Canada Luxury Fashion & Lifestyle Market Overview

- The Canada Luxury Fashion & Lifestyle Market is valued at USD 15 billion, based on a five-year historical analysis. This growth is primarily driven by increasing disposable incomes, a growing affluent population, and a rising demand for high-quality, exclusive products. The market has seen a significant shift towards online shopping, with consumers increasingly seeking luxury goods that reflect their personal style and status.

- Key cities such as Toronto, Vancouver, and Montreal dominate the luxury fashion market due to their vibrant economies, diverse populations, and status as cultural hubs. These cities attract both local and international luxury brands, making them prime locations for high-end retail. The presence of affluent consumers and a strong tourism sector further bolster the market in these regions.

- In 2023, the Canadian government implemented regulations aimed at promoting sustainable fashion practices. This includes a mandate for luxury brands to disclose their environmental impact and adopt eco-friendly materials in their production processes. The initiative is designed to encourage responsible consumption and reduce the fashion industry's carbon footprint, aligning with global sustainability goals.

Canada Luxury Fashion & Lifestyle Market Segmentation

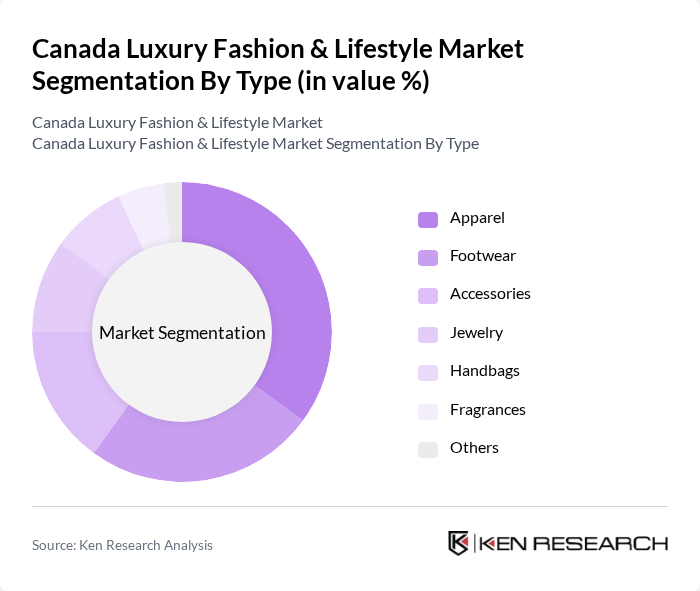

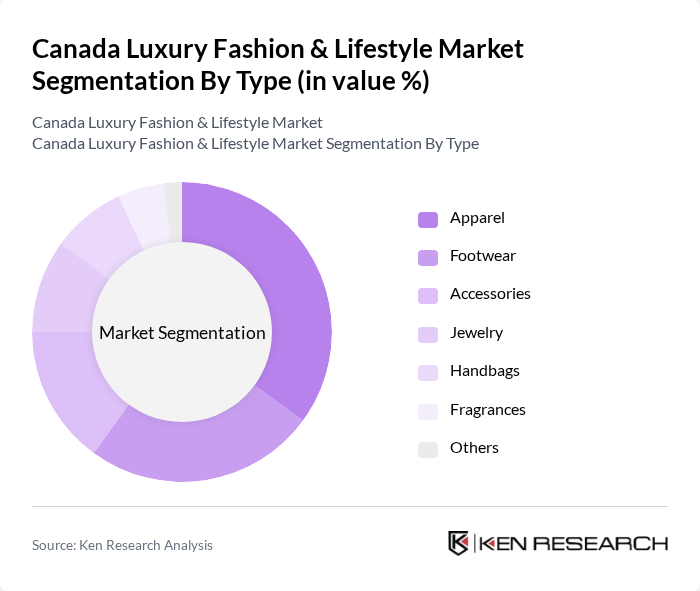

By Type:The luxury fashion market is segmented into various types, including apparel, footwear, accessories, jewelry, handbags, fragrances, and others. Among these, apparel is the leading segment, driven by consumer preferences for high-quality clothing and the influence of fashion trends. Footwear and handbags also hold significant market shares, as consumers increasingly invest in luxury items that enhance their personal style and status. The demand for accessories and fragrances is growing, reflecting a broader trend towards complete luxury lifestyle experiences.

