Region:Africa

Author(s):Shubham

Product Code:KRAB6606

Pages:83

Published On:October 2025

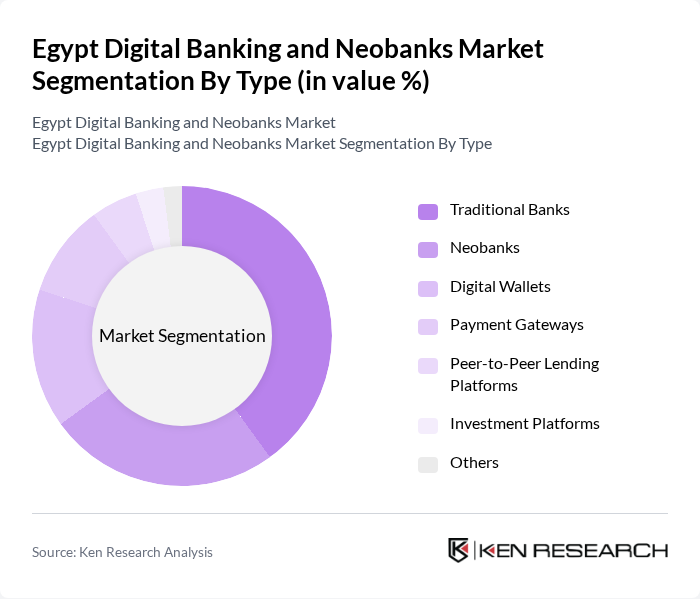

By Type:The market is segmented into various types, including Traditional Banks, Neobanks, Digital Wallets, Payment Gateways, Peer-to-Peer Lending Platforms, Investment Platforms, and Others. Each of these segments plays a crucial role in shaping the digital banking landscape in Egypt.

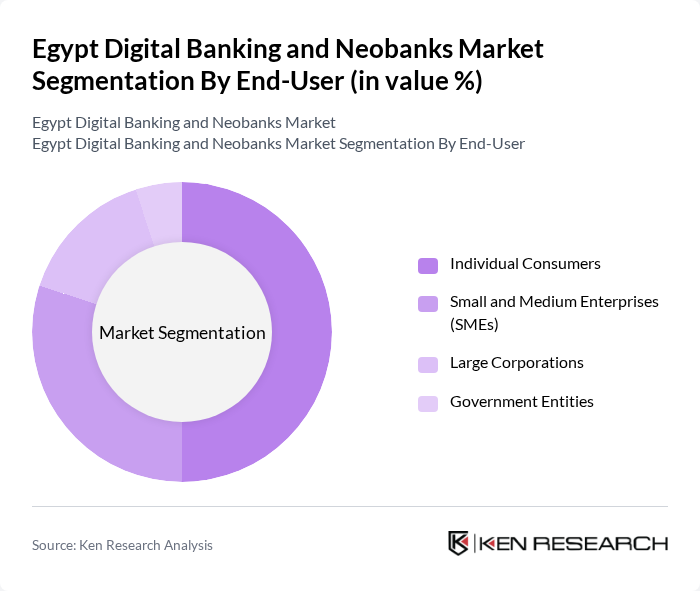

By End-User:The market is segmented by end-users, including Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Each segment has unique needs and preferences that influence their engagement with digital banking services.

The Egypt Digital Banking and Neobanks Market is characterized by a dynamic mix of regional and international players. Leading participants such as CIB (Commercial International Bank), Fawry, NBE (National Bank of Egypt), Banque Misr, QNB Alahli, EFG Hermes, Paymob, N26, Revolut, Orange Money, Vodafone Cash, Al Ahly Bank, Arab African International Bank, and Abu Dhabi Islamic Bank contribute to innovation, geographic expansion, and service delivery in this space.

The future of Egypt's digital banking and neobanks market appears promising, driven by technological advancements and evolving consumer preferences. As mobile banking solutions gain traction, financial institutions are likely to enhance their digital offerings, focusing on user experience and accessibility. Additionally, the integration of artificial intelligence and blockchain technology is expected to streamline operations and improve security. With ongoing government support for financial inclusion, the market is poised for significant growth, attracting both local and international players seeking to capitalize on emerging opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Banks Neobanks Digital Wallets Payment Gateways Peer-to-Peer Lending Platforms Investment Platforms Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Service Offered | Savings Accounts Loans and Credit Investment Services Insurance Products |

| By Customer Segment | Retail Customers Corporate Clients High Net-Worth Individuals |

| By Distribution Channel | Online Platforms Mobile Applications Physical Branches |

| By Payment Method | Credit/Debit Cards Bank Transfers Mobile Payments |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Customers | 150 | Individual Account Holders, Retail Banking Managers |

| Neobank Users | 100 | Digital Banking Customers, Product Managers |

| Fintech Industry Experts | 50 | Consultants, Industry Analysts |

| Regulatory Bodies | 30 | Policy Makers, Compliance Officers |

| Small Business Owners | 70 | Entrepreneurs, Financial Managers |

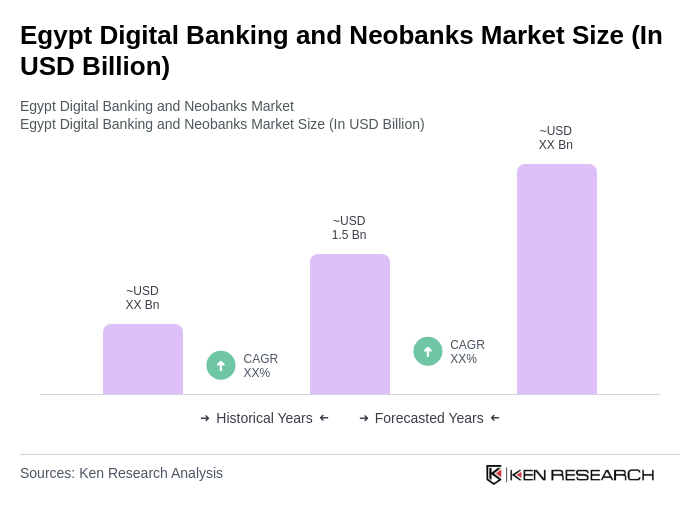

The Egypt Digital Banking and Neobanks Market is valued at approximately USD 1.5 billion, driven by the increasing adoption of digital financial services, smartphone penetration, and a young population favoring online banking solutions.