Region:Asia

Author(s):Dev

Product Code:KRAA5199

Pages:94

Published On:January 2026

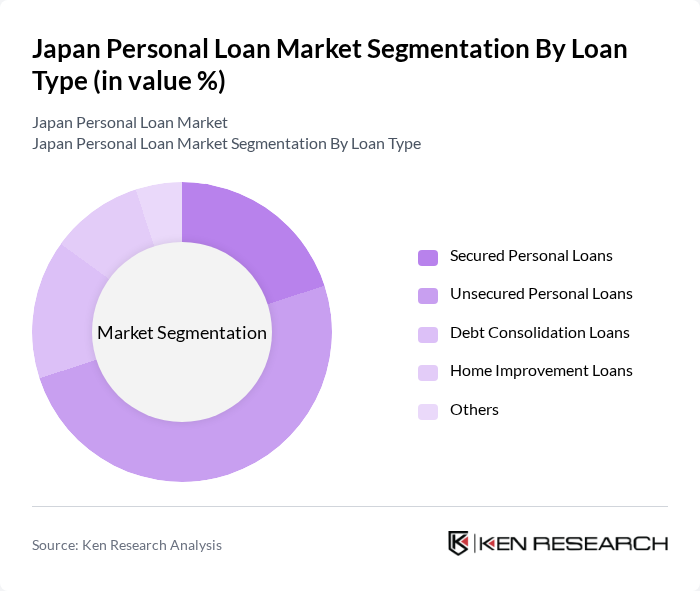

By Loan Type:The market is segmented into various loan types, including secured personal loans, unsecured personal loans, debt consolidation loans, home improvement loans, and others. Among these, unsecured personal loans dominate the market due to their accessibility and the growing trend of consumers seeking quick and hassle-free financing options without the need for collateral. The convenience and speed of obtaining unsecured loans have made them a preferred choice for many borrowers.

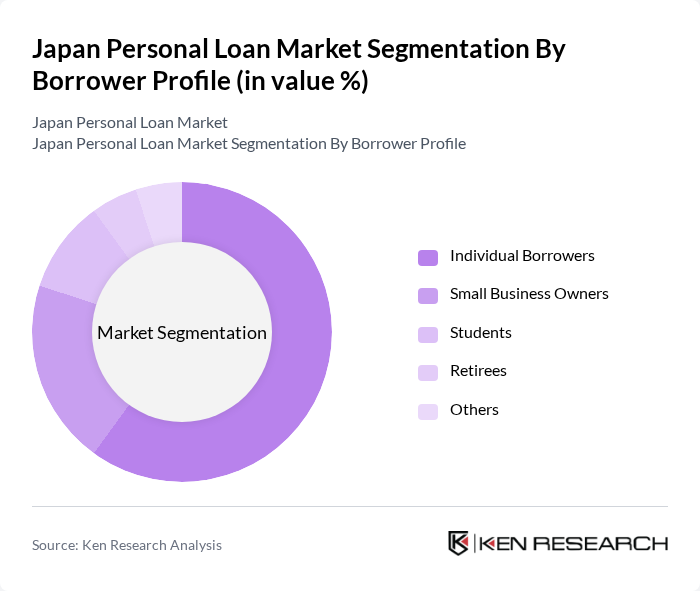

By Borrower Profile:The borrower profile segmentation includes individual borrowers, small business owners, students, retirees, and others. Individual borrowers represent the largest segment, driven by the increasing number of young professionals and families seeking personal loans for various purposes, such as education, home purchases, and personal expenses. This demographic's growing financial literacy and willingness to engage with digital lending platforms further bolster their dominance in the market.

The Japan Personal Loan Market is characterized by a dynamic mix of regional and international players. Leading participants such as MUFG Bank, Sumitomo Mitsui Banking Corporation, Mizuho Bank, Resona Bank, Japan Finance Corporation, Acom Co., Ltd., Promise Co., Ltd., JACCS Co., Ltd., SBI Sumishin Net Bank, Rakuten Bank, Orico, Aeon Credit Service, Juroku Bank, Shinsei Bank, Aiful Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan personal loan market appears promising, driven by technological advancements and evolving consumer preferences. As digital lending platforms continue to gain traction, the market is likely to see increased competition and innovation. Additionally, the ongoing economic recovery post-pandemic is expected to bolster consumer confidence, leading to higher borrowing levels. However, lenders must navigate regulatory challenges and consumer debt concerns to capitalize on these opportunities effectively.

| Segment | Sub-Segments |

|---|---|

| By Loan Type | Secured Personal Loans Unsecured Personal Loans Debt Consolidation Loans Home Improvement Loans Others |

| By Borrower Profile | Individual Borrowers Small Business Owners Students Retirees Others |

| By Loan Purpose | Medical Expenses Education Expenses Travel Expenses Emergency Funds Others |

| By Loan Amount | Small Loans (up to ¥500,000) Medium Loans (¥500,001 - ¥1,500,000) Large Loans (over ¥1,500,000) Others |

| By Repayment Term | Short-term Loans (up to 1 year) Medium-term Loans (1-3 years) Long-term Loans (over 3 years) Others |

| By Distribution Channel | Online Platforms Banks Credit Unions Financial Institutions Others |

| By Customer Segment | Urban Customers Rural Customers High-Income Customers Low-Income Customers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Consumers with Personal Loans | 120 | Individuals aged 25-45, employed, with recent loan experience |

| Rural Consumers with Personal Loans | 80 | Individuals aged 30-60, self-employed or small business owners |

| Financial Advisors and Loan Officers | 60 | Professionals working in banks, credit unions, and financial advisory firms |

| Young Adults Considering Personal Loans | 100 | Individuals aged 18-24, students or early career professionals |

| High-Income Borrowers | 50 | Individuals with annual income above ¥10 million, seeking premium loan products |

The Japan Personal Loan Market is valued at approximately USD 3 billion, driven by increasing consumer demand for personal financing options across various sectors, including healthcare, education, and entertainment, alongside a favorable low-interest-rate environment.