Region:Global

Author(s):Shubham

Product Code:KRAC5244

Pages:80

Published On:January 2026

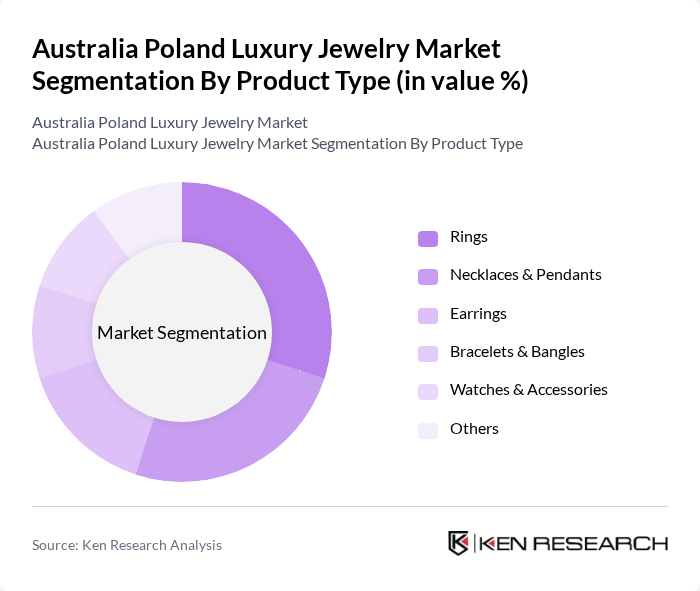

By Product Type:The product type segmentation includes various categories such as rings, necklaces & pendants, earrings, bracelets & bangles, watches & accessories, and others. Rings and necklaces remain core revenue contributors in fine and luxury jewelry due to their central role in engagements, weddings, and gifting, as well as their fashion relevance. The trend towards customization, including bespoke engagement rings, stackable bands, and personalized pendants, together with growing interest in bridal and occasion-led purchases, has led to increased demand in these segments, particularly among younger consumers seeking unique designs.

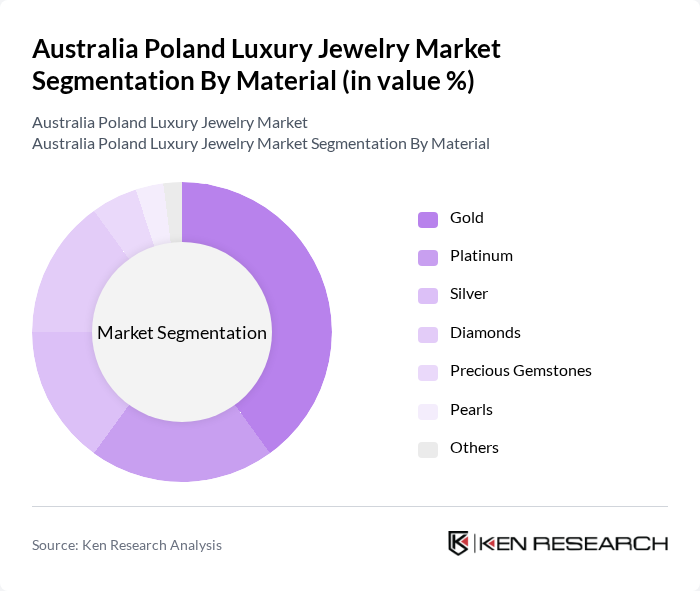

By Material:The material segmentation encompasses gold, platinum, silver, diamonds, precious gemstones, pearls, and others. Gold remains the most sought-after material in both fine and luxury jewelry because of its role in investment?oriented pieces, bridal jewelry, and timeless designs, while diamond jewelry is gaining share as consumers trade up to higher-quality stones and branded settings. The increasing popularity of ethical sourcing and sustainability, including recycled precious metals and lab?grown or ethically certified diamonds, has led to a rise in demand for responsibly sourced materials and traceable supply chains, particularly among younger, digitally engaged luxury consumers.

The Australia Poland Luxury Jewelry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Paspaley, Michael Hill International, Pandora, Tiffany & Co., Bulgari, Cartier, Chopard, Graff, Harry Winston, Van Cleef & Arpels, Boucheron, Swarovski, Apart (Poland), W.Kruk, Local Independent Luxury Maisons (Australia & Poland) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the luxury jewelry market in Australia and Poland appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands that adopt ethical sourcing and eco-friendly practices are likely to attract a loyal customer base. Additionally, the integration of augmented reality in online shopping experiences is expected to enhance consumer engagement, making luxury jewelry more accessible and appealing. These trends will shape the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Rings Necklaces & Pendants Earrings Bracelets & Bangles Watches & Accessories Others |

| By Material | Gold Platinum Silver Diamonds Precious Gemstones Pearls Others |

| By Collection / Design | Bridal & Wedding Jewelry High Jewelry (Haute Joaillerie) Everyday Luxury / Contemporary Classics Limited Edition & Collaboration Lines Heritage & Vintage-Inspired Collections |

| By End User | Women Men Unisex Children & Young Adults |

| By Distribution Channel | Mono-brand Luxury Boutiques Multi-brand Jewelry Retailers Department & Duty-Free Stores Online Brand Stores (D2C) E-commerce Marketplaces Travel Retail and Others |

| By Price Band | Entry Luxury (Accessible Luxury) Core Luxury Ultra-High-End / High Jewelry |

| By Occasion / Usage | Engagement & Wedding Festive & Cultural Events Gifting (Personal & Corporate) Self-purchase / Investment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Jewelry Retailers in Australia | 100 | Store Managers, Brand Representatives |

| High-Net-Worth Individuals in Poland | 90 | Affluent Consumers, Jewelry Collectors |

| Jewelry Designers and Artisans | 60 | Independent Designers, Workshop Owners |

| Luxury E-commerce Platforms | 70 | eCommerce Managers, Digital Marketing Specialists |

| Market Analysts and Industry Experts | 50 | Market Researchers, Economic Analysts |

The Australia Poland Luxury Jewelry Market is valued at approximately USD 3.1 billion, reflecting the combined contributions from Australias fine jewelry segment and Polands luxury jewelry revenues, driven by increasing disposable incomes and a rising trend in luxury spending.