Region:Asia

Author(s):Shubham

Product Code:KRAC5241

Pages:99

Published On:January 2026

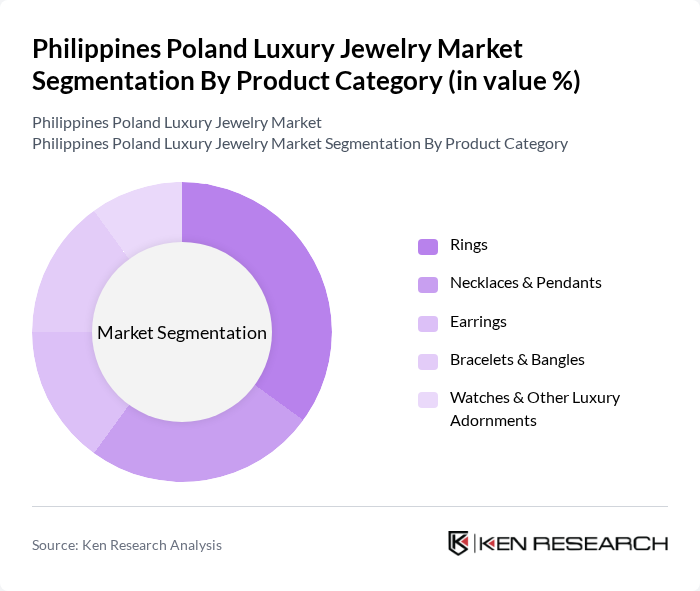

By Product Category:The product category segmentation includes Rings, Necklaces & Pendants, Earrings, Bracelets & Bangles, and Watches & Other Luxury Adornments. Among these, Rings are the most dominant sub-segment, driven by their significance in engagement and wedding traditions in both markets, consistent with global luxury jewelry patterns where bridal and engagement categories are key revenue drivers. The increasing trend of personalized and custom-designed rings, including bespoke settings, mixed metals, and lab?grown diamond options, has further fueled their popularity, making them a preferred choice for consumers looking to make a statement and reflect individual style.

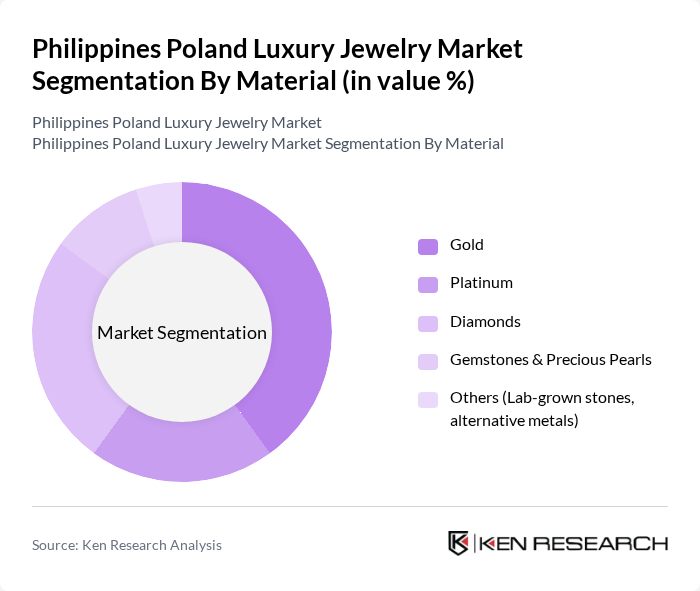

By Material:The material segmentation includes Gold, Platinum, Diamonds, Gemstones & Precious Pearls, and Others (Lab-grown stones, alternative metals). Gold remains the leading material in the luxury jewelry market, favored for its timeless appeal, liquidity, and role as a store of value, which is particularly strong in the Philippines where gold jewelry is deeply embedded in cultural and investment behavior. Globally and in Europe, gold also retains a dominant share in luxury jewelry assortments across major brands. The rising trend of ethical sourcing, demand for responsibly mined or recycled gold, and the rapid adoption of lab-grown diamonds and traceable gemstones are influencing consumer choices, especially among younger, urban buyers, but gold continues to dominate due to its cultural significance and status symbol across both countries.

The Philippines Poland Luxury Jewelry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jewelmer, Karat World, Meycauayan Jewelry Industry Cluster, W.Kruk, Apart, YES Bi?uteria, Cartier, Van Cleef & Arpels, Bulgari, Chopard, Tiffany & Co., Harry Winston, Graff, Swarovski, and local high-end independent jewelers contribute to innovation, geographic expansion, and service delivery in this space.

The luxury jewelry market in the Philippines is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. As disposable incomes rise, consumers are increasingly seeking unique, personalized jewelry options. The integration of e-commerce platforms will further facilitate access to luxury products, while sustainability trends will shape purchasing decisions. Brands that adapt to these changes and leverage digital marketing strategies will likely thrive in this competitive landscape, ensuring a vibrant future for the industry.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Rings Necklaces & Pendants Earrings Bracelets & Bangles Watches & Other Luxury Adornments |

| By Material | Gold Platinum Diamonds Gemstones & Precious Pearls Others (Lab?grown stones, alternative metals) |

| By Customer Segment | Women Men Unisex Children & Youth |

| By Price Tier | Entry Luxury Core Luxury High Luxury Ultra?High / High Jewelry |

| By Distribution Channel | Mono?brand Boutiques Multi?brand Jewelry Retailers Department & Duty?Free Stores Online Brand Stores & Marketplaces Other Specialized Luxury Channels |

| By Purchase Occasion | Bridal & Engagement Gifting (Anniversaries, Birthdays, Festivals) Self?purchase & Investment Corporate & VIP Gifting Others |

| By Geography | Philippines – Metro Manila Philippines – Other Key Cities Poland – Warsaw Poland – Other Tier?1 & Tier?2 Cities Tourist & Duty?Free Hubs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Jewelry Retailers in the Philippines | 90 | Store Managers, Brand Owners |

| Affluent Consumers in Poland | 140 | High Net-Worth Individuals, Luxury Shoppers |

| Jewelry Designers and Artisans | 75 | Independent Designers, Workshop Owners |

| Luxury Goods Distributors | 65 | Distribution Managers, Supply Chain Executives |

| Market Analysts and Industry Experts | 45 | Market Researchers, Economic Analysts |

The Philippines Poland Luxury Jewelry Market is valued at approximately USD 1.3 billion, combining the luxury jewelry segments of both countries. The Philippines jewelry market alone is valued at around USD 7.3 billion, with luxury jewelry representing a smaller premium share.