Region:Europe

Author(s):Shubham

Product Code:KRAC5242

Pages:95

Published On:January 2026

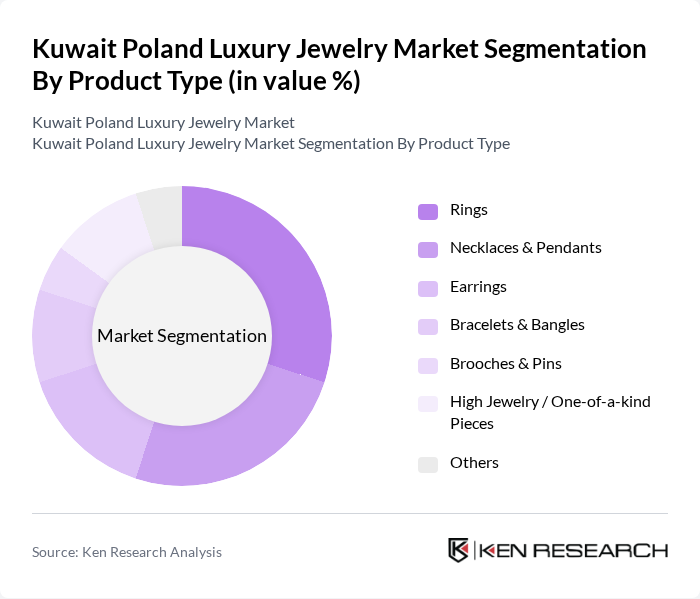

By Product Type:The product type segmentation includes various categories such as rings, necklaces & pendants, earrings, bracelets & bangles, brooches & pins, high jewelry/one-of-a-kind pieces, and others. Rings and necklaces remain key categories in global and European luxury jewelry markets, reflecting their versatility, symbolic value, and prominence in engagements, weddings, and gifting occasions. Earrings and bracelets are also increasingly favored as fashion-driven purchases, especially among younger and urban consumers who follow influencer and social media trends. The demand for high jewelry and one-of-a-kind pieces has surged among affluent clients and high-net-worth individuals, driven by a preference for exclusivity, investment-grade gemstones, and bespoke craftsmanship, often supported by private appointments and personalized design services.

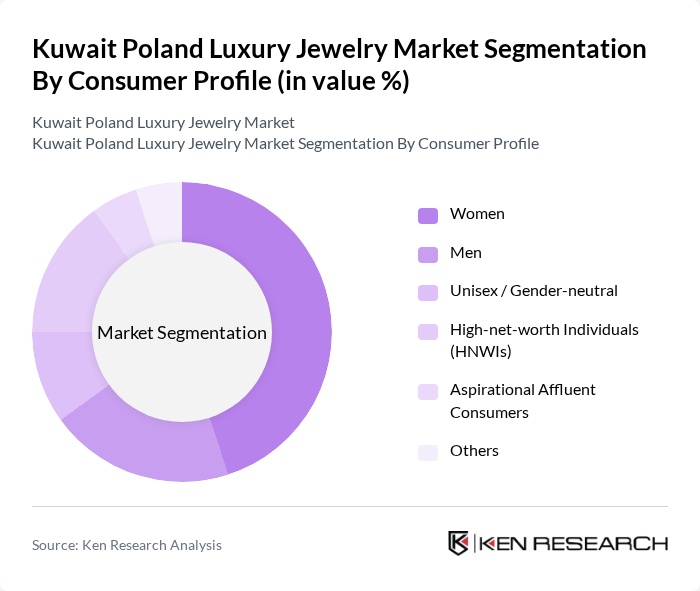

By Consumer Profile:The consumer profile segmentation includes women, men, unisex/gender-neutral, high-net-worth individuals (HNWIs), aspirational affluent consumers, and others. Women represent the largest segment, consistent with broader luxury jewelry markets where female consumers drive a substantial share of demand for both self-purchase and gifting. Men are an important and growing segment, particularly in categories such as watches, rings, bracelets, and cufflinks, supported by rising interest in personal grooming and status-driven accessories. Unisex and gender-neutral designs are gaining traction among younger demographics seeking contemporary, minimalist, and inclusive styles. High-net-worth individuals play a crucial role in the market as they seek exclusive, bespoke, and investment-oriented pieces, while aspirational affluent consumers increasingly trade up to branded luxury jewelry, often influenced by celebrities, social media, and global fashion trends.

