Region:Middle East

Author(s):Dev

Product Code:KRAA5183

Pages:82

Published On:January 2026

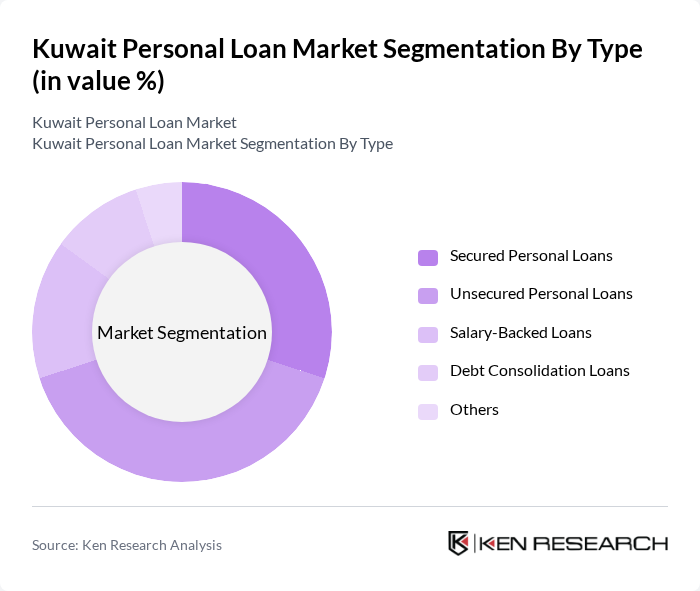

By Type:The personal loan market can be segmented into various types, including secured personal loans, unsecured personal loans, salary-backed loans, debt consolidation loans, and others. Among these, unsecured personal loans are gaining traction due to their ease of access and minimal requirements, appealing to a broad range of consumers. Secured loans, while offering lower interest rates, require collateral, which may deter some borrowers.

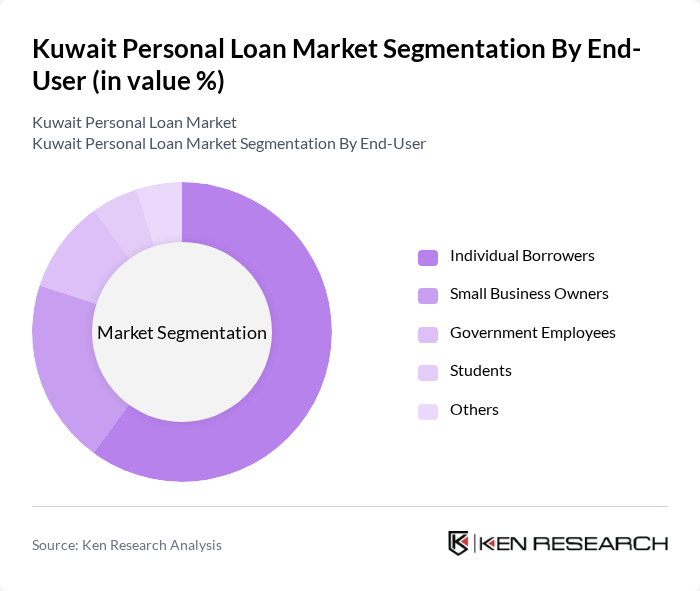

By End-User:The end-user segmentation includes individual borrowers, small business owners, government employees, students, and others. Individual borrowers dominate the market, driven by the increasing need for personal financing for various purposes such as home renovations, education, and emergencies. Small business owners also represent a significant segment, seeking loans to fund operations and growth.

The Kuwait Personal Loan Market is characterized by a dynamic mix of regional and international players. Leading participants such as National Bank of Kuwait, Gulf Bank, Kuwait Finance House, Boubyan Bank, Al Ahli Bank of Kuwait, Warba Bank, Burgan Bank, Kuwait International Bank, Commercial Bank of Kuwait, Ahli United Bank, Qatar National Bank - Kuwait, Al Baraka Banking Group, KFH Capital, Al-Mal Investment Company, Kuwait Investment Authority contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait personal loan market appears promising, driven by technological advancements and evolving consumer preferences. As digital banking continues to grow, more consumers are likely to embrace online lending platforms, enhancing accessibility. Additionally, the introduction of personalized loan products tailored to individual needs will likely attract a broader customer base. Financial institutions that prioritize customer experience and leverage data analytics will be well-positioned to capitalize on these trends, fostering sustainable growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Secured Personal Loans Unsecured Personal Loans Salary-Backed Loans Debt Consolidation Loans Others |

| By End-User | Individual Borrowers Small Business Owners Government Employees Students Others |

| By Loan Amount | Low-value Loans (up to KWD 1,000) Mid-value Loans (KWD 1,001 - KWD 5,000) High-value Loans (above KWD 5,000) Others |

| By Tenure | Short-term Loans (up to 1 year) Medium-term Loans (1-3 years) Long-term Loans (above 3 years) Others |

| By Interest Rate Type | Fixed Interest Rate Loans Variable Interest Rate Loans Hybrid Interest Rate Loans Others |

| By Distribution Channel | Banks Non-Banking Financial Companies (NBFCs) Online Lending Platforms Credit Unions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Loan Borrowers | 150 | Individuals aged 25-45 with recent loan experience |

| Bank Loan Officers | 100 | Loan officers from various banks in Kuwait |

| Financial Advisors | 80 | Financial consultants and advisors with expertise in personal loans |

| Consumer Financial Literacy Groups | 60 | Members of financial literacy programs and workshops |

| Regulatory Bodies | 50 | Officials from the Central Bank of Kuwait and financial regulatory authorities |

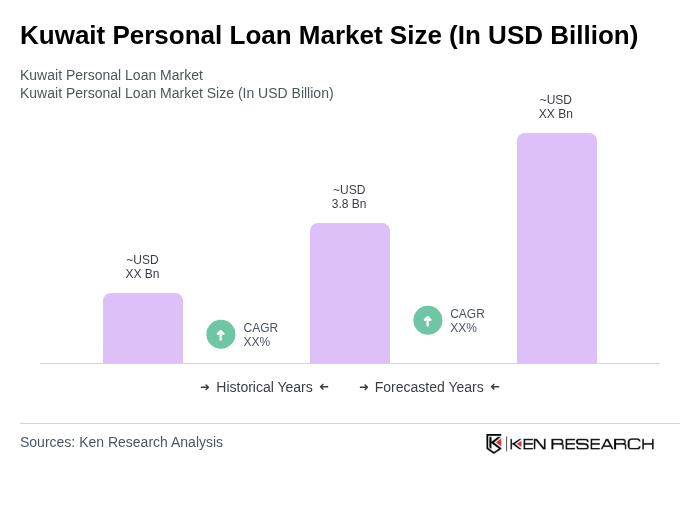

The Kuwait personal loan market is valued at approximately USD 3.8 billion, reflecting significant growth driven by increasing consumer demand, rising disposable income, and a growing population seeking loans for various purposes such as home improvements and education.