Region:Asia

Author(s):Shubham

Product Code:KRAC5240

Pages:88

Published On:January 2026

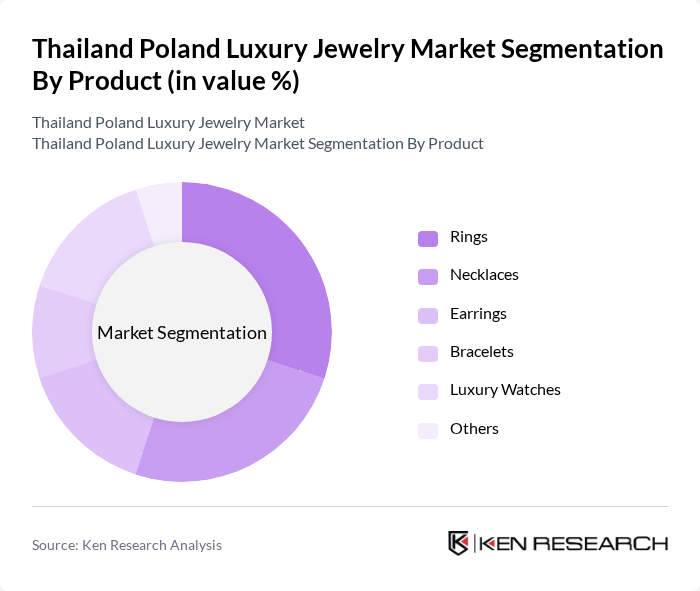

By Product:The product segmentation of the luxury jewelry market includes various categories such as rings, necklaces, earrings, bracelets, luxury watches, and others. Rings and necklaces are consistently among the leading product types in luxury jewelry markets due to their symbolic value, versatility, and central role in cultural traditions such as engagements, weddings, and milestone gifting in both Asian and European markets. The demand for luxury watches has also surged, supported by their positioning as status symbols, investment pieces, and collectible items, particularly among affluent male consumers and younger high-net-worth individuals. Overall, the product category is characterized by a diverse range of offerings, with brands increasingly focusing on personalized, limited-edition, and bespoke designs to cater to evolving consumer preferences in Thailand and Poland.

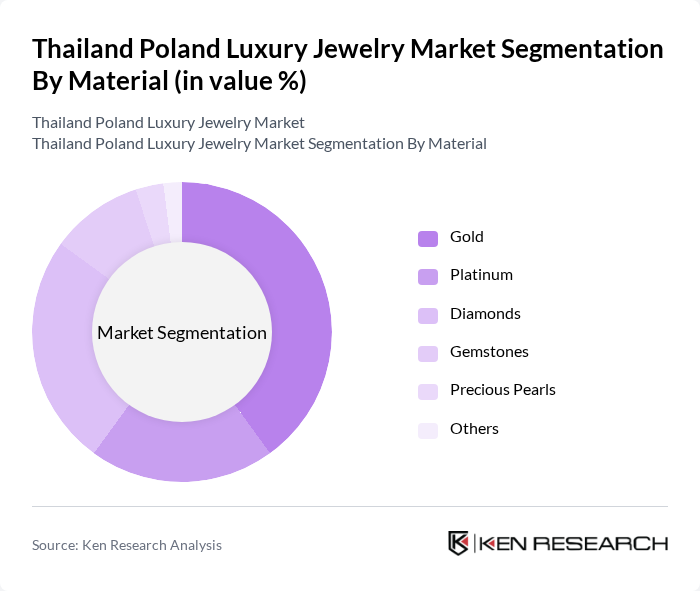

By Material:The material segmentation of the luxury jewelry market includes gold, platinum, diamonds, gemstones, precious pearls, and others. Gold remains the most sought-after material, especially in Thailand, where gold jewelry is deeply embedded in cultural practices and viewed as both an adornment and a store of value, supporting steady demand across income segments. Diamonds are highly favored in engagement and bridal jewelry, as well as in premium collections from global brands targeting Polish and Thai urban consumers, while platinum continues to gain traction in high-end segments due to its durability, hypoallergenic properties, and association with exclusivity. Gemstones and pearls are increasingly used in contemporary and heritage-inspired designs, appealing to consumers seeking differentiated aesthetics, color, and storytelling, which is particularly relevant in Thailand’s gemstone hub positioning and in Poland’s emerging preference for distinctive, design-led luxury pieces.

The Thailand Poland Luxury Jewelry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Swarovski, Chopard, Cartier, Van Cleef & Arpels, Bulgari, Harry Winston, Piaget, Graff, Mikimoto, David Yurman, Tiffany & Co., Buccellati, Damiani, Pomellato, Messika contribute to innovation, geographic expansion, and service delivery in this space, leveraging strong brand equity, heritage craftsmanship, and increasingly omnichannel strategies to engage affluent consumers in Bangkok, Warsaw, and other key cities.

The Thailand Poland luxury jewelry market is poised for dynamic growth, driven by increasing disposable incomes and a shift towards personalized and sustainable products. As e-commerce continues to expand, brands will need to enhance their online presence and digital marketing strategies to capture the attention of tech-savvy consumers. Additionally, collaborations with fashion designers and a focus on ethical sourcing will likely shape the future landscape, aligning with evolving consumer values and preferences in luxury purchases.

| Segment | Sub-Segments |

|---|---|

| By Product | Rings Necklaces Earrings Bracelets Luxury Watches Others |

| By Material | Gold Platinum Diamonds Gemstones Precious Pearls Others |

| By Customer Type | Women Men Unisex / Gender-neutral Children |

| By Distribution Channel | Online (Brand E-commerce, Marketplaces) Mono-brand Luxury Boutiques Multi-brand Jewelry & Watch Retailers Department Stores & Duty-free Others |

| By Price Band | Accessible Luxury (Entry-level) Core Luxury High Luxury Ultra-high / High Jewelry |

| By Occasion & Use Case | Bridal & Engagement Gifting (Festive, Corporate, Personal) Investment & Collection Everyday / Self-purchase Others |

| By Region | Thailand – Key Cities (Bangkok, Phuket, Chiang Mai, Others) Rest of Thailand Poland – Key Cities (Warsaw, Kraków, Others) Rest of Poland |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Jewelry Retailers in Thailand | 90 | Store Managers, Sales Directors |

| Luxury Jewelry Consumers in Poland | 120 | Affluent Individuals, Jewelry Enthusiasts |

| Manufacturers of Fine Jewelry | 70 | Production Managers, Business Owners |

| Jewelry Designers and Artisans | 60 | Creative Directors, Independent Designers |

| Luxury Market Analysts | 45 | Market Researchers, Industry Experts |

The Thailand Poland luxury jewelry market is valued at approximately USD 2.3 billion, driven by increasing disposable incomes, a growing affluent consumer base, and strong tourism inflows in Thailand, particularly in urban areas like Bangkok and Warsaw.