Region:Europe

Author(s):Shubham

Product Code:KRAC5245

Pages:90

Published On:January 2026

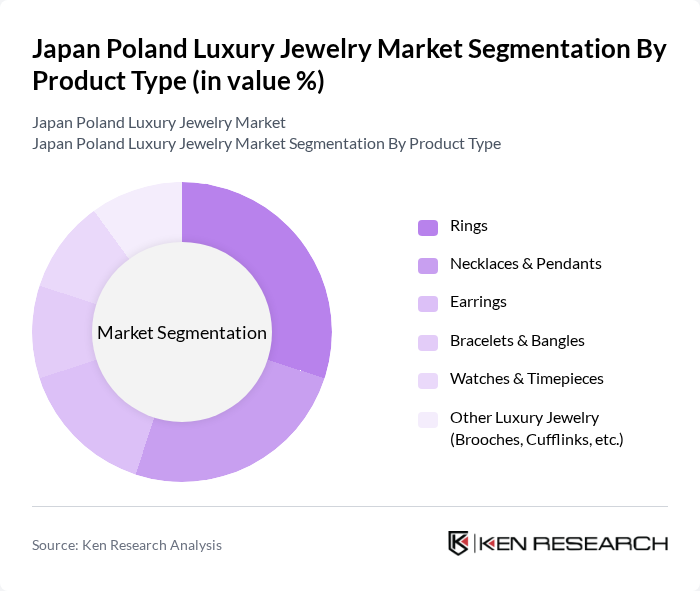

By Product Type:The product type segmentation includes various categories such as rings, necklaces and pendants, earrings, bracelets and bangles, watches and timepieces, and other luxury jewelry items like brooches and cufflinks. This structure is aligned with common product segmentation used in jewelry industry reports for Japan and globally, where necklaces, rings, earrings, and bracelets form the core product groups. Among these, rings and necklaces and pendants are particularly popular due to their versatility, association with engagements, weddings, and gifting, and their strong emotional and symbolic value for consumers. The demand for watches and timepieces is also notable, driven by their role as status symbols within the broader luxury goods category and by the presence of global luxury watchmakers in both Japan and Poland.

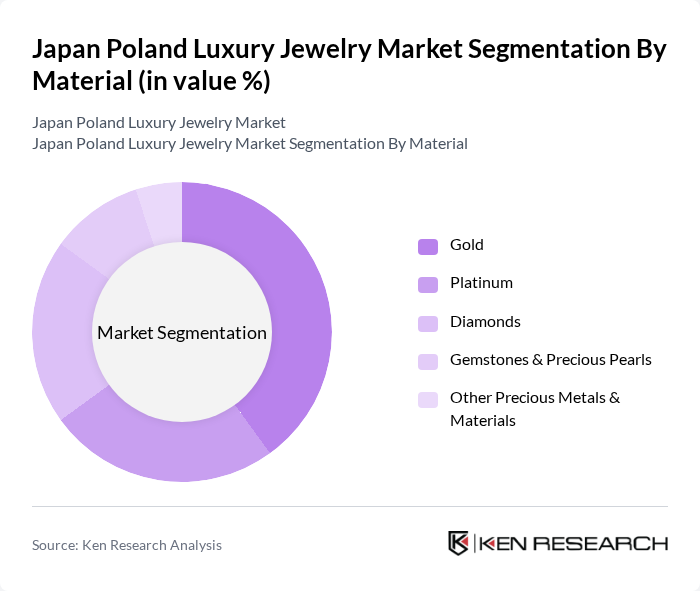

By Material:The material segmentation encompasses gold, platinum, diamonds, gemstones and precious pearls, and other precious metals and materials. This aligns with standard material-based segmentation used in Japan jewelry market analyses, which highlight gold, platinum, and diamonds as core materials, with pearls and gemstones also playing an important role. Gold remains the most sought-after material due to its traditional value, liquidity, and versatility in both everyday and ceremonial jewelry. Diamonds are favored for their luxury appeal, brandable nature, and strong position in engagement and bridal segments, while platinum is gaining traction among affluent consumers for its rarity, durability, hypoallergenic properties, and suitability for premium bridal and high-jewelry pieces. In Japan, pearl-based jewelry, including Akoya pearls, is particularly significant, reinforcing the importance of gemstones and precious pearls within the material mix.

The Japan Poland Luxury Jewelry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mikimoto, Tasaki, Ginza Tanaka, Festaria Holdings, W. Kruk, Apart, Yes Bi?uteria, Cartier, Van Cleef & Arpels, Bulgari, Tiffany & Co., Chopard, Harry Winston, Piaget, Graff contribute to innovation, geographic expansion, and service delivery in this space.

The Japan Poland luxury jewelry market is poised for growth, driven by increasing disposable incomes and a shift towards personalized products. As consumers become more environmentally conscious, the demand for ethically sourced materials is expected to rise. Additionally, the integration of technology in design and manufacturing processes will enhance product offerings. Brands that adapt to these trends and leverage e-commerce platforms will likely capture a larger market share, ensuring sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Rings Necklaces & Pendants Earrings Bracelets & Bangles Watches & Timepieces Other Luxury Jewelry (Brooches, Cufflinks, etc.) |

| By Material | Gold Platinum Diamonds Gemstones & Precious Pearls Other Precious Metals & Materials |

| By Consumer Profile | Women Men Gen Z & Younger Affluent Consumers High-Net-Worth Individuals (HNWIs) |

| By Price Band | Entry Luxury (Accessible Luxury) Core Luxury High-End Luxury Ultra-High-End & High Jewelry |

| By Distribution Channel | Monobrand Boutiques Multibrand Luxury Retailers & Department Stores Duty-Free & Travel Retail Online Flagship Stores & E-commerce Platforms |

| By Purchase Occasion | Bridal & Engagement Gifting (Anniversaries, Birthdays, Festivals) Self-Purchase & Investment Collectors & Limited-Edition Pieces |

| By Geography | Japan – Tier-1 Cities & Luxury Districts Japan – Other Urban & Emerging Luxury Hubs Poland – Major Metropolitan Areas Poland – Secondary Cities & Tourist Destinations |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Jewelry Retailers in Japan | 60 | Store Managers, Brand Representatives |

| Affluent Consumers in Poland | 120 | High Net-Worth Individuals, Luxury Shoppers |

| Jewelry Designers and Artisans | 80 | Independent Designers, Workshop Owners |

| Luxury E-commerce Platforms | 40 | eCommerce Managers, Marketing Directors |

| Market Analysts and Consultants | 40 | Industry Analysts, Market Research Experts |

The Japan Poland luxury jewelry market is valued at approximately USD 12.6 billion, reflecting a combination of historical analysis from both countries. This growth is attributed to rising disposable incomes and an increasing number of high-net-worth individuals.