The Kuwait Poland Luxury Jewelry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cartier, Tiffany & Co., Bvlgari, Chopard, Van Cleef & Arpels, Harry Winston, Piaget, Graff, Mikimoto, Buccellati, Damas Jewellery, L'azurde, Malabar Gold & Diamonds, Tanishq, and selected local and regional luxury jewelry houses in Kuwait and Poland contribute to innovation, geographic expansion, and service delivery in this space.

The luxury jewelry market in Kuwait and Poland is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are expected to adopt ethical sourcing practices, appealing to environmentally conscious consumers. Furthermore, the integration of augmented reality in online shopping experiences will enhance customer engagement, allowing for virtual try-ons. These trends indicate a dynamic market landscape that will require adaptability and innovation from luxury jewelry brands to thrive in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Rings Necklaces & Pendants Earrings Bracelets & Bangles Brooches & Pins High Jewelry / One-of-a-kind Pieces Others |

| By Consumer Profile | Women Men Unisex / Gender-neutral High-net-worth Individuals (HNWIs) Aspirational Affluent Consumers Others |

| By Purchase Occasion | Weddings & Engagements Religious & Cultural Events Gifting (Birthdays, Anniversaries, Festivals) Self-purchase & Investment Corporate & VIP Gifting Others |

| By Material & Stone | Gold (18K, 21K, 22K, 24K) Platinum & Palladium Diamonds (Natural) Lab-grown Diamonds Colored Gemstones & Precious Pearls Mixed Materials & Innovative Alloys Others |

| By Distribution Channel | Branded Monobrand Boutiques Multi-brand Luxury Retailers Department Stores & Duty-free Online Brand Store & E-commerce Marketplaces Travel Retail & Airport Stores Others |

| By Price Band | Accessible Luxury (Entry-level) Core Luxury High Luxury Ultra-high / High Jewelry Bespoke & Custom-made Others |

| By Brand Origin | Global Heritage Maisons Regional / GCC Brands Polish & European Designer Brands Local Independent Designers & Atelier Houses Private-label & Retailer Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Jewelry Retailers in Kuwait | 80 | Store Managers, Sales Executives |

| Affluent Consumers in Poland | 120 | High Net Worth Individuals, Luxury Shoppers |

| Jewelry Designers and Artisans | 60 | Independent Designers, Workshop Owners |

| Market Analysts and Experts | 40 | Industry Analysts, Market Researchers |

| Luxury Brand Representatives | 70 | Brand Managers, Marketing Directors |

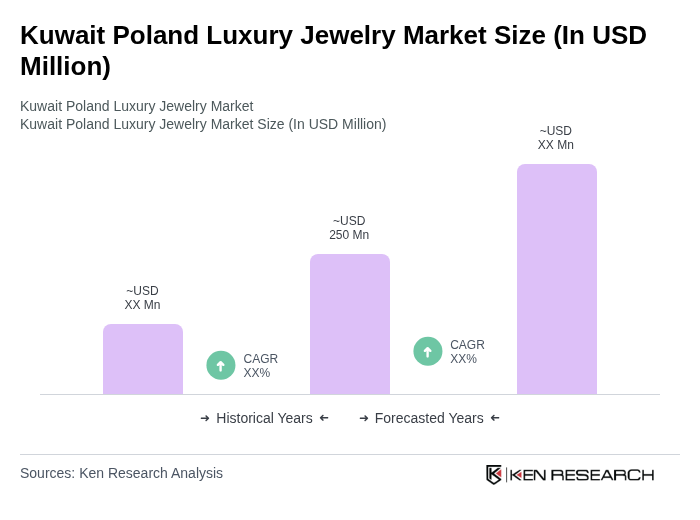

The Kuwait Poland Luxury Jewelry Market is valued at approximately USD 250 million, driven by increasing disposable incomes and a growing preference for luxury goods among consumers in both countries.