Region:Europe

Author(s):Shubham

Product Code:KRAC5243

Pages:80

Published On:January 2026

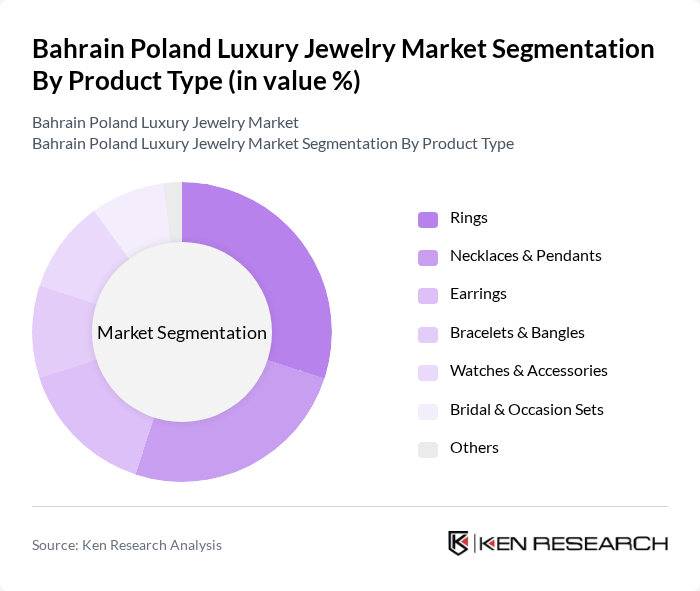

By Product Type:The product type segmentation includes various categories such as rings, necklaces & pendants, earrings, bracelets & bangles, watches & accessories, bridal & occasion sets, and others. Rings and necklaces remain among the most popular categories in key luxury jewelry markets, supported by their symbolic role in engagements and weddings and their versatility for everyday and occasion wear, a pattern also reported for the UK and Poland luxury jewelry segment where rings hold the leading share. The demand for bridal sets has also surged, driven by cultural traditions and wedding celebrations in both the Middle East and Europe, where wedding- and gifting-led jewelry purchases are a major growth driver for the luxury segment.

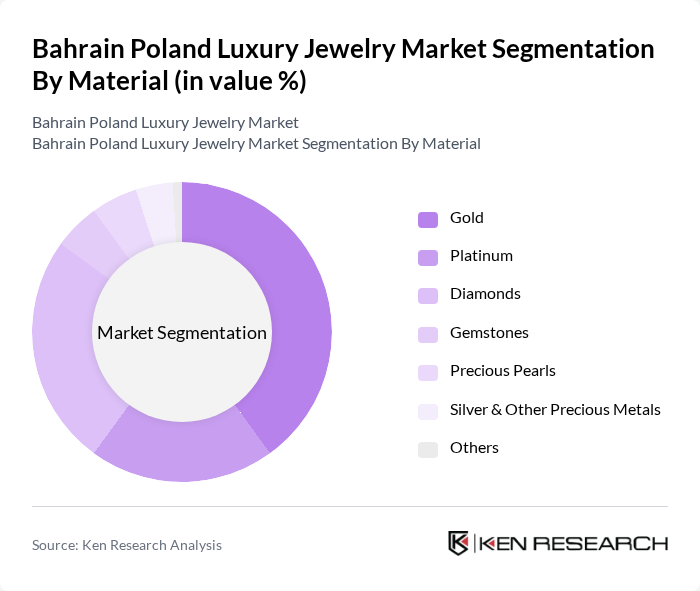

By Material:The material segmentation encompasses gold, platinum, diamonds, gemstones, precious pearls, silver & other precious metals, and others. Gold remains the most sought-after material in both Middle Eastern and European luxury jewelry markets due to its cultural significance, role as a store of value, and centrality in bridal and gifting purchases. Diamonds are also highly favored, particularly in engagement rings and high-end pieces, while platinum and other premium metals are gaining traction among affluent consumers who value durability, hypoallergenic properties, and discreet prestige, in line with broader global luxury jewelry trends.

The Bahrain Poland Luxury Jewelry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Zain Jewellery, Damas Jewellery, L’azurde Company for Jewelry, Mouawad, Tiffany & Co., Cartier, Bulgari, Chopard, Van Cleef & Arpels, Harry Winston, Piaget, Graff, Boodles, Apart (Poland), YES Bi?uteria contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain luxury jewelry market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands that adopt ethical sourcing and eco-friendly practices are likely to gain a competitive edge. Additionally, the integration of augmented reality in online shopping experiences is expected to enhance customer engagement. These trends indicate a shift towards a more personalized and responsible luxury shopping experience, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Rings Necklaces & Pendants Earrings Bracelets & Bangles Watches & Accessories Bridal & Occasion Sets Others |

| By Material | Gold Platinum Diamonds Gemstones Precious Pearls Silver & Other Precious Metals Others |

| By Consumer Profile | Women Men Youth & Children High-Net-Worth Individuals (HNWIs) Tourists & Expatriates Others |

| By Distribution Channel | Mono-Brand Boutiques Multi-Brand Luxury Retailers Department Stores & Duty-Free Online Brand Stores Online Marketplaces Others |

| By Price Band | Entry Luxury (Accessible Premium) Core Luxury High Luxury Ultra-High / High Jewelry Others |

| By Purchase Occasion | Weddings & Engagements Religious & Cultural Festivals Gifting (Personal & Corporate) Self-Purchase Investment & Portfolio Diversification Others |

| By Country | Bahrain Poland Cross-Border / Touristic Flows |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Jewelry Retailers in Bahrain | 60 | Store Managers, Sales Directors |

| Affluent Consumers in Poland | 120 | High Net-Worth Individuals, Luxury Shoppers |

| Jewelry Designers and Artisans | 70 | Independent Designers, Workshop Owners |

| Luxury Brand Executives | 50 | Marketing Managers, Brand Strategists |

| Market Analysts and Consultants | 40 | Industry Analysts, Market Researchers |

The Bahrain Poland Luxury Jewelry Market is valued at approximately USD 1.3 billion, reflecting a significant growth trend driven by increasing disposable incomes and a rising number of high-net-worth individuals in both regions.