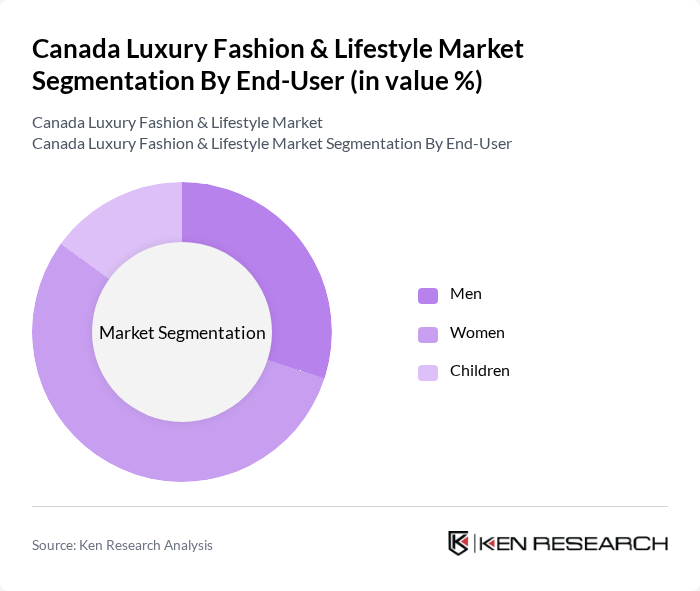

By End-User:The luxury fashion market is segmented by end-user into men, women, and children. The women’s segment dominates the market, driven by a higher propensity to spend on luxury fashion and a wider range of product offerings. Men’s luxury fashion is also growing, particularly in categories like apparel and accessories, as male consumers increasingly seek high-quality and stylish options. The children’s segment, while smaller, is gaining traction as parents invest in luxury items for their children.

Canada Luxury Fashion & Lifestyle Market Competitive Landscape

The Canada Luxury Fashion & Lifestyle Market is characterized by a dynamic mix of regional and international players. Leading participants such as LVMH Moët Hennessy Louis Vuitton, Kering S.A., Chanel S.A., Gucci, Prada S.p.A., Hermès International S.A., Burberry Group plc, Ralph Lauren Corporation, Dolce & Gabbana, Versace, Tory Burch LLC, Michael Kors Holdings Limited, Moncler S.p.A., Coach, Inc., Valentino S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

Canada Luxury Fashion & Lifestyle Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The average disposable income in Canada is projected to reach CAD 48,000 per capita in future, reflecting a 4% increase from the previous year. This rise in disposable income enables consumers to allocate more funds towards luxury fashion and lifestyle products. As a result, the luxury market is expected to benefit significantly, with affluent consumers increasingly willing to invest in high-quality, premium brands that align with their lifestyle aspirations.

- Rising Demand for Sustainable Fashion:In future, the Canadian sustainable fashion market is anticipated to grow to CAD 2.8 billion, driven by a 17% increase in consumer interest in eco-friendly products. This shift is largely influenced by heightened awareness of environmental issues and a desire for ethical consumption. Luxury brands that prioritize sustainability in their production processes are likely to attract a growing segment of environmentally conscious consumers, enhancing their market position.

- Growth of E-commerce Platforms:E-commerce sales in Canada are projected to reach CAD 55 billion in future, with luxury fashion accounting for a significant portion of this growth. The convenience of online shopping, coupled with enhanced digital marketing strategies, has led to a surge in online luxury purchases. As more consumers turn to e-commerce for their luxury needs, brands that invest in robust online platforms and user-friendly experiences will likely see substantial revenue increases.

Market Challenges

- Economic Uncertainty:The Canadian economy is expected to face challenges in future, with GDP growth projected at only 1.8%. This economic slowdown may lead to reduced consumer spending on luxury items, as individuals prioritize essential goods over discretionary purchases. Economic uncertainty can dampen consumer confidence, making it crucial for luxury brands to adapt their strategies to maintain sales and customer loyalty during turbulent times.

- Intense Competition:The Canadian luxury fashion market is characterized by fierce competition, with over 220 established brands vying for market share. This saturation can lead to price wars and reduced profit margins, as brands strive to differentiate themselves. In future, companies must focus on unique value propositions and innovative marketing strategies to stand out in a crowded marketplace, ensuring they capture the attention of discerning consumers.

Canada Luxury Fashion & Lifestyle Market Future Outlook

The future of the Canada luxury fashion and lifestyle market appears promising, driven by evolving consumer preferences and technological advancements. As digital experiences become increasingly important, brands are expected to invest in immersive online platforms and personalized shopping experiences. Additionally, the focus on sustainability will continue to shape product offerings, with consumers favoring brands that demonstrate ethical practices. Overall, the market is poised for growth, adapting to the changing landscape of consumer expectations and technological innovations.

Market Opportunities

- Expansion into Emerging Markets:Canadian luxury brands have the opportunity to expand into emerging markets, particularly in Asia, where the middle class is projected to grow by 1.5 billion people in future. This demographic shift presents a significant opportunity for luxury brands to tap into new consumer bases, driving sales and brand recognition in previously untapped regions.

- Collaborations with Local Designers:Collaborating with local designers can enhance brand authenticity and appeal to Canadian consumers. In future, partnerships that emphasize local craftsmanship and cultural heritage are expected to resonate well, potentially increasing brand loyalty and market share. Such collaborations can also attract attention from consumers seeking unique, culturally relevant luxury products.