Region:Middle East

Author(s):Dev

Product Code:KRAA5186

Pages:87

Published On:January 2026

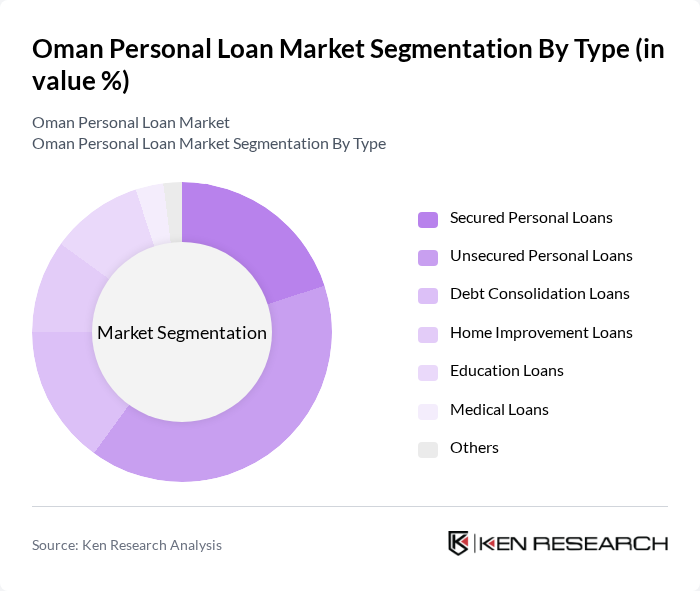

By Type:The personal loan market can be segmented into various types, including secured personal loans, unsecured personal loans, debt consolidation loans, home improvement loans, education loans, medical loans, and others. Among these, unsecured personal loans are the most popular due to their accessibility and the absence of collateral requirements. This segment appeals to a broad range of consumers, particularly those who may not have significant assets to pledge as security. The demand for education loans is also rising, driven by the increasing number of students pursuing higher education both locally and abroad.

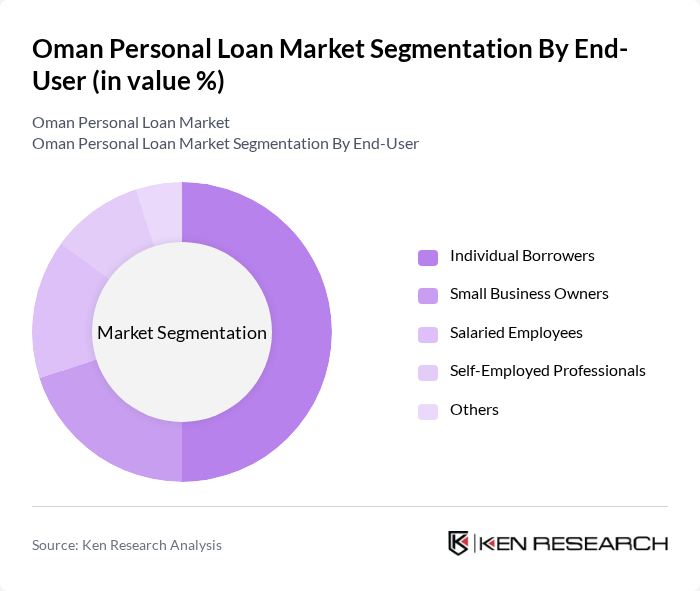

By End-User:The end-user segmentation includes individual borrowers, small business owners, salaried employees, self-employed professionals, and others. Individual borrowers dominate the market, driven by the increasing need for personal financing for various purposes such as home renovations, travel, and emergencies. Salaried employees also represent a significant portion of the market, as they often have stable incomes that make them attractive candidates for personal loans. The rise of entrepreneurship has led to a growing demand from small business owners seeking loans for business expansion.

The Oman Personal Loan Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bank Muscat, National Bank of Oman, Oman Arab Bank, Bank Dhofar, Sohar International Bank, Alizz Islamic Bank, Muscat Bank, Oman Housing Bank, HSBC Oman, Qatar National Bank Oman, Dhofar International Bank, Oman Investment and Finance Co., Oman United Insurance Company, Al Izz Islamic Bank, Oman National Investment Corporation Holding contribute to innovation, geographic expansion, and service delivery in this space.

The Oman personal loan market is poised for continued growth, driven by increasing consumer demand and the expansion of digital banking services. As disposable incomes rise, more individuals will seek personal loans for various needs. However, challenges such as high consumer debt levels and stringent regulations will require careful navigation. Financial institutions that leverage technology and focus on customer experience will likely thrive, adapting to the evolving landscape while addressing consumer needs effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Secured Personal Loans Unsecured Personal Loans Debt Consolidation Loans Home Improvement Loans Education Loans Medical Loans Others |

| By End-User | Individual Borrowers Small Business Owners Salaried Employees Self-Employed Professionals Others |

| By Loan Amount | Low-Value Loans (up to OMR 5,000) Mid-Value Loans (OMR 5,001 - OMR 15,000) High-Value Loans (above OMR 15,000) Others |

| By Loan Tenure | Short-Term Loans (up to 1 year) Medium-Term Loans (1 to 3 years) Long-Term Loans (above 3 years) Others |

| By Interest Rate Type | Fixed Interest Rate Loans Variable Interest Rate Loans Others |

| By Purpose of Loan | Personal Expenses Business Expansion Travel and Leisure Others |

| By Customer Demographics | Age Group (18-25, 26-35, 36-50, 51+) Income Level (Low, Middle, High) Employment Status (Employed, Unemployed, Retired) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Personal Loan Borrowers | 120 | Individuals aged 25-45 with recent loan experience |

| Bank Loan Officers | 80 | Loan officers from various banks in Oman |

| Financial Advisors | 60 | Financial consultants and advisors working with consumers |

| Regulatory Bodies | 40 | Officials from the Central Bank of Oman and financial regulators |

| Market Analysts | 50 | Analysts specializing in the Omani financial services sector |

The Oman Personal Loan Market is valued at approximately USD 32 billion, reflecting significant growth driven by increasing consumer demand for personal financing options, rising disposable income, and a growing middle class.