Region:Asia

Author(s):Rebecca

Product Code:KRAA4834

Pages:80

Published On:September 2025

By Security Type:The cybersecurity market for SMEs is segmented into various security types, including Network Security, Endpoint Security, Cloud Security, Internet Security, Data Security, Identity and Access Management, and Others. Among these,Network Securityis currently the leading subsegment due to the increasing need for secure network infrastructures as SMEs expand their online presence. The rise in cyberattacks targeting network vulnerabilities has prompted SMEs to prioritize investments in this area, ensuring the protection of their digital assets. Cloud Security is also gaining traction as more SMEs migrate to cloud-based platforms, requiring advanced protection against evolving threats .

By Organization Size:The market is also segmented by organization size, primarily focusing on Small Enterprises and Medium Enterprises.Small Enterprisesdominate the market as they represent a larger portion of the SME landscape in Indonesia. These businesses are increasingly recognizing the importance of cybersecurity to protect their operations and customer data, leading to a surge in demand for tailored cybersecurity solutions that fit their specific needs. Budget constraints and limited in-house expertise drive small enterprises to seek managed security services and cost-effective solutions .

The Indonesia Cybersecurity for SMEs Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Cyberindo Aditama (CBN), PT. Vaksincom, PT. Mitra Integrasi Informatika, PT. Dwi Tunggal Putra, PT. Synnex Metrodata Indonesia, PT. Indosat Tbk, PT. Telkom Indonesia (Persero) Tbk, PT. Cipta Sarana Informatika, PT. Solusi247, PT. Cybertech, PT. Aplikanusa Lintasarta, PT. Astra Graphia Tbk, PT. Bhinneka Mentari Dimensi, PT. Infinys System Indonesia, PT. Multipolar Technology Tbk contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cybersecurity landscape for SMEs in Indonesia appears promising, driven by increasing government support and a growing recognition of cyber threats. As digital transformation accelerates, SMEs are expected to adopt more sophisticated cybersecurity measures. The integration of advanced technologies, such as AI and machine learning, will enhance threat detection capabilities. Additionally, the rise of managed security services will provide SMEs with access to expert resources, enabling them to navigate the complex cybersecurity landscape more effectively.

| Segment | Sub-Segments |

|---|---|

| By Security Type | Network Security Endpoint Security Cloud Security Internet Security Data Security Identity and Access Management Others |

| By Organization Size | Small Enterprises Medium Enterprises |

| By Industry Vertical | BFSI (Banking, Financial Services, and Insurance) Government and Defence Energy and Utilities Healthcare IT and Telecommunication Retail Manufacturing Others |

| By Deployment Mode | On-Premises Cloud-Based |

| By Service Type | Managed Security Services Consulting & Implementation Services Training and Education |

| By Sales Channel | Direct Sales Distributors Online Sales Resellers |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-As-You-Go Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing SMEs Cybersecurity Practices | 100 | IT Managers, Operations Directors |

| Retail SMEs Cybersecurity Awareness | 80 | Business Owners, Store Managers |

| Service Sector SMEs Cybersecurity Solutions | 60 | Service Managers, IT Consultants |

| Financial Services SMEs Cybersecurity Compliance | 50 | Compliance Officers, Risk Managers |

| Technology Startups Cybersecurity Adoption | 70 | Founders, CTOs |

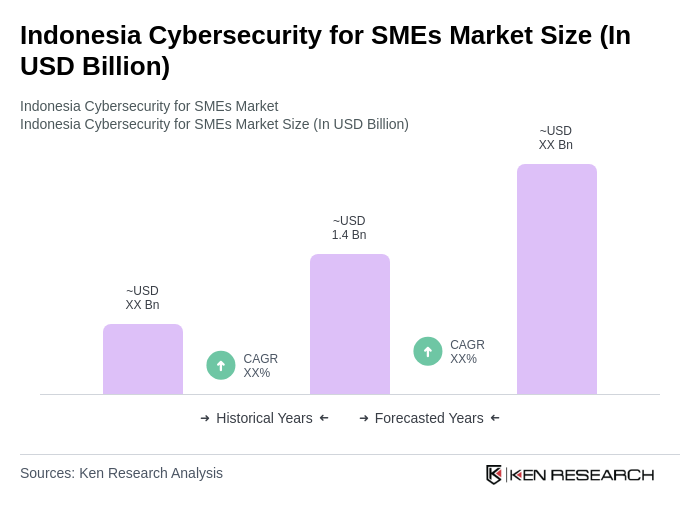

The Indonesia Cybersecurity for SMEs market is valued at approximately USD 1.4 billion, driven by increased digitalization, rising cyber threats, and the growth of digital payment solutions. This market is expected to continue expanding as SMEs prioritize cybersecurity investments.