Region:Europe

Author(s):Rebecca

Product Code:KRAB4050

Pages:82

Published On:October 2025

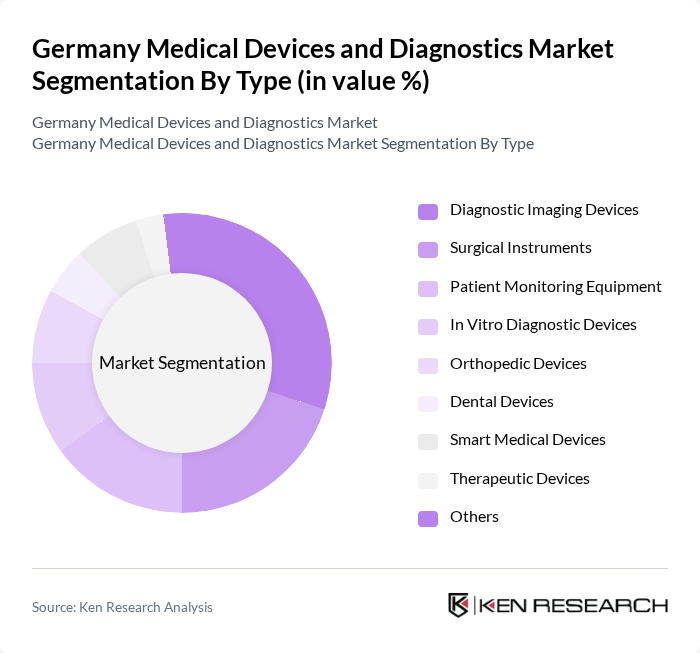

By Type:The market is segmented into various types of medical devices and diagnostics, including diagnostic imaging devices, surgical instruments, patient monitoring equipment, in vitro diagnostic devices, orthopedic devices, dental devices, smart medical devices, therapeutic devices, and others. Among these, diagnostic imaging devices are leading the market due to their critical role in early disease detection and management. The increasing demand for non-invasive diagnostic procedures and technological advancements in imaging modalities are driving this segment's growth.

By End-User:The end-user segmentation includes hospitals, diagnostic laboratories, home healthcare settings, ambulatory surgical centers, rehabilitation centers, and others. Hospitals are the dominant end-user segment, driven by the increasing number of surgical procedures and the need for advanced diagnostic tools. The growing trend of hospital consolidation and the expansion of healthcare facilities further contribute to the demand for medical devices in this segment.

The Germany Medical Devices and Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers AG, Roche Diagnostics GmbH, B. Braun Melsungen AG, Drägerwerk AG & Co. KGaA, Philips Medizin Systeme Böblingen GmbH, GE Healthcare Deutschland, Medtronic GmbH, Abbott Laboratories GmbH, Stryker GmbH & Co. KG, Johnson & Johnson Medical GmbH, Boston Scientific Medizintechnik GmbH, Terumo Deutschland GmbH, Olympus Europa SE & Co. KG, Canon Medical Systems GmbH, Hologic Deutschland GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Germany medical devices and diagnostics market appears promising, driven by ongoing technological advancements and an increasing focus on patient-centric solutions. As the healthcare landscape evolves, the integration of artificial intelligence and telemedicine is expected to reshape service delivery. Additionally, the emphasis on personalized medicine will likely lead to the development of tailored therapies and diagnostics, enhancing treatment efficacy and patient satisfaction in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Imaging Devices Surgical Instruments Patient Monitoring Equipment In Vitro Diagnostic Devices Orthopedic Devices Dental Devices Smart Medical Devices Therapeutic Devices Others |

| By End-User | Hospitals Diagnostic Laboratories Home Healthcare Settings Ambulatory Surgical Centers Rehabilitation Centers Others |

| By Application | Cardiovascular Applications Neurology Applications Orthopedic Applications Respiratory Applications Diabetes Management Oncology Applications Infectious Disease Diagnostics Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Pharmacies Others |

| By Region | North Germany South Germany East Germany West Germany Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Technology | Digital Health Technologies Wearable Devices Telehealth Solutions Robotics in Surgery AI-Enabled Diagnostic Tools Lab Automation Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Diagnostic Imaging Devices | 120 | Radiologists, Imaging Technologists |

| Surgical Instruments | 110 | Surgeons, Operating Room Managers |

| Patient Monitoring Systems | 100 | Nurses, Clinical Engineers |

| Wearable Medical Devices | 90 | Product Managers, Health Tech Innovators |

| Regulatory Compliance in Medical Devices | 80 | Quality Assurance Managers, Regulatory Affairs Specialists |

The Germany Medical Devices and Diagnostics Market is valued at approximately USD 766 billion, driven by factors such as an aging population, increasing chronic diseases, and technological advancements in healthcare.