Region:Asia

Author(s):Geetanshi

Product Code:KRAA3715

Pages:100

Published On:September 2025

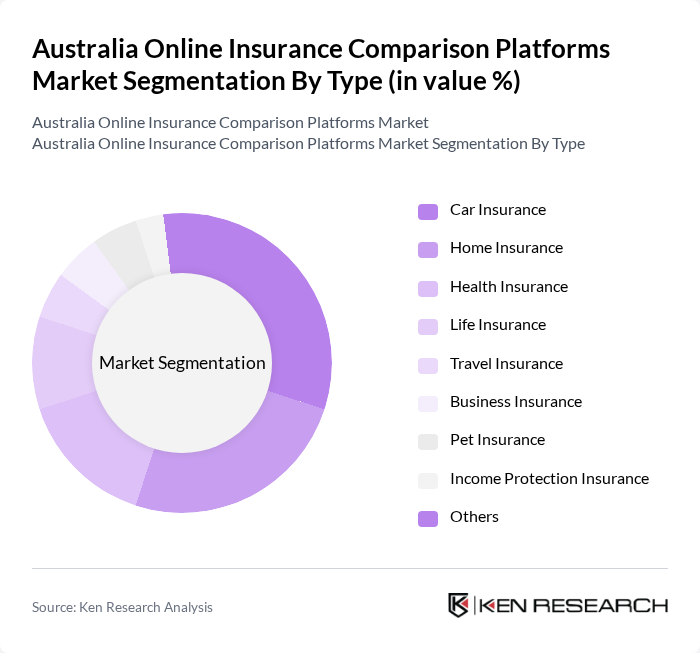

By Type:The market is segmented into various types of insurance products, including Car Insurance, Home Insurance, Health Insurance, Life Insurance, Travel Insurance, Business Insurance, Pet Insurance, Income Protection Insurance, and Others. Each segment addresses distinct consumer needs and preferences, with digital innovation, regulatory changes, and increased personalization driving growth across categories. Notably, usage-based and behavior-linked insurance products are gaining traction, particularly in auto and home insurance, as consumers seek tailored coverage and dynamic pricing options .

The Car Insurance segment is currently the dominant player in the market, driven by the high number of vehicle owners in Australia and growing consumer awareness of the importance of comprehensive coverage. The adoption of telematics and usage-based insurance models is accelerating, as consumers increasingly use online platforms to compare and select policies that best match their driving habits and risk profiles. The convenience of digital comparison tools enables users to efficiently evaluate multiple options, supporting the ongoing shift toward personalized, value-driven insurance solutions .

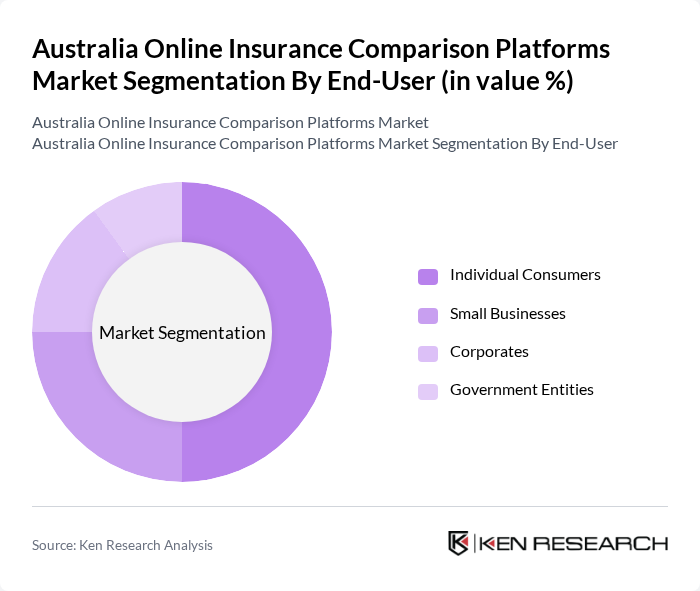

By End-User:The market is segmented by end-users, including Individual Consumers, Small Businesses, Corporates, and Government Entities. Each segment exhibits distinct purchasing behaviors and requirements, with digital transformation and the demand for tailored insurance solutions shaping market dynamics. Individual consumers increasingly favor platforms offering personalized recommendations and seamless digital experiences, while small businesses and corporates prioritize comprehensive coverage and efficient claims management .

Individual Consumers represent the largest segment in the market, driven by the growing trend of online shopping, demand for personalized insurance solutions, and increased digital literacy. The ability to compare a wide range of policies online appeals to consumers seeking value and transparency. Enhanced user interfaces, mobile-first design, and AI-driven policy recommendations further support the growth of this segment by simplifying the insurance selection process and improving overall customer satisfaction .

The Australia Online Insurance Comparison Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Compare the Market, Finder, iSelect, Canstar, RateCity, One Big Switch, Mozo, Youi, Budget Direct, AAMI, RACV, Suncorp, Allianz Australia, QBE Insurance Group, Zurich Australia Insurance Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online insurance comparison market in Australia appears promising, driven by technological advancements and evolving consumer preferences. As artificial intelligence continues to enhance user experiences, platforms will likely offer more personalized recommendations, increasing user engagement. Additionally, the shift towards subscription-based insurance models may create new avenues for comparison platforms, allowing them to cater to a broader audience and adapt to changing market dynamics effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Car Insurance Home Insurance Health Insurance Life Insurance Travel Insurance Business Insurance Pet Insurance Income Protection Insurance Others |

| By End-User | Individual Consumers Small Businesses Corporates Government Entities |

| By Sales Channel | Direct Online Sales Affiliate Marketing Insurance Brokers Comparison Websites Bundled Sales via Online Travel Agents & Airlines |

| By Customer Demographics | Age Group (18-25, 26-35, 36-50, 51+) Income Level (Low, Middle, High) Geographic Location (Urban, Suburban, Rural) |

| By Policy Type | Comprehensive Policies Third-Party Policies Pay-As-You-Go Policies Usage-Based Insurance |

| By Customer Engagement Level | Active Users Occasional Users New Users |

| By Price Range | Low-Cost Insurance Mid-Range Insurance Premium Insurance |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Insurance Comparison | 100 | Consumers aged 25-45, Health Insurance Users |

| Auto Insurance Comparison | 90 | Car Owners, Insurance Policy Holders |

| Home Insurance Comparison | 80 | Homeowners, Renters |

| Life Insurance Comparison | 60 | Individuals aged 30-60, Financial Advisors |

| Travel Insurance Comparison | 50 | Frequent Travelers, Travel Consultants |

The Australia Online Insurance Comparison Platforms Market is valued at approximately AUD 1.1 billion, reflecting significant growth driven by digital adoption, consumer demand for transparent pricing, and the convenience of comparing multiple insurance products online.