Region:Europe

Author(s):Shubham

Product Code:KRAB1237

Pages:97

Published On:October 2025

By Type:The online advertising market is segmented into Display Advertising, Search Engine Marketing, Social Media Advertising, Video Advertising, Affiliate Marketing, Email Marketing, Native Advertising, Full-Screen Interstitials, and Others. Among these, Video Advertising has emerged as the leading segment, reflecting the growing consumption of digital video content and the effectiveness of video formats in driving engagement. Display Advertising and Social Media Advertising also remain prominent, supported by the increasing use of mobile devices and the integration of interactive ad formats .

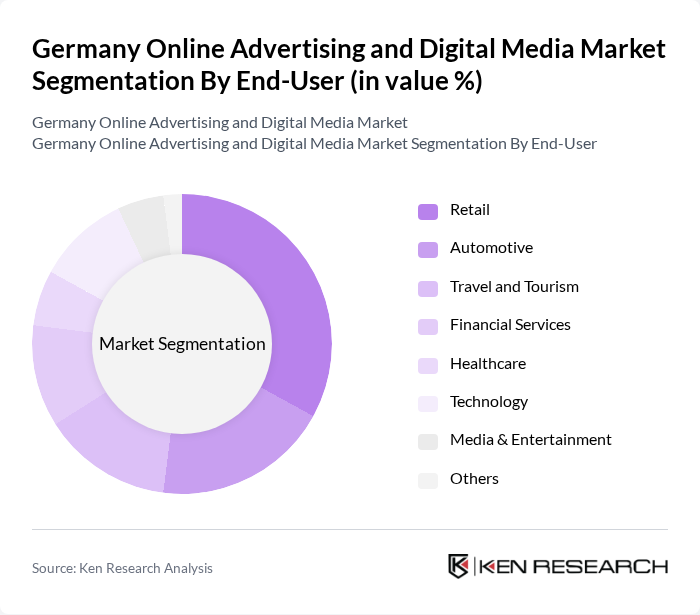

By End-User:The end-user segmentation includes Retail, Automotive, Travel and Tourism, Financial Services, Healthcare, Technology, Media & Entertainment, and Others. The Retail sector remains the largest contributor, driven by the continued rise of e-commerce and the need for personalized digital outreach. Automotive and Technology sectors also represent significant shares, leveraging digital campaigns to engage consumers and promote innovation .

The Germany Online Advertising and Digital Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google Germany GmbH, Meta Platforms Ireland Limited (Germany Branch), Amazon Deutschland Services GmbH (Amazon Advertising), Ströer SE & Co. KGaA, United Internet Media GmbH, Axel Springer SE (Media Impact), Seven.One Media GmbH (ProSiebenSat.1 Group), Ad Alliance GmbH (RTL Group), Criteo S.A., Adform A/S, Outbrain Inc., Taboola Inc., Xandr (Microsoft Advertising), TikTok Germany GmbH, Snap Germany GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online advertising and digital media market in Germany appears promising, driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt data-driven marketing strategies, the integration of artificial intelligence and machine learning will enhance targeting capabilities. Additionally, the growing emphasis on sustainability in advertising practices will shape brand strategies, aligning with consumer values. These trends indicate a dynamic market landscape, where adaptability and innovation will be crucial for success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Engine Marketing Social Media Advertising Video Advertising Affiliate Marketing Email Marketing Native Advertising Full-Screen Interstitials Others |

| By End-User | Retail Automotive Travel and Tourism Financial Services Healthcare Technology Media & Entertainment Others |

| By Platform | Mobile Platforms Desktop Platforms Social Media Platforms Video Streaming Platforms Connected TV (CTV) Others |

| By Advertising Format | Native Advertising Banner Ads Sponsored Content Retargeting Ads Full-Screen Interstitials Video Ads Others |

| By Consumer Demographics | Age Group Gender Income Level Geographic Location Others |

| By Campaign Objective | Brand Awareness Lead Generation Customer Engagement Sales Conversion App Installs Others |

| By Investment Source | Direct Investment Venture Capital Government Grants Private Equity Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Advertising Agencies | 60 | Agency Owners, Account Managers |

| Brand Marketing Departments | 50 | Marketing Directors, Brand Managers |

| Media Buying Firms | 40 | Media Buyers, Campaign Strategists |

| Consumer Insights and Analytics | 40 | Data Analysts, Market Researchers |

| Regulatory Bodies and Industry Associations | 40 | Policy Makers, Industry Advocates |

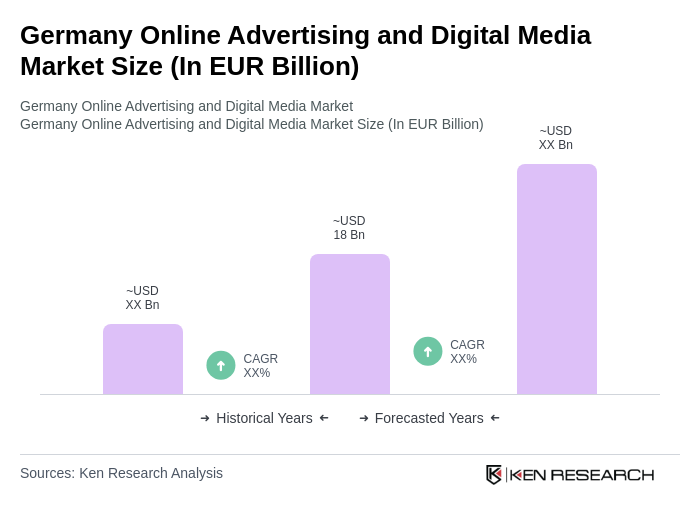

The Germany Online Advertising and Digital Media Market is valued at approximately EUR 18 billion, driven by the growth of e-commerce, advancements in 5G infrastructure, and the increasing use of targeted advertising strategies by businesses.