Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB5745

Pages:92

Published On:October 2025

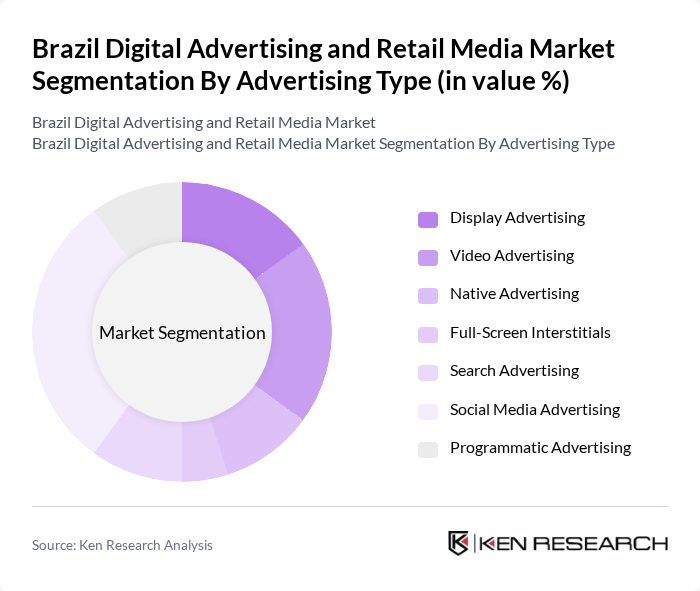

By Advertising Type:The advertising type segmentation includes various forms of digital advertising that cater to different marketing strategies and consumer engagement methods. The subsegments include Display Advertising, Video Advertising, Native Advertising, Full-Screen Interstitials, Search Advertising, Social Media Advertising, and Programmatic Advertising. Among these,Social Media Advertisinghas emerged as a dominant force due to the widespread use of platforms like Facebook, Instagram, and TikTok, which allow for targeted advertising and high engagement rates. Video advertising is also a key growth driver, reflecting the popularity of streaming and short-form video content among Brazilian consumers .

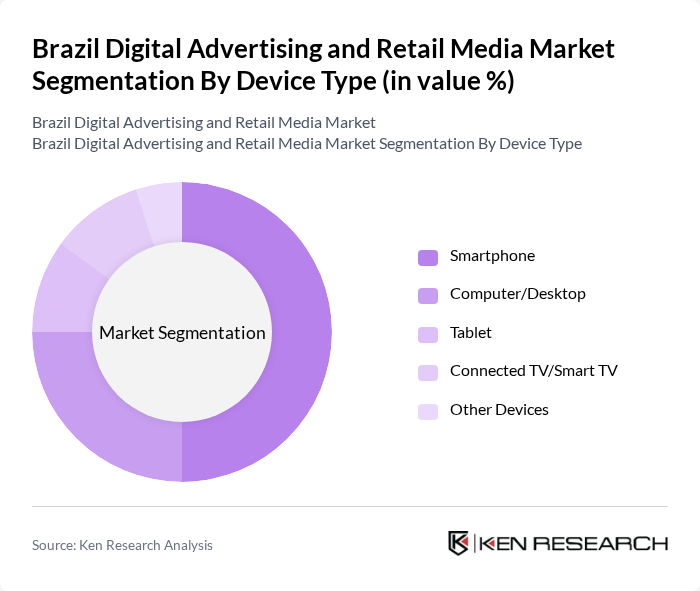

By Device Type:The device type segmentation encompasses the various platforms through which digital advertising is delivered. This includes Smartphones, Computers/Desktop, Tablets, Connected TVs/Smart TVs, and Other Devices.Smartphoneshave become the leading device for digital advertising due to their ubiquitous presence and the increasing amount of time consumers spend on mobile applications and social media, making them a key focus for advertisers. The growth of mobile-first strategies and the expansion of high-speed internet access have further reinforced this trend .

The Brazil Digital Advertising and Retail Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Meta Platforms Inc (Facebook/Instagram Brasil), Alphabet Inc (Google Brasil), Amazon.com Inc (Amazon Brasil), Microsoft Corp (Microsoft Brasil), ByteDance (TikTok Brasil), Rede Globo, MercadoLibre Inc (Mercado Livre), Magazine Luiza S.A., Via S.A. (Via Varejo), iFood, UOL (Universo Online), Adobe Inc, Verizon Communications Inc (AOL), Tencent Holdings Ltd, Dentsu Aegis Network contribute to innovation, geographic expansion, and service delivery in this space.

The Brazil digital advertising and retail media market is poised for significant evolution, driven by technological advancements and changing consumer preferences. The integration of artificial intelligence in advertising strategies is expected to enhance targeting and personalization, improving campaign effectiveness. Additionally, the rise of omnichannel marketing strategies will enable brands to engage consumers across multiple platforms, fostering deeper connections and driving sales. As these trends unfold, the market will likely see increased investment and innovation, positioning Brazil as a leader in the digital advertising space.

| Segment | Sub-Segments |

|---|---|

| By Advertising Type | Display Advertising Video Advertising Native Advertising Full-Screen Interstitials Search Advertising Social Media Advertising Programmatic Advertising |

| By Device Type | Smartphone Computer/Desktop Tablet Connected TV/Smart TV Other Devices |

| By End-User Industry | Retail & E-commerce Financial Services Automotive Consumer Electronics Travel and Tourism Healthcare & Pharmaceuticals Food & Beverage |

| By Platform | Social Media Platforms Search Engines E-commerce Marketplaces Mobile Applications Streaming Platforms Publisher Websites |

| By Buying Method | Programmatic Buying Direct Buying Real-Time Bidding (RTB) Private Marketplace (PMP) |

| By Campaign Objective | Brand Awareness Lead Generation Sales Conversion Customer Retention App Installs |

| By Audience Targeting | Demographic Targeting Behavioral Targeting Contextual Targeting Geolocation Targeting Retargeting/Remarketing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Advertising Agencies | 85 | Account Managers, Media Planners |

| Retail Brands Utilizing Digital Media | 75 | Marketing Directors, Brand Managers |

| Consumers Engaged with Retail Media | 120 | Online Shoppers, Social Media Users |

| Market Analysts and Consultants | 55 | Industry Analysts, Market Researchers |

| Technology Providers in Advertising | 65 | Product Managers, Sales Executives |

The Brazil Digital Advertising and Retail Media Market is valued at approximately USD 14.2 billion, driven by increased internet penetration, mobile device usage, and a shift towards online shopping and digital content consumption.