Region:Asia

Author(s):Rebecca

Product Code:KRAE3008

Pages:95

Published On:February 2026

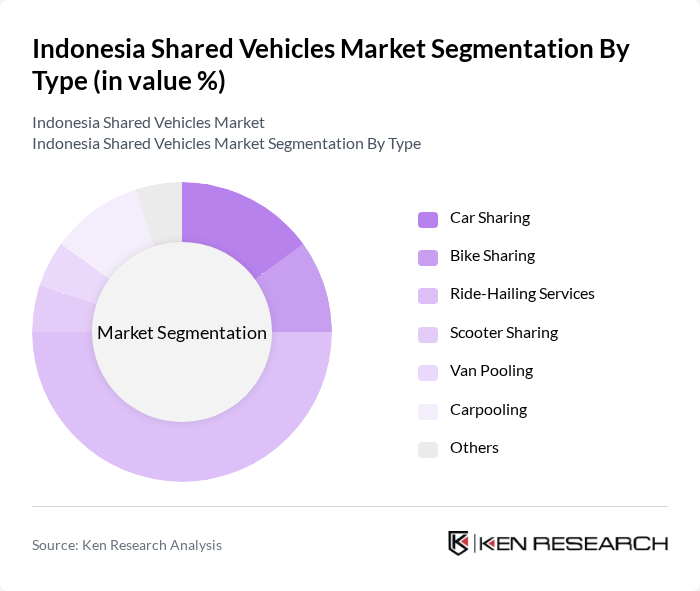

By Type:The market is segmented into various types, including Car Sharing, Bike Sharing, Ride-Hailing Services, Scooter Sharing, Van Pooling, Carpooling, and Others. Among these, Ride-Hailing Services have emerged as the dominant segment due to their convenience and widespread adoption among urban commuters. The increasing smartphone penetration and the availability of user-friendly apps have further accelerated the growth of this segment, making it a preferred choice for many consumers.

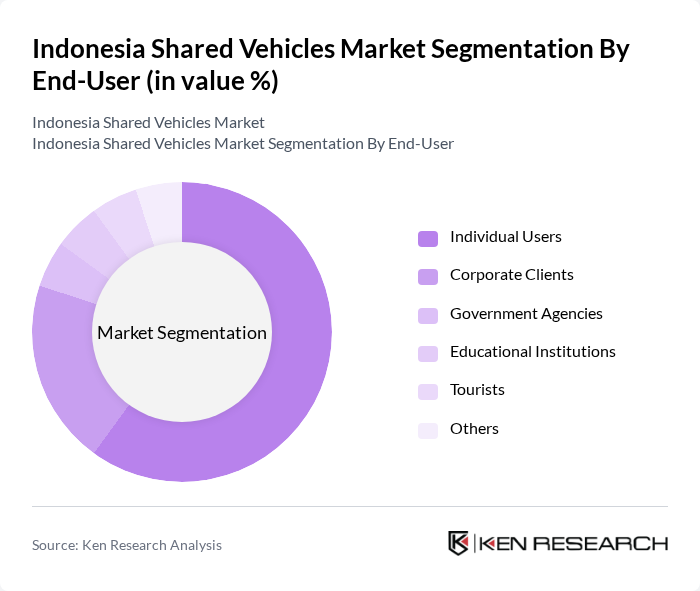

By End-User:The end-user segmentation includes Individual Users, Corporate Clients, Government Agencies, Educational Institutions, Tourists, and Others. Individual Users represent the largest segment, driven by the growing trend of urbanization and the need for flexible transportation options. The increasing number of young professionals and students in urban areas has led to a higher demand for shared mobility services, making this segment a key driver of market growth.

The Indonesia Shared Vehicles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gojek, Grab, Bluebird Group, OVO, Maxim, Anterin, Ride Indonesia, Carro, TaniHub, Migo, Kudo, Tada, Blibli, Tix ID, Traveloka contribute to innovation, geographic expansion, and service delivery in this space.

The future of the shared vehicles market in Indonesia appears promising, driven by increasing urbanization and a shift towards sustainable mobility solutions. As the government continues to invest in infrastructure and regulatory frameworks, the market is expected to evolve significantly. Innovations in technology, such as app-based services and electric vehicle integration, will likely enhance user experience and operational efficiency, making shared mobility a more viable option for urban commuters in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Car Sharing Bike Sharing Ride-Hailing Services Scooter Sharing Van Pooling Carpooling Others |

| By End-User | Individual Users Corporate Clients Government Agencies Educational Institutions Tourists Others |

| By Vehicle Size | Compact Vehicles Mid-Size Vehicles SUVs Vans Others |

| By Service Model | Peer-to-Peer Sharing Fleet-Based Sharing Subscription Services Others |

| By Payment Model | Pay-Per-Use Subscription-Based Membership Models Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Others |

| By Customer Demographics | Age Groups Income Levels Occupation Types Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Shared Vehicle Users | 150 | Frequent Users, Occasional Users |

| Shared Vehicle Service Providers | 100 | Operations Managers, Business Development Heads |

| Government Transportation Officials | 50 | Policy Makers, Urban Planners |

| Industry Experts and Analysts | 30 | Market Analysts, Academic Researchers |

| Potential Users (Non-users of Shared Vehicles) | 80 | Urban Residents, Commuters |

The Indonesia Shared Vehicles Market is valued at approximately USD 1.5 billion, driven by urbanization, rising fuel prices, and a preference for cost-effective transportation solutions. This market is expected to grow as shared mobility services gain popularity in urban areas.