Region:Asia

Author(s):Geetanshi

Product Code:KRAB1469

Pages:96

Published On:October 2025

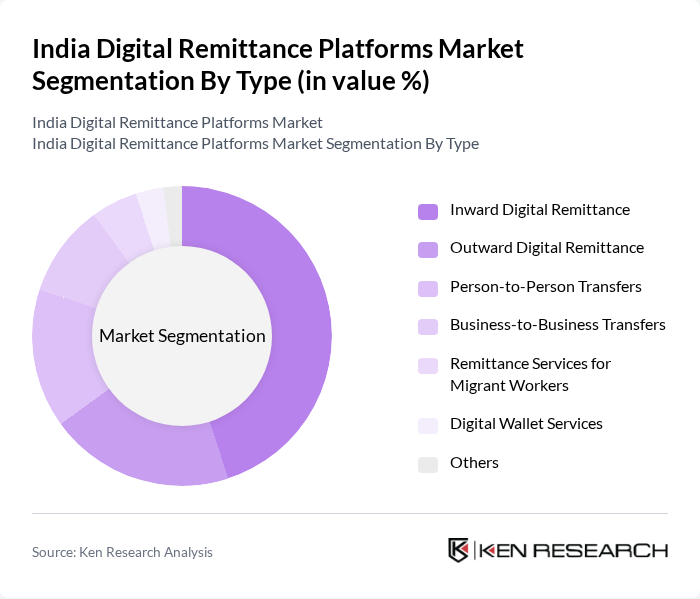

By Type:The segmentation by type includes various subsegments such as Inward Digital Remittance, Outward Digital Remittance, Person-to-Person Transfers, Business-to-Business Transfers, Remittance Services for Migrant Workers, Digital Wallet Services, and Others. Among these, Inward Digital Remittance is the leading subsegment, driven by the high volume of remittances sent by Indian expatriates from countries like the USA, UAE, and Canada. The ease of use and lower costs associated with digital platforms have made them the preferred choice for sending money back home .

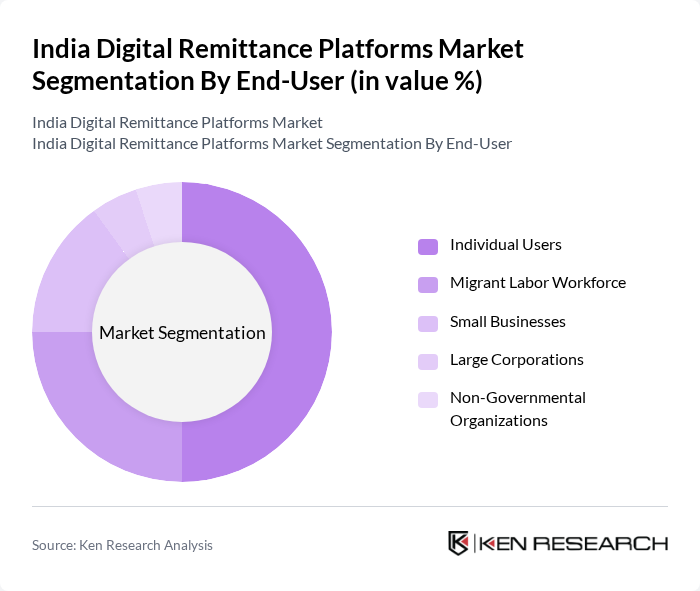

By End-User:The end-user segmentation includes Individual Users, Migrant Labor Workforce, Small Businesses, Large Corporations, and Non-Governmental Organizations. The Individual Users segment is the most significant, as it encompasses a vast number of people who rely on remittances for personal and family support. The increasing trend of digital payments among individuals, especially in urban areas, has further propelled this segment's growth .

The India Digital Remittance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as PayPal Holdings, Inc., Western Union Company, MoneyGram International, Inc., Wise PLC (formerly TransferWise Ltd.), Remitly, Inc., Xoom Corporation, Payoneer Inc., Ria Money Transfer, WorldRemit Ltd., Nium (formerly InstaReM), Google Pay (GPay), PhonePe, MobiKwik, Freecharge, Razorpay, ICICI Bank, State Bank of India (SBI), HDFC Bank, Axis Bank, Kotak Mahindra Bank contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India digital remittance market appears promising, driven by technological advancements and increasing consumer demand. The integration of blockchain technology is expected to enhance transaction security and reduce costs, while artificial intelligence will improve customer service efficiency. Additionally, the ongoing expansion of internet connectivity in rural areas will likely facilitate greater access to digital remittance services, further propelling market growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Inward Digital Remittance Outward Digital Remittance Person-to-Person Transfers Business-to-Business Transfers Remittance Services for Migrant Workers Digital Wallet Services Others |

| By End-User | Individual Users Migrant Labor Workforce Small Businesses Large Corporations Non-Governmental Organizations |

| By Region | North India South India East India West India |

| By Payment Channel | Banks Money Transfer Operators Online Platforms Mobile Payments Cash Pickup Services Others |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions |

| By Frequency of Transactions | One-time Transfers Recurring Transfers Seasonal Transfers |

| By Customer Segment | Students Professionals Retirees Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Domestic Remittance Users | 100 | Individuals aged 18-65, frequent remittance senders |

| International Remittance Users | 80 | Expatriates and migrant workers sending money to India |

| Digital Payment Platform Providers | 50 | Product Managers, Business Development Executives |

| Regulatory Bodies | 40 | Policy Makers, Financial Regulators |

| Financial Institutions | 60 | Banking Executives, Financial Analysts |

The India Digital Remittance Platforms Market is valued at approximately USD 1.6 billion, reflecting significant growth driven by the increasing number of Indian expatriates, digital payment adoption, and the convenience of online remittance services.