Region:Global

Author(s):Geetanshi

Product Code:KRAA2774

Pages:97

Published On:August 2025

Market.png)

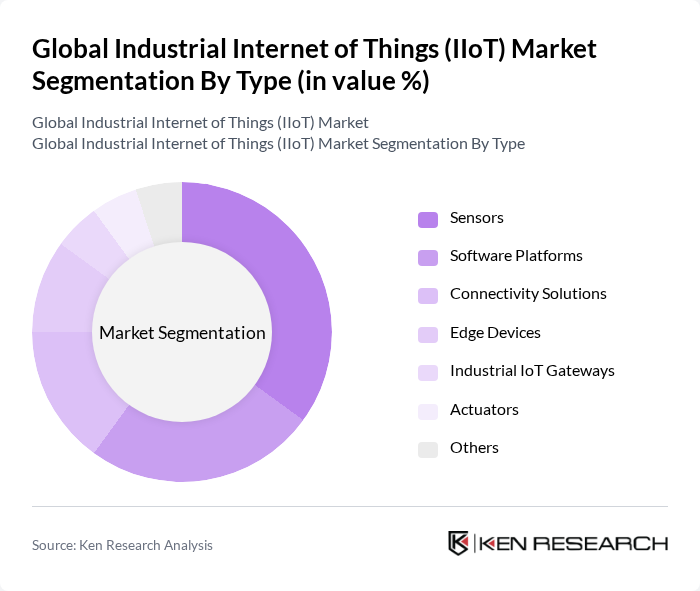

By Type:The IIoT market is segmented into various types, including sensors, software platforms, connectivity solutions, edge devices, industrial IoT gateways, actuators, and others. Among these, sensors are the most dominant sub-segment, driven by the increasing need for data collection and monitoring in industrial applications. The demand for advanced sensors that can provide real-time data is growing, as industries seek to enhance operational efficiency and predictive maintenance capabilities.

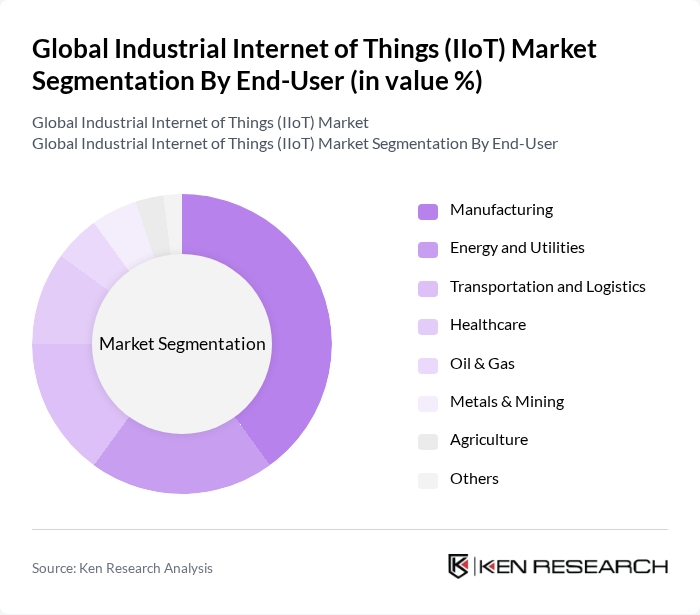

By End-User:The end-user segmentation includes manufacturing, energy and utilities, transportation and logistics, healthcare, oil & gas, metals & mining, agriculture, and others. The manufacturing sector is the leading end-user, as industries increasingly adopt IIoT solutions to optimize production processes, reduce downtime, and enhance supply chain management. The push for smart factories and automation is driving significant investments in IIoT technologies within this sector.

The Global Industrial Internet of Things (IIoT) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, General Electric Company, Honeywell International Inc., Cisco Systems, Inc., IBM Corporation, Rockwell Automation, Inc., PTC Inc., Schneider Electric SE, ABB Ltd., Microsoft Corporation, Oracle Corporation, SAP SE, Bosch Rexroth AG, Emerson Electric Co., Telit Communications PLC, Intel Corporation, Huawei Technologies Co., Ltd., KUKA AG, Texas Instruments Incorporated, Dassault Systèmes SE, Arm Limited, NEC Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the IIoT market appears promising, driven by technological advancements and increasing integration of smart technologies across industries. The proliferation of 5G technology is expected to enhance connectivity, enabling faster data transmission and improved operational capabilities. Furthermore, the shift towards predictive maintenance will likely reduce downtime and operational costs, while the focus on sustainability will drive innovations in energy-efficient solutions, positioning IIoT as a cornerstone of modern industrial practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Sensors Software Platforms Connectivity Solutions Edge Devices Industrial IoT Gateways Actuators Others |

| By End-User | Manufacturing Energy and Utilities Transportation and Logistics Healthcare Oil & Gas Metals & Mining Agriculture Others |

| By Application | Predictive Maintenance Asset Tracking Supply Chain Management Remote Monitoring Smart Manufacturing Process Optimization Quality Control Others |

| By Component | Hardware Software Services |

| By Deployment Mode | On-Premise Cloud-Based |

| By Connectivity Technology | Wired Wireless (5G, Wi-Fi, LPWAN, etc.) |

| By Industry Vertical | Automotive Aerospace Food and Beverage Pharmaceuticals Retail Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector IIoT Adoption | 120 | Plant Managers, Operations Directors |

| Energy Sector Smart Grid Implementation | 60 | Energy Analysts, IT Managers |

| Logistics and Supply Chain Optimization | 50 | Supply Chain Managers, Logistics Coordinators |

| Predictive Maintenance Solutions | 40 | Maintenance Engineers, Technical Directors |

| Smart Manufacturing Technologies | 70 | Product Development Managers, R&D Heads |

The Global Industrial Internet of Things (IIoT) Market is valued at approximately USD 483 billion, reflecting significant growth driven by the adoption of smart manufacturing technologies and the demand for real-time data analytics across various industries.