Region:Asia

Author(s):Dev

Product Code:KRAA6500

Pages:99

Published On:January 2026

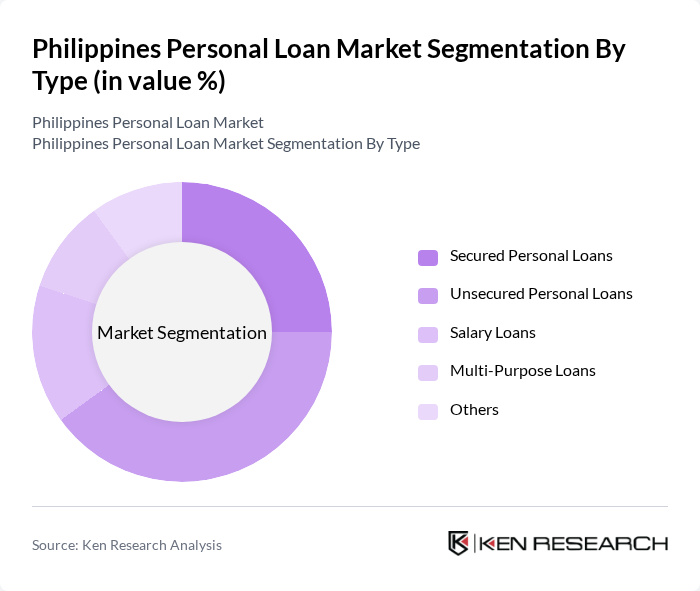

By Type:The personal loan market is segmented into various types, including secured personal loans, unsecured personal loans, salary loans, multi-purpose loans, and others. Among these, unsecured personal loans are gaining significant traction due to their ease of access and minimal documentation requirements. This segment appeals to consumers who may not have substantial assets to offer as collateral, thus driving its popularity. The trend towards digital lending platforms has further accelerated the growth of unsecured loans, as they provide quick approval processes and convenience for borrowers.(source)

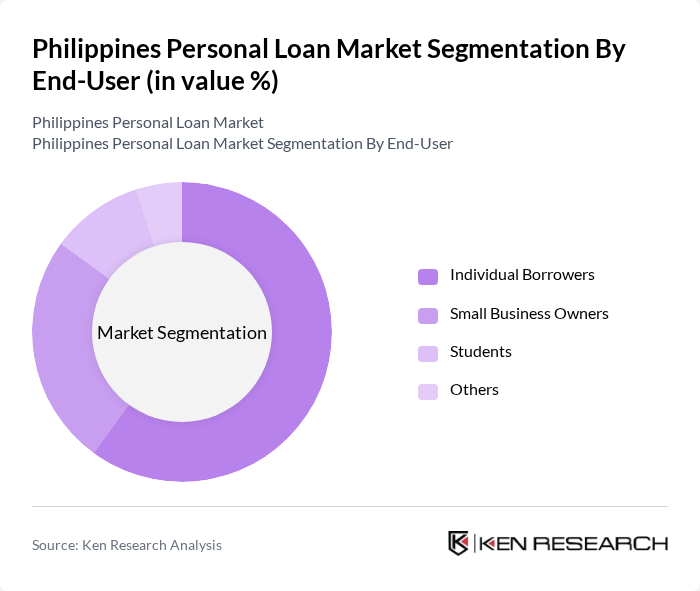

By End-User:The end-user segmentation includes individual borrowers, small business owners, students, and others. Individual borrowers dominate the market, driven by the increasing need for personal financing for various purposes such as home renovations, medical expenses, and debt consolidation. The rise in consumer awareness regarding financial products and the ease of obtaining loans through digital platforms have significantly contributed to the growth of this segment. Small business owners also represent a growing segment as they seek personal loans to fund business operations and expansion.

The Philippines Personal Loan Market is characterized by a dynamic mix of regional and international players. Leading participants such as BDO Unibank, Metrobank, Bank of the Philippine Islands (BPI), UnionBank of the Philippines, Security Bank, EastWest Banking Corporation, Philippine National Bank (PNB), RCBC, Maybank Philippines, Citibank Philippines, Home Credit Philippines, Tala Philippines, Cashalo, and Finastra contribute to innovation, geographic expansion, and service delivery in this space.

The future of the personal loan market in the Philippines appears promising, driven by technological advancements and evolving consumer preferences. As digital lending continues to gain traction, more borrowers are expected to utilize online platforms for their financing needs. Additionally, the increasing focus on financial literacy initiatives will empower consumers to make informed borrowing decisions, potentially reducing default rates. Overall, the market is poised for growth, with innovative loan products catering to diverse consumer needs likely to emerge in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Secured Personal Loans Unsecured Personal Loans Salary Loans Multi-Purpose Loans Others |

| By End-User | Individual Borrowers Small Business Owners Students Others |

| By Loan Amount | Low-Value Loans (Below PHP 50,000) Medium-Value Loans (PHP 50,000 - PHP 200,000) High-Value Loans (Above PHP 200,000) Others |

| By Loan Tenure | Short-Term Loans (Less than 1 Year) Medium-Term Loans (1-3 Years) Long-Term Loans (More than 3 Years) Others |

| By Purpose of Loan | Medical Expenses Home Renovation Education Expenses Debt Consolidation Others |

| By Distribution Channel | Online Platforms Banks Microfinance Institutions Others |

| By Demographics | Age Group (18-25, 26-35, 36-45, 46+) Income Level (Low, Middle, High) Employment Status (Employed, Self-Employed, Unemployed) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Personal Loan Users | 140 | Individuals aged 25-45 with recent loan experience |

| Bank Loan Officers | 100 | Loan officers from major banks and credit unions |

| Financial Advisors | 80 | Certified financial planners and advisors |

| Regulatory Bodies | 50 | Officials from the Bangko Sentral ng Pilipinas |

| Consumer Advocacy Groups | 40 | Members of organizations focused on consumer rights in finance |

The Philippines Personal Loan Market is valued at approximately USD 10.4 billion, driven by increasing consumer demand for financial products, rising disposable incomes, and the growth of digital banking, making loan applications more accessible.