Region:Middle East

Author(s):Shubham

Product Code:KRAD0885

Pages:83

Published On:November 2025

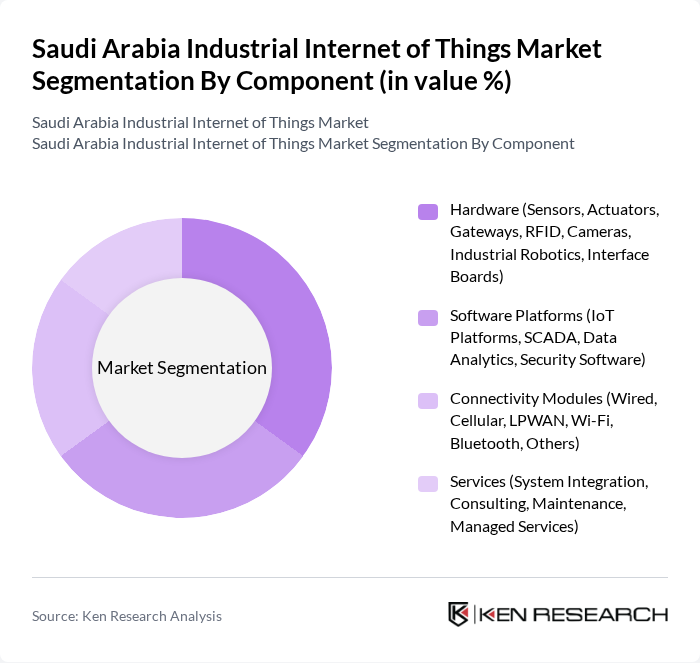

By Component:

The hardware segment, which includes sensors, actuators, and industrial robotics, is currently dominating the market due to the increasing demand for automation and real-time data collection in various industries. The proliferation of smart devices, the expansion of 5G networks, and the need for enhanced operational efficiency are driving investments in hardware components. Additionally, the growing trend of predictive maintenance, asset management, and the integration of AI-powered edge devices is further propelling the demand for advanced hardware solutions, making it a critical area for market growth .

In the end-use industry segmentation, manufacturing is the leading sector, driven by the need for automation and efficiency improvements. The adoption of IoT technologies in manufacturing processes enhances productivity, reduces downtime, and optimizes resource management. The oil and gas sector follows closely, leveraging IoT for monitoring and predictive maintenance to ensure safety and operational efficiency. The increasing focus on smart energy solutions, logistics, and the integration of digital technologies in utilities and transportation further supports the growth of IoT applications across these industries .

The Saudi Arabia Industrial Internet of Things market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens, Schneider Electric, Honeywell, Cisco Systems, IBM, GE Digital, PTC, Microsoft, Oracle, SAP, Rockwell Automation, Dell Technologies, Ericsson, Nokia, Accenture, Saudi Telecom Company (STC), Huawei Technologies Co., Ltd., Intel Corporation, Zain KSA, Aramco Digital contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Industrial Internet of Things (IIoT) market in Saudi Arabia appears promising, driven by ongoing government support and technological advancements. As the nation continues to invest in smart city initiatives and digital transformation, the integration of IoT solutions is expected to enhance operational efficiency across various sectors. Furthermore, the expansion of 5G networks will facilitate real-time data processing, enabling industries to leverage advanced analytics and AI, ultimately fostering innovation and growth in the IIoT landscape.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware (Sensors, Actuators, Gateways, RFID, Cameras, Industrial Robotics, Interface Boards) Software Platforms (IoT Platforms, SCADA, Data Analytics, Security Software) Connectivity Modules (Wired, Cellular, LPWAN, Wi-Fi, Bluetooth, Others) Services (System Integration, Consulting, Maintenance, Managed Services) |

| By End-Use Industry | Manufacturing Oil & Gas Energy & Utilities Transportation & Logistics Healthcare Mining Agriculture Others |

| By Application | Predictive Maintenance Asset Tracking & Management Remote Monitoring Smart Metering SCADA Condition Monitoring Yield Monitoring Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Connectivity Technology | Wired Wireless (Cellular, LPWAN, Wi-Fi, Bluetooth, Others) |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas IIoT Applications | 100 | Operations Managers, IT Directors |

| Manufacturing Automation Solutions | 90 | Plant Managers, Process Engineers |

| Logistics and Supply Chain Optimization | 80 | Supply Chain Managers, Logistics Coordinators |

| Smart Factory Implementations | 60 | Technology Officers, Production Supervisors |

| IIoT Security Solutions | 50 | Cybersecurity Analysts, Compliance Officers |

The Saudi Arabia Industrial Internet of Things market is valued at approximately USD 5.4 billion, driven by the adoption of smart manufacturing technologies and the need for operational efficiency across various industries, including oil and gas, manufacturing, and logistics.