Region:Asia

Author(s):Dev

Product Code:KRAA6499

Pages:88

Published On:January 2026

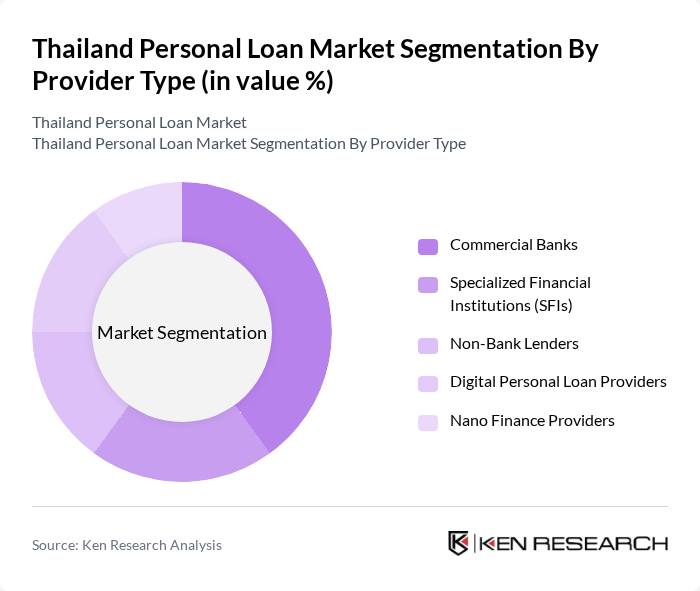

By Provider Type:The personal loan market in Thailand is segmented by provider type, which includes various financial institutions catering to different consumer needs. Commercial banks are the most prominent players, offering a wide range of personal loan products with competitive interest rates. Specialized Financial Institutions (SFIs) focus on niche markets, while Non-Bank Lenders provide alternative financing options. Digital Personal Loan Providers have gained traction due to the rise of fintech, and Nano Finance Providers cater to low-income individuals seeking small loans.

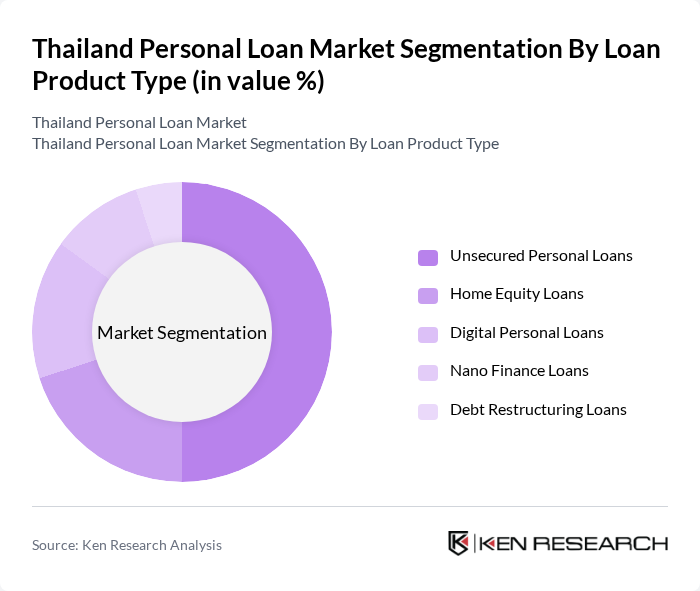

By Loan Product Type:The segmentation by loan product type reveals a diverse range of offerings tailored to meet the varying needs of borrowers. Unsecured Personal Loans are the most popular, as they do not require collateral, making them accessible to a broader audience. Home Equity Loans allow homeowners to leverage their property for financing, while Digital Personal Loans cater to tech-savvy consumers seeking quick and convenient access to funds. Nano Finance Loans target low-income individuals needing small amounts, and Debt Restructuring Loans assist borrowers in managing existing debts more effectively.

The Thailand Personal Loan Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bangkok Bank, Kasikorn Bank, Siam Commercial Bank, Krung Thai Bank, TMBThanachart Bank, UOB Thailand, Kiatnakin Phatra Bank, Bank of Ayudhya, CIMB Thai Bank, Government Savings Bank, AEON Thana Sinsap (Thailand) Public Company Limited, Thai Credit Bank, First Choice Leasing, Srisawad Corporation Public Company Limited, Poonphol Group contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand personal loan market is poised for continued evolution, driven by technological advancements and changing consumer preferences. As digital lending platforms gain traction, lenders will increasingly leverage data analytics and AI to enhance credit scoring and personalize loan offerings. Additionally, the focus on financial inclusion will likely lead to innovative products tailored for underserved segments, particularly in rural areas, fostering broader access to credit and stimulating market growth.

| Segment | Sub-Segments |

|---|---|

| By Provider Type | Commercial Banks Specialized Financial Institutions (SFIs) Non-Bank Lenders Digital Personal Loan Providers Nano Finance Providers |

| By Loan Product Type | Unsecured Personal Loans Home Equity Loans Digital Personal Loans Nano Finance Loans Debt Restructuring Loans |

| By Borrower Profile | Salaried Individuals Self-Employed Individuals Micro and Small Entrepreneurs Underserved Populations Others |

| By Loan Amount | Nano Loans (Up to THB 50,000) Small Loans (THB 50,001 - THB 200,000) Medium Loans (THB 200,001 - THB 1,000,000) Large Loans (Above THB 1,000,000) |

| By Distribution Channel | Online Platforms and Mobile Applications Bank Branches Direct Sales and Relationship Managers Microfinance Institutions Others |

| By Customer Demographics | Age Group (18-25, 26-35, 36-50, 51+) Income Level (Low, Middle, High) Urban vs Rural Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Consumers with Personal Loans | 120 | Individuals aged 25-45, employed, with active loans |

| Rural Consumers with Personal Loans | 80 | Individuals aged 30-55, self-employed or farmers |

| Loan Officers from Major Banks | 40 | Loan officers and branch managers from top banks |

| Financial Advisors and Consultants | 30 | Financial advisors with experience in personal loans |

| Regulatory Experts in Banking | 20 | Regulatory officials and compliance officers |

The Thailand personal loan market is valued at approximately THB 1.2 trillion, reflecting significant growth driven by increasing consumer demand for credit, rising disposable incomes, and the expansion of fintech solutions.