed individuals, expatriates, students, and others. Salaried individuals represent the largest segment due to their stable income, making them more attractive to lenders. Expatriates also form a significant portion of the market, driven by their need for personal loans to finance various expenses in a foreign country. Self-employed individuals face more scrutiny but are increasingly accessing loans as financial institutions adapt their offerings to meet diverse borrower needs.

The Bahrain Personal Loan Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Baraka Banking Group, Bahrain Islamic Bank, National Bank of Bahrain, Gulf International Bank, Bank of Bahrain and Kuwait, Ahli United Bank, Bahrain Development Bank, Abu Dhabi Commercial Bank, Qatar National Bank, Emirates NBD, Mashreq Bank, Standard Chartered Bank, HSBC Bank Middle East, Arab Banking Corporation, Kuwait Finance House contribute to innovation, geographic expansion, and service delivery in this space.

The future of the personal loan market in Bahrain appears promising, driven by technological advancements and evolving consumer preferences. As digital platforms continue to gain traction, financial institutions are likely to enhance their online offerings, making loans more accessible. Additionally, the integration of artificial intelligence in credit scoring will improve risk assessment, enabling lenders to cater to a broader audience. These trends suggest a dynamic market landscape that prioritizes customer experience and innovation in loan products.

| Segment | Sub-Segments |

|---|---|

| By Loan Type | Secured Personal Loans Unsecured Personal Loans Debt Consolidation Loans Home Improvement Loans Others |

| By Borrower Profile | Salaried Individuals Self-Employed Individuals Expatriates Students Others |

| By Loan Amount | Small Loans (up to BHD 1,000) Medium Loans (BHD 1,001 - BHD 5,000) Large Loans (above BHD 5,000) Others |

| By Loan Tenure | Short-Term Loans (up to 1 year) Medium-Term Loans (1-3 years) Long-Term Loans (above 3 years) Others |

| By Purpose of Loan | Personal Expenses Medical Expenses Education Expenses Travel Expenses Others |

| By Distribution Channel | Banks Credit Unions Online Lenders Peer-to-Peer Platforms Others |

| By Customer Demographics | Age Group (18-25, 26-35, 36-50, 51+) Income Level (Low, Middle, High) Employment Status (Employed, Unemployed, Retired) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Loan Borrowers | 120 | Individuals aged 25-45 with recent loan experience |

| Bank Loan Officers | 60 | Loan officers from various banks in Bahrain |

| Financial Advisors | 40 | Financial consultants and advisors working with consumers |

| Regulatory Bodies | 20 | Officials from the Central Bank of Bahrain and financial regulators |

| Consumer Finance Experts | 30 | Economists and market analysts specializing in consumer finance |

The Bahrain personal loan market is valued at approximately BHD 6 billion, driven by increasing consumer demand for personal financing options, rising disposable income, and a growing expatriate population seeking financial solutions.